The JOLTS survey shows that job opening in Nov'23 fell by 62k to 8.79mn from 8.8mn, dropping to lowest levels since Mar'21

Sonal Badhan,

Economist,

Bank of Baroda

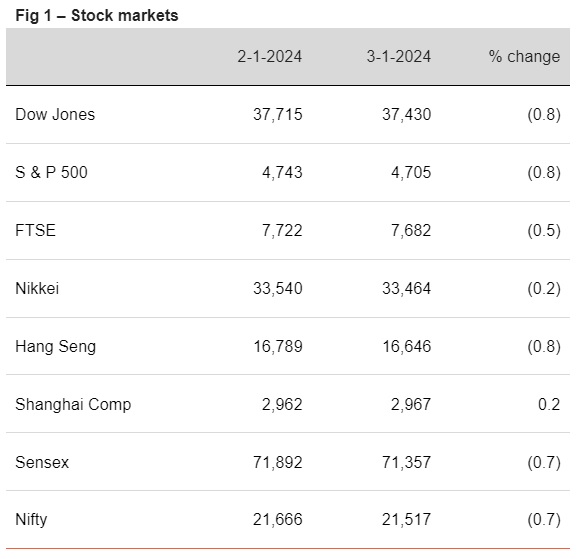

Mumbai, January 4, 2024: FOMC minutes of the Dec’23 meeting revealed, that while the members have acknowledged fading inflationary risks, they are now also concerned about of the impact of restrictive monetary policy on growth and employment. Fed Chair is of the view that US economy might skirt off recession, while some other members pointed out that recession is impending. Concerns were also raised that gradual cooling off in the labour market may turn into a “more abrupt downward shift conditions”. The JOLTS survey shows that job opening in Nov’23 fell by 62k to 8.79mn from 8.8mn, dropping to lowest levels since Mar’21. US ISM manufacturing PMI also signals deteriorating conditions in Dec’23 (46.7, unchanged from last month). In Japan as well, manufacturing PMI indicates deepening contraction (47.9 versus 48.3).

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)