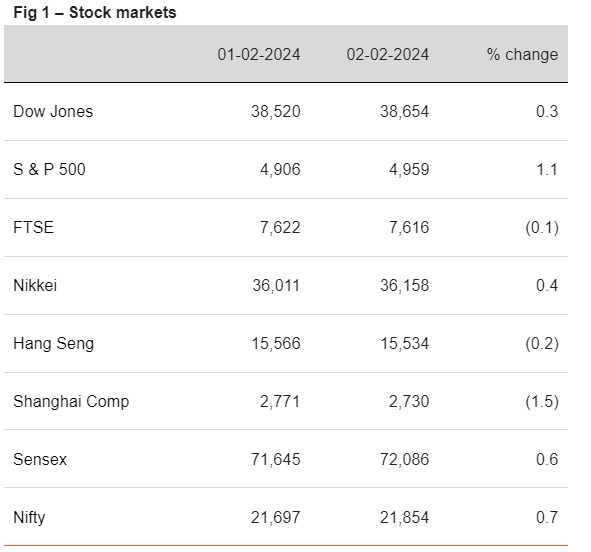

Global market indices reacted differently to different outcomes

Dipanwita Mazumdar

Economist,

Bank of Baroda

Mumbai, February 5, 2024: Global market indices reacted differently to different outcomes. On macro front, US non-farm payroll rose at a solid pace, adding 353K in Jan’24 against expectation of 185K. Average hourly earnings remained sticky rising by 0.6% on MoM basis (est.: 0.3%). University of Michigan’s 1 and 5 year inflation expectation index also remained firm. Fed Chair in his recent interview pushed off expectation of rate cut in Mar’24. In other developments, Japan’s services PMI inched up to 53.1 in Jan’24 from 51.5 in Dec’23, led by higher business confidence. The Caixin PMI services data of China remained above the 50 mark at 52.7, albeit a notch down from 52.9 in Dec’23. China’s Securities Regulatory Commission again vowed to prevent market fluctuation. In Japan, BoJ offered to purchase bonds, in an effort to check gains in short term rates. On domestic front, RBI’s policy would be closely monitored.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)