Lending and Deposit Rates of Scheduled Commercial Banks – March 2024

FinTech BizNews Service

Mumbai, March 29, 2024:Data on lending and deposit rates of scheduled commercial banks (SCBs) (excluding regional rural banks and small finance banks) have been received by the RBI during the month of March 2024.

Highlights:

Lending Rates:

The weighted average lending rate (WALR) on fresh rupee loans of SCBs stood at 9.36 per cent in February 2024 (9.43 per cent in January 2024).

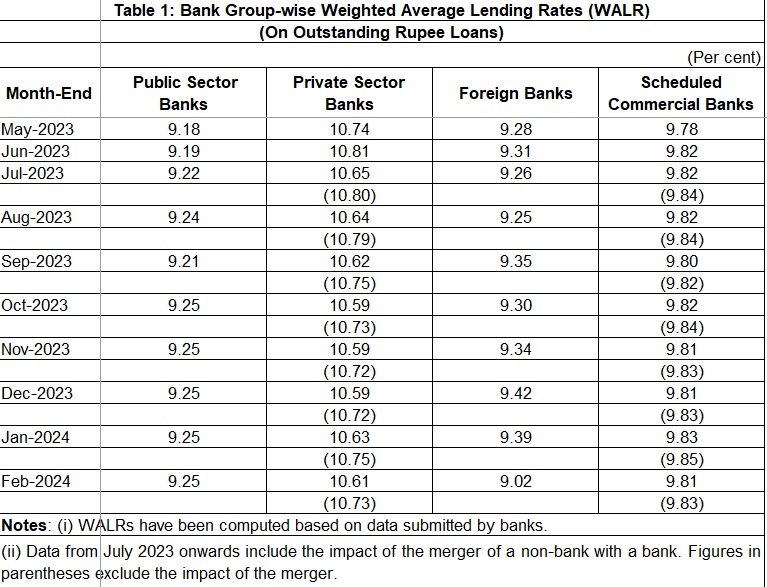

The WALR on outstanding rupee loans of SCBs was at 9.83 per cent in February 2024 (9.85 per cent in January 2024).1

1-Year median Marginal Cost of Fund based Lending Rate (MCLR) of SCBs remained unchanged at 8.80 per cent in March 2024.

The share of External Benchmark based Lending Rate (EBLR) linked loans in total outstanding floating rate rupee loans of SCBs was 56.2 per cent at end-December 2023 (53.3 per cent at end-September) while that of MCLR linked loans was 39.4 per cent (41.9 per cent at end-September).1

Deposit Rates:

The weighted average domestic term deposit rate (WADTDR) on fresh rupee term deposits of SCBs increased to 6.44 per cent in February 2024 from 6.43 per cent in January.

The weighted average domestic term deposit rate (WADTDR) on outstanding rupee term deposits of SCBs was at 6.86 per cent in February 2024 (6.84 per cent in January).