India’s 10Y yield closed steady at 7.09%, as oil prices retreated. It is trading flat today as well

FinTech BizNews Service

Mumbai, March 27, 2024: In US, durable goods orders made a recovery after it rose by 1.4% in Feb’24 (-6.9% in Jan’24). Transportation and motor vehicles orders jumped up to 3.3% and 1.8% in Feb’24 respectively. Thus, signalling manufacturing sector could be steadily be regaining back its footing. Separately, there were some mixed reports for the market including the dip in home sales data, cooling off-housing prices and an unchanged consumer confidence at 104.7 in Mar’24. On the other hand, in China industrial profits for Jan-Feb’24 jumped up to 10.2% with increase in manufacturing and electricity, heat production industry. Profits for state owned enterprises also rose by 0.5% for the same period. On domestic front, India’s current account deficit dropped down to US$ 10.5bn (1.2% of GDP) in Q3 from US$ 11.4bn in Q2.

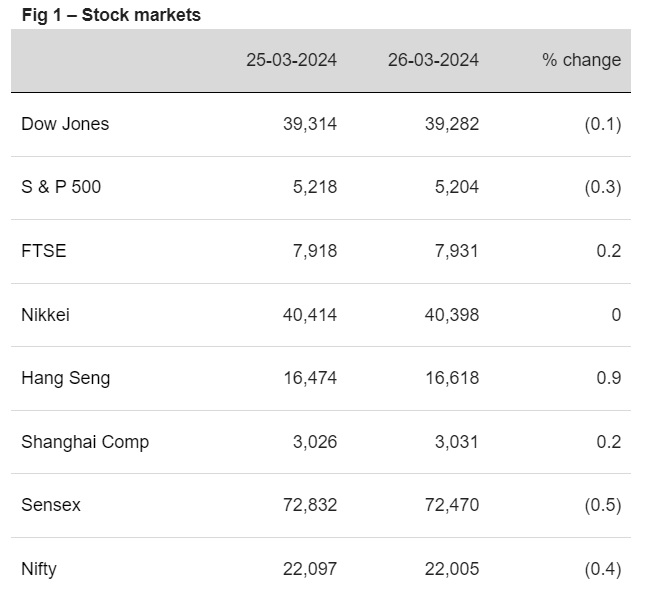

§ Global stock indices ended mixed. US indices declined as investors awaited for the PCE data print in order to gauge Fed’s policy path. As per the Fed watch tool, there is a 70.4% chance of a rate cut in Jun’24 (59.2%-last week). Sensex ended in red and was dragged down by losses in IT and banking stocks. However, it is trading higher today while other Asian indices are trading mixed.

§ Except CNY and INR, other global currencies closed lower against US$. DXY rose by 0.1%, supported by resilience in US economic activity (durable goods orders). JPY fell to its 34-year low as US$ strengthened. Investors are expecting BoJ to intervene. INR rose by 0.2%, as increase in oil prices halted. However, it is trading lower today, in line with other Asian currencies.

Barring China and India (flat), other global 10Y yields eased. Mixed macro data from the US (pickup in durable goods orders and flat consumer confidence) impacted investor sentiments. Inflation data is awaited for more guidance. India’s 10Y yield closed steady at 7.09%, as oil prices retreated. It is trading flat today as well.