“The downside to rating stems from lack of political commitment to fiscal consolidation. Accordingly, continued reforms and a reduction in the public debt-to-GDP ratio could bring further upgrades.”

FinTech BizNews Service

Mumbai, August 14, 2025: Standard & Poor’s (S&P) Global Ratings today upgraded India’s long-term sovereign credit rating to ‘BBB’ from ‘BBB-’ and its short-term rating to ‘A-2’ from ‘A-3’, with a Stable Outlook. S&P has upgraded India to BBB with a Stable Outlook, highlighting economic resilience and sustained fiscal consolidation.

Here are views of leading economists of India on this rating upgrade:

Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India:

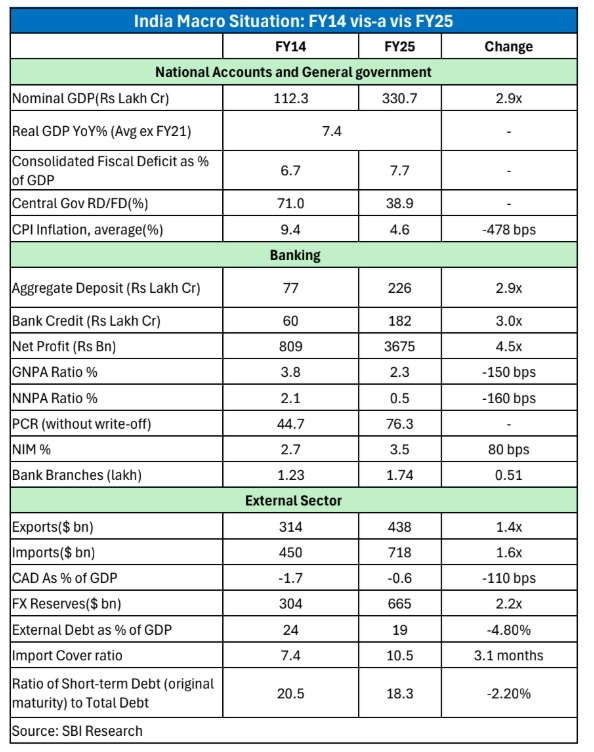

S&P upgrades India’s sovereign rating to BBB (STABLE), a level last witnessed decades back in 1990. S&P Global Ratings raised its long-term sovereign credit ratings on India to BBB from BBB– in August 2025 with stable outlook. The rating upgrade was across both time horizons. The rating agency also upgraded the transfer & convertibility assessment to A– which is the risk that a government imposes capital or exchange controls that prevent an entity from converting local currency into foreign currency and/or transferring funds to creditors located outside the country. The agency had revised the outlook on India's rating in May 2024 to positive from stable on robust growth and improved quality of government expenditure.

The rating action hinges on three fundamental observation— credible fiscal consolidation, strong external position and well anchored inflationary expectations.

The agency acknowledged that quality of government spending has improved in the past five to six years with higher budget allocation to capex spending at 3.1%. Inflationary expectations are better anchored than they were a decade ago. Agency projects the ratio of general government debt to GDP to decline to 78% by fiscal 2029, from 83% in fiscal 2025.

S&P forecasts India's real GDP growth at 6.5% this year which is on the more pragmatic side when compared to other forecasts. Notably, S&P notes that US tariffs will have overall marginal impact and will not derail India's long-term growth prospects. This is because, sectoral exemptions on pharmaceuticals and consumer electronics, the exposure of Indian exports subjected to tariffs is lower at 1.2% of GDP. The current account deficit is expected in the range 1.0-1.4% for 2025-2028. CPI is expected in the range 4-4.5% till 2028.

The downside to rating stems from lack of political commitment to fiscal consolidation. Accordingly, continued reforms and a reduction in the public debt-to-GDP ratio could bring further upgrades.

The rating of India did not capture India’s fundamentals for all most a decade. The current rating action by S&P reaffirms the position that Indian rating ought to have been on the higher side is no surprise.

Radhika Rao, Executive Director and Senior Economist at DBS Bank:

“S&P upgraded India’s credit rating higher within the investment grade universe, bringing the country on par with Indonesia, and Mexico. Positive impetus on the back of this upgrade will help lower the credit premium on the sovereign’s debt as well as further ease corporates’ offshore borrowing costs. This upgrade is driven by improvement in the economy’s macro backdrop, including material progress towards fiscal consolidation goals. With this year’s Budget focused on aligning deficits with overall debt levels, we expect cumulative deficit and debt levels to recede in the coming years, aided by healthy growth momentum as well as consolidation. As it stands, fiscal risks are partially mitigated by a large reliance on domestic financing of the government debt. Assessment on India’s external balance was also likely favourable, marked by a strong reserves stock, narrow current account deficits and contained external debt levels. Strong legislative and executive institutions likely represented the other key credit strength, besides a strong commitment for reforms. The agency expects the fallout of the high tariff rates to be manageable. The rating agency had upgraded India’s outlook to positive in May last year, which had opened a window for a potential upgrade over the next two years. The move was significant back then as it had come before the results of the election results and ahead of the Budget.”

Indranil Pan, Chief Economist, YES BANK:

“In a surprise move S&P upgraded India’s sovereign credit, by one notch. The astute management of the economy by policy makers, most principally, a sustained fiscal consolidation despite many challenges, is possibly the biggest reason for the ratings upgrade. Note that the sustained fiscal discipline of India comes in a period when most Developed Economies have relied on fiscal push to generate the growth impulse in their economies. Importantly, this fiscal discipline has not come at the cost of any constriction to the infrastructure spending, that is now at 3.1% of GDP compared to 2% of GDP in the pre-Covid period. The expectation of current sound economic fundamentals and likely incremental economic reforms process is leading up to the belief of robust growth in the next couple of years. The current trade wars and the imposition of 50% tariffs on India is understood to be manageable as India continues to be a domestic consumption-oriented economy. Overall, the ratings upgrade will be a positive for foreign flows into India, and lead to a stable currency atmosphere, thereby adding to the belief of lower financial market risks for India.”