Even if the RBI resort to OMO sales, we see the probability of it only in February 2024

Indranil Pan, Chief Economist

Deepthi Mathew, Economist

Economics Knowledge Banking

YES BANK

Mumbai, December 9, 2023: Rate and stance remain unchanged, as expected. The RBI reiterated its focus on getting inflation down to 4% on a durable basis and even indicating that this target is yet to be reached and hence policy needs to acknowledge the same. While global commodity prices have corrected and with domestic core inflation falling consistently, the RBI’s fight seems to be now with food inflation. Unseasonal weather events, El Nino and geopolitical issues are leading to supply side worries and need monitoring. RBI revised its GDP growth forecast for FY24 to 7.0% (earlier 6.5%) but maintained its inflation forecast at 5.4%. Given the growth-inflation dynamics, we expect the RBI to be on an extended pause and only ease around August 2024.

Robust growth, watchful on inflation

With growth numbers surprising on the upside for the first two quarters, RBI is sanguine on growth outcomes and revised up the forecast to 7.0% YoY for FY24 (earlier 6.5% YoY) with an upwardly revised projection for Q3FY24 and Q4FY24 at 6.5% and 6.0%, respectively. Though global headwinds would persist via weak external demand, financial market volatility, geopolitical tension, geoeconomic fragmentation etc., domestic conditions remain supportive. The recovery seen in rural economy, improved business optimism, resilient services sector, government’s capital expenditure and healthy twin balance sheets of banks and corporates are expected to support domestic growth dynamics. Though the CPI inflation forecast for FY24 has been retained at 5.4%, risks to inflation persist. Importantly, the fan chart on CPI indicates a chance for a higher than 4% zone sustaining, while the confidence interval around central point has a much wider range than that for GDP. In the near term, inflation risk is principally from uncertainty in food prices. While the worst of vegetable spike is behind us, recent data indicates that onion prices have shot up due to crop damage in certain regions on account of unseasonal rains. As per the NHB data, onion prices increased by 40% MoM in November. Today, the government has extended the export ban on onion till March 2024. The sowing of rabi crops, that is now lower (by 4% than last year), also need to be monitored for inflation risks. Lower reservoir levels add to the worry for rabi production.

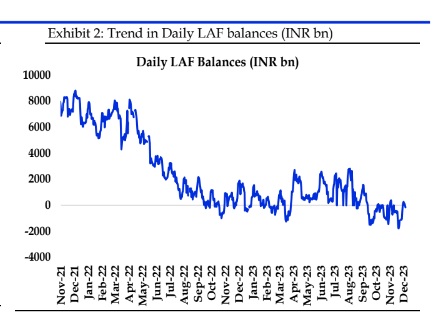

Nimble on liquidity management

Assessing that excess liquidity could be inflationary, the RBI had been guiding towards a tight liquidity condition. Since the October meeting, LAF liquidity averaged to a deficit of INR 500 bn pushing up the call money rate close to the MSF rate, not warranting any additional measures from the RBI. However, the RBI has refused to remove the OMO sales as a liquidity management tool from the table and this can be used as necessary. No policy reversal visible soon – 4% CPI remains the focus: With growth conditions remaining resilient, RBI continues to focus on bringing inflation to the 4% target. Though the CPI inflation came at 4.87% in October, RBI expects inflation to pick up in November and December. As per RBI’s and our own projections, CPI inflation would come close to the 4% target only in Q2FY25, taking away any chance of an early rate cut. Setting the expectations right for the market, the Governor maintained that the “policy makers have to be mindful of the risk of being carried away by a few months of good data or by the fact that CPI inflation has come within the target range”. Volatility in food prices continues to be a major risk for the RBI as it could de-anchor household inflation expectations. However, RBI expects a fuller impact of the transmission of the 250-bps rate increase to keep inflation in check, closing the door for any rate hikes. Consequently, based on our inflation model, we expect the first rate cut by the RBI in the current cycle to be around the August 2024. Further, the next rate cutting cycle is expected to be shallow to the extent of 50-75 bps. On the liquidity front, we do not expect the RBI to resort to OMO sales immediately, given the tight liquidity conditions. However, we expect liquidity to improve in January and February with increased inflows on account of spending by both the state and central government. Even if the RBI resort to OMO sales, we see the probability of it only in February 2024 (post Union Budget) as there could be also some front loading of FX flows into the bond segment ahead of the JP Morgan index inclusion in June 2024. The RBI then can mop up excess FX flows to replenish its reserves and also prevent unduly appreciation of INR, thereby needing to use the OMO sales tool to suck out the excess rupee liquidity.

(Disclaimer: Information gathered and material used in this document is believed to have been obtained from reliable sources. However, YES Bank makes no warranty, representation or undertaking whether expressed or implied, with respect that such information is being accurate, complete or up to date, nor does it assume any legal liability, whether direct or indirect or responsibility for the accuracy, completeness or usefulness of any information in this document. YES Bank takes no responsibility for the contents of those external data sources or such third party references. No third party will assume and direct or indirect liability, whose references have been provided in this document. It is the responsibility of the user of this document to make its/his/her own decisions or discretion about the accuracy, currency, reliability and correctness of information found in this document.)