US labour market data showed persistent tightening. Jobless claims rose less than expected by 208

Dipanwita Mazumdar

Economist,

Bank of Baroda

Mumbai, May 3, 2024: US labour market data showed persistent tightening. Jobless claims rose less than expected by 208K (est.: 211K). Unit labour cost has risen the most in a year in

Q1CY24. What could be understood from the data is that considerable tightness would pose upward risk to wages and hence inflationary pressure cannot be ruled out in totality. Thus, cautious/wait and watch mode of Fed w.r.t. future policy action

would prevail. Elsewhere, ECB official also confirmed that approach should be data dependent and refrained from pre-committing to rate path.

As per latest OECD report, India’s buoyant growth rate will be driven by robust government capex. India’s PMI recorded the second fastest improvement. More importantly, inventories rose to near record level to support growing demand, as highlighted in the report.

Global stocks ended broadly higher. Hang Seng rose the most by 2.5% led by gains in technology and property sectors. US indices rose supported by better-than-expected earnings results. Tech stocks led the gains. Investors keenly

await the US jobs report due later in the day to assess the Fed’s rate path.

Sensex rose by 0.2%, led by gains in power and oil & gas stocks. It is trading further higher today, in line with other Asian stocks.

Global currencies ended mixed. All eyes remained on JPY which strengthened

by another 0.6%, amidst signs of suspected intervention. DXY was 0.4% lower

as investors await the payroll data. INR hovered near its record low amidst a

slowdown in FPI inflows. However, it is trading stronger today, in line with other

Asian currencies.

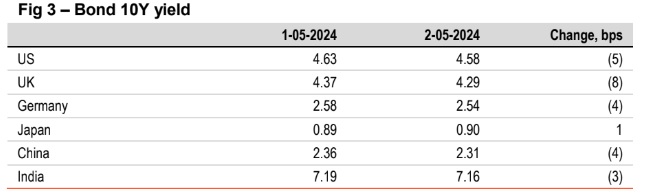

Except Japan (a tad higher), global yields closed lower. UK’s 10Y fell at the

sharpest pace by 8bps as OECD report reflected some concerns on growth of

the region. Even US and Germany’s 10Y yield have fallen, as Fed Chair’s

commentary reflected some easing of monetary policy. India’s 10Y yield fell by

3bps, taking global cues. It is trading at the same level today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)