DCCBS FUNCTION WITH LOWER C-D RATIOS THAN STCBS, OWING TO THEIR HIGHER DEPOSIT BASE

FinTech BizNews Service

Mumbai, January 27, 2024: The Reserve Bank of India recently released the Report on Trend and Progress of Banking in India 2022-23, a statutory publication in compliance with Section 36 (2) of the Banking Regulation Act, 1949. This Report presents the performance of the banking sector, including co-operative banks during 2022-23 and 2023-24 so far.

Short-Term And Long-Term Institutions

Rural credit co-operatives (RCCs), with a history of more than a century in India, were set up to address the concerns of inadequate access to formal and affordable credit in rural areas. They have since carved out a niche for themselves in the rural credit delivery system, owing to their wide reach at the grassroots level.

As per latest data available, there were 1,502 UCBs and 1,05,268 Rural credit co-operatives (RCCs). At end March 2022, the short-term rural co-operative sector consisted of 34 State co-operative banks (StCBs), 351 District Central Co-operative Banks (DCCBs), and 1,04,266 PACS spread across 34 States/UTs.More than 97 % of RCCs are primary agricultural credit societies (PACS). The consolidated assets of the cooperative banking sector at end-March 2022 were Rs21.6 lakh crore, around 10 % of that of scheduled commercial banks (SCBs). Rural co-operatives comprise more than two-thirds of the sector.

The sector, consisting of short-term and long-term institutions, expanded its operations further in 2021-22. Its share in the total assets of the cooperative sector increased to 69.2 % from a recent low of 65.2 % at end-March 2018.

RCC Assets

Within RCCs, the financial performance of short-term rural co-operatives has consistently been better than their long-term counterparts. The latter provide term finance for capital formation and rural non-farm projects. Such longer maturity loans are exposed to the risk of a fast-evolving external environment. Repeated debt waivers have also created a moral hazard problem, impacting loan recovery. While the share of long-term rural co-operatives in total RCC assets is miniscule at 4 %, they have disproportionately higher NPAs, losses and lower recovery-to-demand ratios.

The increasing number of loss-making RCCs, particularly PCARDBs, remains a cause of concern. Low profitability and high NPAs have contributed to capital shortfalls in many of these institutions.

Branches Of DCCBs

DCCBs constitute the second tier in the short-term rural co-operative structure and operated with a network of 13,670 branches at end-March 2022. 20 States/UTs have one or more DCCBs (having either a three-tier or a mix of three-tier and two-tier structure). In 14 States/UTs, there are no DCCBs and only a two-tier structure exists. They have a larger presence in the central region. Deposits form the major source of funding for DCCBs, followed by borrowings from StCBs and refinance from NABARD. More than 50 % of DCCBs’ total lending is directed towards agriculture and more than 75 % of their total lending is conducted through PACS. DCCBs function with lower C-D ratios than StCBs, owing to their higher deposit base.

Balance Sheet Operations

The acceleration in the consolidated balance sheet of DCCBs during 2021-22 was led by borrowings on the liabilities side, which offset the deceleration in deposits. On the assets side, their loan growth accelerated, while investments decelerated.

Profitability

DCCBs’ total expenditure rose during 2021-22, driven by operational expenses and higher provisions and contingencies even as interest expenditure declined. With expenditure growth exceeding income growth, net profits contracted during 2021-22.

The number of loss-making DCCBs and their losses increased during the year. The western and southern states contributed the most towards DCCBs’ profits, while the central region added the highest to losses.

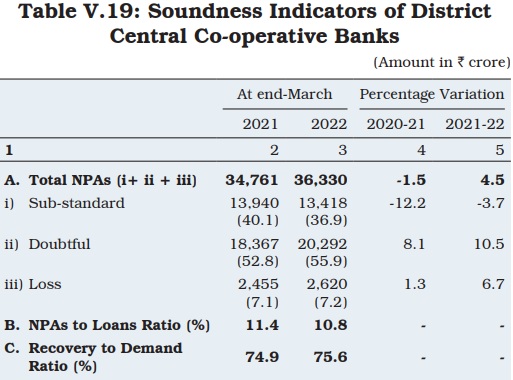

Asset Quality

The GNPA ratio of DCCBs moderated during 2021-22 but remains elevated. Although the accretion to NPAs was higher during the year, the GNPA ratio declined on the back of robust credit growth. Their GNPA ratios declined in 16 of 20 states during 2021-22. The central and southern states — particularly, Kerala, Madhya Pradesh, and Tamil Nadu — experienced an increase in their GNPA ratios. The southern region continued to have the lowest NPA ratio and the highest recovery to-demand ratio across regions.