tighter control on new bookings resulting in delinquencies in line with industry

FinTech BizNews Service

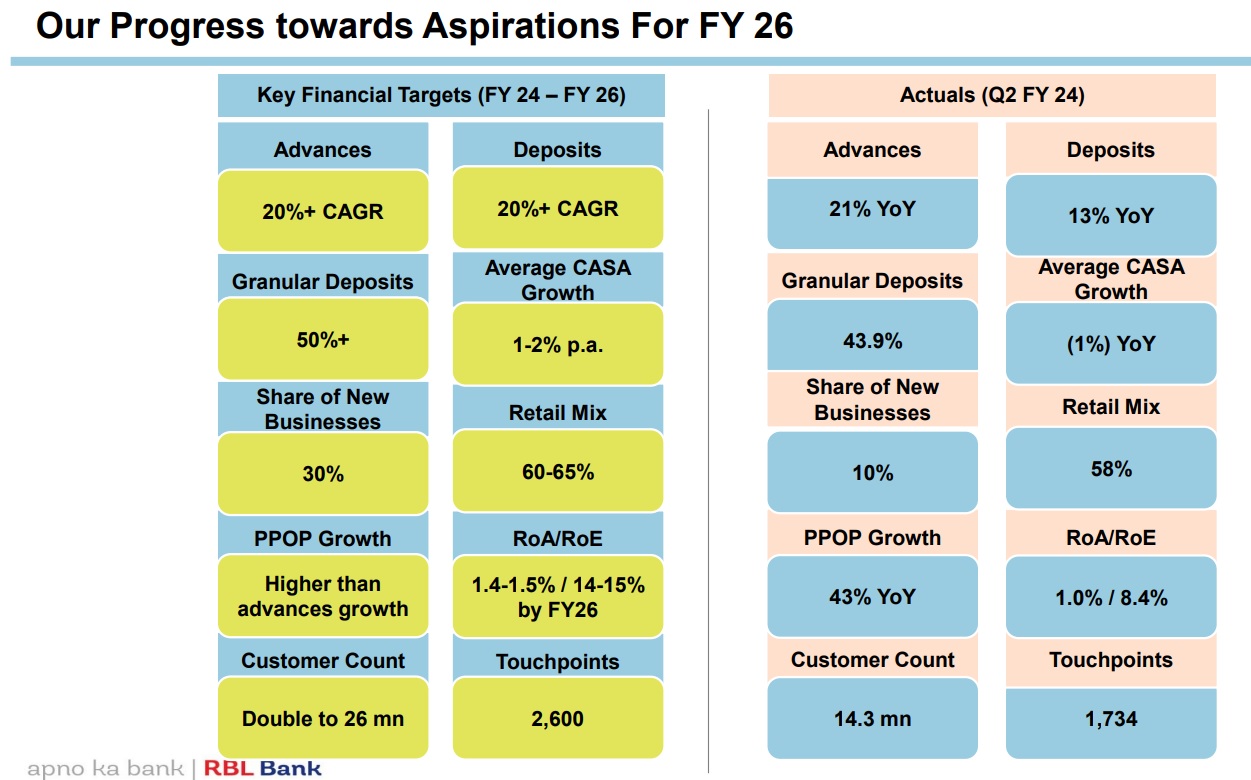

Mumbai, 25 October, 2023: Consolidated PAT of RBL Bank grew 77% YoY and 4% QoQ to Rs331 crore; Standalone PAT for Q2 FY24 grew 46% YoY and 2% QoQ to Rs294 crore.

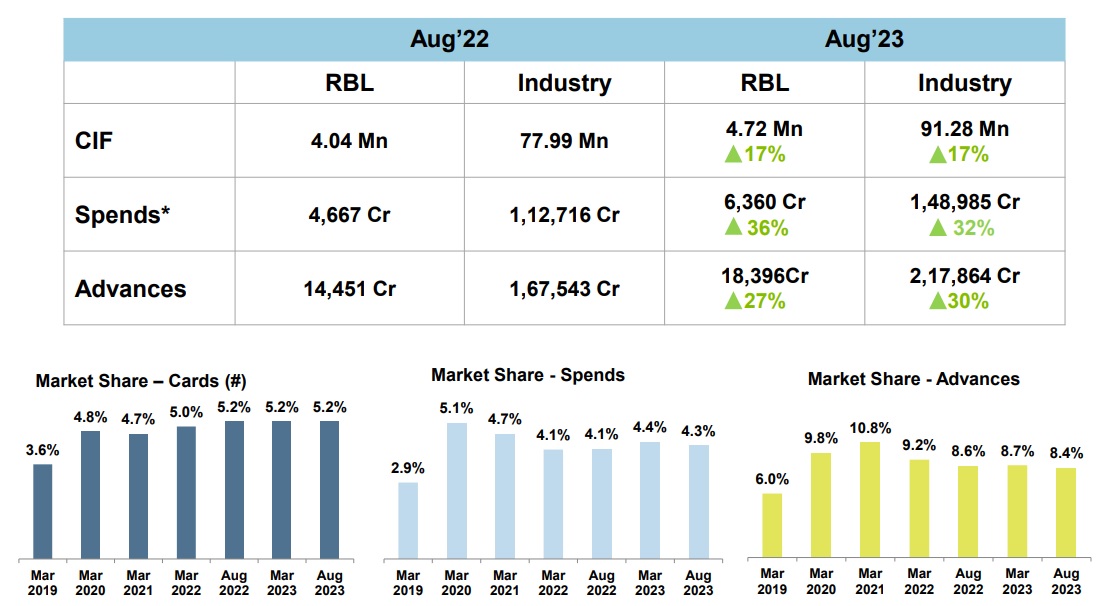

Credit Card Update

RBL Bank is amongst the largest Credit Card issuers in India with over 5% market share of Cards in Force. Retail spends Increased YoY and QoQ. Diversified exposure, expansion outside Tier-1 cities. AS far as Credit Cards are concerned, tighter control on new bookings resulting in delinquencies in line with industry,as per the investor presentation made on 21 October, 2023 at the time of the Financial Results for the Q2 and Half Year ended September 30, 2023.

Key Changes done in Q2 FY24

In Q2FY24, the Bank saw a reversal of tax provisions relating to earlier financial years of Rs223 crore which is direct PAT benefit of Rs. 223 crore (and hence benefit of Rs. 298 crore pre-tax). Bank has used this provision release as follows:

1. Contingency provision of 1% on its Credit Card and Microfinance advances, amounting to Rs252 crore.

2. The Bank’s provisioning policy on credit cards is to provide 70% at 90DPD and 100% at 180DPD; the Bank has now modified this policy to provide 100% at 120DPD; this resulted in increase in provisioning of Rs48 crore.