IMF raised its global growth forecast to 3.2% in 2024 from 3.1% estimated earlier, led by better-than-expected growth outcomes in advanced economies

Aditi Gupta

Economist,

Bank of Baroda

Mumbai, April 18, 2024: IMF raised its global growth forecast to 3.2% in 2024 from 3.1% estimated earlier, led by better-than-expected growth outcomes in advanced economies. Inflation was projected to decline to 5.9% in 2024 and 4.5% in 2025. For India, growth projection for FY24 was revised to 7.8% and FY25 at 6.8% (+30bps). Amongst macro release, inflation in Eurozone was confirmed at 2.4% in Mar’24 from 2.6% in Feb’24, increasing the likelihood of a rate cut in Jun’24. On the other hand, Fed officials including the Fed Chair suggested that the US rate cut cycle might be delayed. In UK, inflation eased to 3.2% in Mar’24 from 3.4% in Feb’24. In Japan, exports rose more than expected by 7.3% (est. 7%) in Mar’24, while imports declined by 4.9%. In Australia, unemployment rate edged up to 3.8% in Mar’24 from 3.7% in Feb’24.

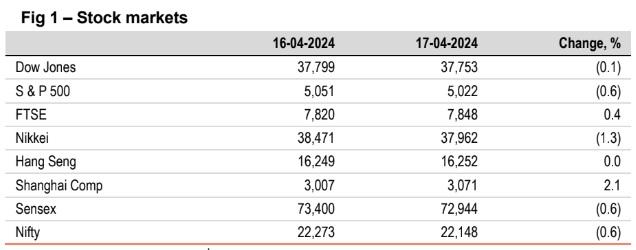

§ Global stocks closed mixed. Stocks in the US inched down as Fed Chair’s recent comments have considerably pared down expectations of rate cuts. The commentary on inflation has also hinted at a hawkish approach. FTSE inched up as BoE Governor gave slight comfort on inflation-unemployment mix. Asian stocks rose ahead of key earnings report. Sensex fell by 0.6%, led by technology stocks. It is trading higher today, in line with other Asian stocks.

Global currencies rose as the dollar rally took a breather. After rising for 6-consecutive sessions, DXY fell by 0.3%. EUR gained the most by 0.5% even as falling inflation bolstered the case for an ECB rate cut in Jun’24. INR fell to a fresh record-low in the last trading session but opened stronger today, in line with other Asian currencies.

Except Japan and India (higher), global yields closed lower. US 10Y yield fell at the sharpest pace by 8bps despite hawkish comments from Fed Chair. A host of other Fed officials are also due to speak this week. The impact was also felt in 10Y yield of UK and Germany. Risk-off sentiment has led to some bit of portfolio rebalancing. India’s 10Y yield is trading lower at 7.16% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)