India has diversified its sources of oil supply to about 40 countries with more supply is coming onto the market from Guyana, Brazil and Canada

FinTech BizNews Service

Mumbai, 8 August, 2025: The State Bank of India’s Economic Research Department has come out with a special Research Report, authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Advisor, State Bank of India:

TARIFF DIPLOMACY: NEGOTIATION, KEEPING PRIDE INTACT IS THE WAY FORWARD

Imposition of 25% Penalty on goods trade, with a proposition of additional 25% on World’s largest democracy can be a bad policy decision for the US policy and its populace

Oil Imports from Russia... from miniscule before 2020 to >30% in 2025

❑ India turned to purchasing Russian oil sold at a discount (capped: $60 per barrel), to ensure its energy security, after Western countries imposed sanctions on Moscow and shunned its supplies over its invasion of Ukraine in Feb 2022

❑ Consequently, from merely 1.7% share in total oil imports in FY20, Russia’s share has increased to 35.1% in FY25 and it is now the biggest oil importer for India

❑ In terms of volume, India imports 88 MMT from Russia in FY25 from the total import of 245 MMT

If not Russia... then Where could India look to Replace Russian Oil?

❑ Besides Russia, India buys oil from Iraq - its top supplier before the war in Ukraine followed by Saudi Arabia -

and the UAE

❑ Indian refiners mostly buy oil from Middle Eastern producers under annual deals with the flexibility to request more supply every month. Since US's sanctions, the refiners have bought crude from the United States, Middle East, West Africa, and Azerbaijan.

❑ India has diversified its sources of supply to about 40 countries with more supply is coming onto the market from Guyana, Brazil and Canada

❑ Before war, India was purchasing other countries like Middle East and Africa, etc. So, India may shift to the

traditional middle eastern producers under annual deals with the flexibility to request more supply every month

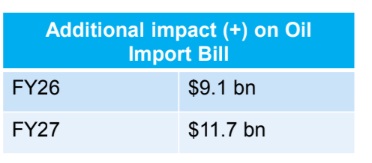

India’s fuel import bill will increase by only $9bn -12bn in the event of stopping oil imports from Russia

❑ if India stopped oil imports from Russia during the rest of FY26, then India’s fuel bill might increase by only $ 9

billion in FY26 and $11.7 billion in FY27...

❑ Russia accounts 10% of global crude supply, if all the countries stopped buying from Russia. So crude price

may increase by 10% if no other countries increase their production

Tariff on Pharma Exports.....India may hit....

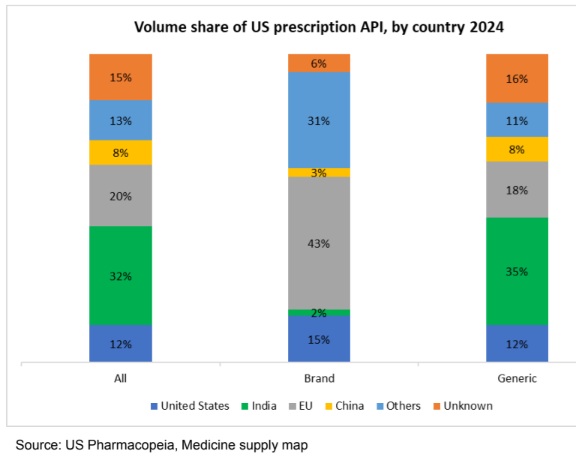

❑ 40% of India’s pharma exports goes to the USA (FY25), India’s share in US’s total pharma imports is 6% (in

2024)...

❑ ...This indicate that a possible tariff of 50% on pharma exports may hit earnings of pharma companies by 5%-

10% in FY26, as many big pharma companies' revenue from US stood in the range of 40-50%

❑ Further, tariff will reduce competitiveness in the world’s largest pharma market and profit margin pressure due to inability to pass on costs

.....But US will also suffer

❑ India has been a cornerstone of global supply chain for affordable, high-quality and availability of essential medicines, particularly life saving oncology drugs, antibiotics, and chronic diseases treatments

❑ In generic drug market, India supplies nearly 35% of the pharmaceutical needs of the US. If US shift manufacturing and API production to other countries or domestic facilities, which will take minimum 3-5 years for meaningful capacity

❑ Though generic drugs constitute 90% of prescriptions dispensed in the US, they account for 26% of drug spending (2018). In US, health expenditures per person per annum is around $15,000, and hence with 35% India’s share in generic drugs tariff will going to impact US citizens significantly

Any US tariff on India medicines is against the rational of DOGE.. hence exempted...

❑ Putting tariff on India Pharm exports hurts the US objective of reducing the size of general government and goes against the objectives of DOGE

❑ US national health expenditures is 17.6% of GDP

❑ Government sponsored Medicare and Medicaid account for 36% of the total expenditure

❑ The expenditure on Retail Prescription Drugs is $450 billion p.a. growing at 11% annually

❑ Higger price of affordable medicines increase both expenditure under Medicare and Medicaid and also the out-of- pocket expenditure of private citizens

HOW the US AGRI / DAIRY CHAEBOLS HAVING DEEP POCKETS & FINANCIAL MUSCLES STACK IN A FREE-WHEELING GLOBAL MARKET.....

Cargill Inc.: Annual Revenue: $160 billion CY24 (10% drop yoy from $177 billion in 2023).

World’s largest grain trader and largest privately held company in the United States by revenue

❑ Production, trade, purchase and distribution of grain, palm oil livestock feed, starch, glucose syrup, and other agricultural commodities

❑ Cargill is one of four "trading giants" known as the ABCD group, comprising ADM, Bunge and Dreyfus

❑ Largely family-owned business (Cargill-MacMillan family), with the descendants of the founder still owning 88% of the company, and estimated to have nearly 21 family members on Forbes 400 List

❑ 37th year since record keeping began in 1985, Cargill has been ranked as the US’s biggest private company, globally ranking only behind Dutch/Swiss energy and commodity MNC Vitol, Trafigura group from Singapore (again a commodities trader) and German retailer Schwarz but above Koch Industries from the US (TOP 5)

❑ Cargill, with a global presence across 70+ nations, having 60 odd subsidiaries and employing 1,55,000 personnel, is operating in India since 1987, in the fields of food, ingredients, agricultural solutions, and industrial products, with revenues of Rs 13,850 crores during FY24

Archer-Daniels-Midland Company (ADM): Annual Revenue: US$ 85.5 Billion (down 8.9% from FY 2023)

An American food processing and commodities trading company which operates more than 270 plants and 420 crop procurement facilities across the globe

❑ Founded in 1902 in Chicago, and ranking #384 on Forbes Global 2000 list, ADM is listed (majority ownership is from institutional investors viz. State Farm Investment, Charles Schwab, Vanguard Group, BlackRock, State Street etc., though stock prices have tumbled post Russia-Ukraine aggression in early 2022). ADM employs 44,000 personnel globally

❑ ADM processes oilseeds, corn, wheat, cocoa and other agricultural commodities, operating through segments viz. Agri Services and Oilseeds, Carbohydrate Solutions, Nutrition and animal feed. ADM also provides agricultural storage and transportation services

❑ The Agri Services and Oilseeds segment includes activities related to the origination, merchandising, crushing, and further processing of oilseeds such as soybeans and soft seeds, such as cottonseed, sunflower seed, canola, rapeseed, and flaxseed into vegetable oils and protein meals

❑ With 25 processing plants and 59 procurement centers in Asia-Pacific region, its presence in India since 2011 is primarily in oilseeds, food and beverage ingredients and animal nutrition. Globally its has ~38,000 personnel and operates in 200 countries

Bunge Ltd.: Annual Revenue US$ 53.10 Billion in 2024 (a 10.8% decline from 2023)

Bunge Global SA is an agribusiness and food company which purchases, stores, transports, and sells food and

ingredients, edible oils, milling products, and fertilizers.

❑ Bunge's product portfolio encompasses oil seeds, vegetable oils, protein meals, packaged and bulk oils, shortenings, margarine, mayonnaise, wheat flour and dry-milled corn products.

❑ It also produces and sells nitrogen-based liquid and solid phosphate fertilizers.

❑ Bunge's products are used by livestock producers, animal feed manufacturers, snack food producers, wheat and corn millers, restaurant chains, food processing companies, bakery confectioners and corn and oilseed processors, among others. The company also generates electricity.

❑ Bunge, headquartered in Missouri (US), operates across the Americas, Africa, the Middle East, Asia-Pacific and Europe.

Listed on NYSE, its stock price has struggled to get to highs tested prior to GFC in 2007.

❑ Bunge employs ~37,000 personnel at 500+ facilities and Port Terminals in 50+ Countries

❑ Bunge is present in India since 2001 with revenue growing to ~Rs 8900 crores during 9M fiscal 2025

Annual Revenue of Tyson Foods at US$ 53.3 billion (~0.81% increase from 2023)

Founded post the Great Depression in 1935, Tyson Foods is one of the world's largest food companies and a leading producer and marketer of meat-based products

❑ Outside of the US, the company is structured into three regional divisions, namely China/Korea, Asia Pacific and Europe, through which it serves customers in over 100 countries worldwide. Alongside its 142,000 employees, Tyson works with 11,000 independent livestock and poultry farmers.

❑ In India it operates in a JV with Godrej group since 2015

Consolidated revenues of US$ 39.3 billion in 2024 (~13.8% decline from 2023)

❑ A diversified global agribusiness cooperative owned by farmers, ranchers and member cooperatives across the US. CHS (Cenex Harvest States) offers innovative crop nutrition and crop protection products to empower retailers and farmers to grow healthy, profitable crops. With close to 10,000 personnel, it operates across 65 countries.

J.R. Simplot

Revenue: $ 11 billion in 2024 (+12%)

13,000 employees, Privately owned

Deere & Company

Revenue: US$ 51.7 billion in 2024 (-15.6% decline)

Since 1837....farm machinery and industrial equipment

Publicly traded... Present across 30+ countries (160+ through dealers' network)

In India since 1998, with operations at Pune and Dewas

Corteva

Revenue:$16.9 billion in 2024 (-1.85%)

publicly traded, global pure-play

agriculture company

22,000 personnel

India Trumped Global Biggies in Milk production between 2015-2024......

In the year 2015, India total milk production stood close to 155.5 million Tonne (EU 154.6 MT & US 94.6 MT)... By 2024, India’s share had swelled to 211.7 MT (growth of ~36%), while EU (incl. Britain) grew to 165.9 MT and the US 102.5 MT

US, despite faring low on milk production, remains a large processed items market.

Capitalism benefits the MOST in the long run when it innovates and promotes sustainability....

India, STRATEGICALLY PROTECTING ITS SOVEREIGNITY MUST CONTINUE protecting its farmers from likelihood of predatory practices of select global conglomerates who may vie for a lucrative Desi pie without ‘investing in sustainable market infrastructure creation, anchoring agri value chain financing and being a partner in welfare schemes that upend ‘Ease of Living’ for our farming community’, a sine qua non for asymmetric yet synergetic mutual benefits where the Society, the Government and the Markets (समाज, सरकार और बाजार)

❑ These concerns arise from a “weakened farm economy” prevailing in the US for quite some time, as a large MNC farm enterprise recently put in its shareholders meet, also evident through the financial results (24) prompting many to scout and screen large economies, growing at a breath neck pace and a bulge in middle class that can sustain the buoyancy in consumption.....

❑ Time to move away from a Bayesian Nash equilibrium to a Win-Win proposition.....