INR is trading stronger today

Aditi Gupta

Economist,

Bank of Baroda

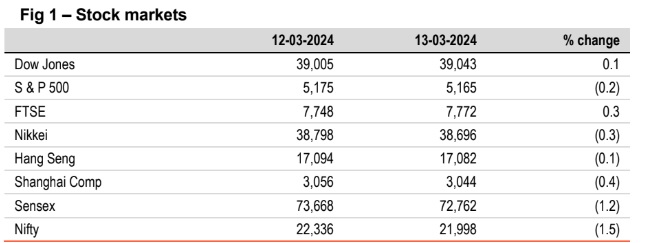

Mumbai, March 14, 2024: Global markets assessed the US inflation data to determine the trajectory of Fed rate cuts. For now, investors believe a rate cut in Jun’24 as most likely (probability of 64.3% as per CME FedWatch Tool). A key ECB policymaker also suggested that the central bank is likely to begin its rate cut cycle in “spring” as victory against inflation was in sight. Weakness in the economy continued with industrial production declining more than expected by 2.1% in Jan’24, from an increase of 1.6% in Dec’23. In UK, GDP growth rebounded and increased by 0.2% in Jan’24 after declining by 0.1% in Dec’23 on a MoM basis. In Japan, focus remains on the spring wage negotiations with expectations of a sizeable increase, which is fuelling expectations of a hawkish pivot by BoJ. Volatility is expected in oil markets after Ukraine’s attack on Russian oil refineries which will weigh on domestic markets

Except Japan and China, global yields closed higher. UK’s 10Y yield rose

sharply as investors monitored the GDP data, which was in line with estimates.

Even 10Y yields in US and Germany firmed up, ahead of major macro releases,

for cues on evolution of Fed fund rate. India’s 10Y yield rose a tad by 1bps. It is

trading at 7.05% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)