Except Japan, stock markets elsewhere ended in green

Dipanwita Mazumdar,

Economist,

Bank of Baroda

Mumbai, 31 October, 2023: BoJ in its latest policy has made a slight tweak in its YCC program. It has scrapped its reference to daily bond purchasing at a fixed level of 1%, albeit shying of market expectations of a greater relaxation in the same. Post this decision, yen weakened slightly. Apart from this, policy rate is retained at the same level. Inflation forecasts have been revised higher for this and upcoming fiscal. Elsewhere, in Germany, 3rd quarter preliminary estimate of GDP showed contraction of 0.1%, slightly lower than estimated contraction of 0.2%. The provisional Oct’23 CPI print of the region has also showed some softening. In China, both manufacturing (49.5 vs est.: 50.2) and non-manufacturing print (50.6 vs est.: 52), raised calls for more stimulus to support the economy. On domestic front, all eyes will be on month end releases.

Except INR (flat), other global currencies appreciated against the dollar. DXY was weaker ahead of Fed policy decision. EUR rose the most by 0.5% as Germany’s GDP contracted less than expected. JPY too appreciated amidst hopes of a possible tweak in BoJ’s YCC. INR, along with other Asian currencies is trading weaker today.

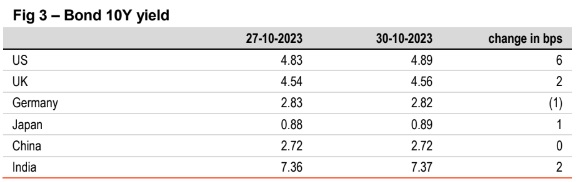

Global yields closed mixed. US 10Y yield rose by 6bps ahead of Fed meeting and waiting commentary on future course of rate action, on the back of resilient macros. Germany’s 10Y yield fell a tad by 1bps as provisional CPI estimate showed moderation. India’s 10Y yield rose by 2bps, amidst expectation of some OMO sales announcements. It is trading higher at 7.36% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)