Bank of England Governor along with other BoE members, commented on the possibility of rate cuts

Aditi Gupta,

Economist,

Bank of Baroda

Mumbai, February 21, 2024:Global markets continued to assess the trajectory of policy rates. Minutes of the Fed policy meeting are due today. On the other hand, Bank of England Governor along with other BoE members, commented on the possibility of rate cuts. Markets now expect BoE to cut rates possibly in Jun’24 by 25bps. In the Euro Zone, wage growth slowed down for the first time since Q2CY22, suggesting some moderation in underlying inflationary pressures. In India, both the RBI and Government attested to the strength of the Indian economy. A pickup in private sector capex, improved capacity utilisation, coupled with moderation in inflation and government’s thrust on infrastructure bode well for the outlook of the economy.

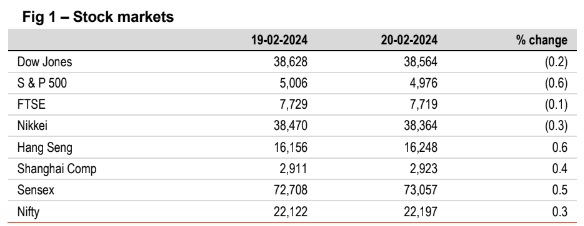

Global stocks ended mixed. Stocks in Hong Kong rose the most led by healthcare, basic materials and technology stocks. Shanghai Comp also inched up supported by monetary easing of PBOC. Nikkei moderated as investors monitored downbeat business sentiment among large manufacturers, assessing the Tankan poll data. Sensex inched up, led by banking and real estate stocks. It is trading further higher today, while Asian stocks are trading mixed.

Global currencies appreciated as the dollar retreated. DXY fell by 0.2%, as

investors await minutes of the Fed meeting. GBP rose by 0.2% even as BoE

Governor hinted at the possibility of rate cuts. EUR too rose by 0.3%. INR

appreciated by 0.1% as oil prices fell. It is trading further stronger today, in line

with other Asian currencies.

Except US and Japan (stable), global yields closed lower. UK’s 10Y yield fell the

most by 7bps as investors monitored BoE Governor’s comments, who spoke of

easing price pressures and possibility of rate cuts. Germany’s 10Y yield also fell

by 4bps as Eurozone wage growth slowed down. India’s 10Y yield fell by 4bps,

in line with global cues and is trading further lower at 7.04% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)