12 million queries and 400k service requests managed by Yes Robot and Whatsapp Banking

FinTech BizNews Service

Mumbai, 23 October, 2023: YES Bank has fast developed as full spectrum retail bank, growing with strong momentum. YES Bank has been consistently putting together the key pieces of the puzzle as it accelerates along its path of profitability expansion. Few such highlights during the Q2 in the current FY included the launch of its next gen mobile banking app ‘iris by YES BANK’ and setup of a dedicated Strategy & Transformation Office.

YES Bank has leadership/ significant share in payment and digital businesses (UPI, AEPS, DMT); 90% of transactions via digital channels; Advanced scorecards and analytics being leveraged across underwriting and engagement, as per the investor presentation made on 21 October, 2023 at the time of the Financial Results for the Q2 and Half Year ended September 30, 2023.

Branch Banking

YES Bank’s branch banking has been expanding footprint, enhanced digital CX & growth in granular deposits.

Assisted Digital

• 93% SA, 85% Sole Proprietor CA opened digitally

• CA digital onboarding for Individuals, Sole Proprietors, CoS & LLP

• Key USP: Auto fetch from online channels like GST,IEC, MCA etc. for KYC validation & seamless UX

Digital Co-origination enabled across CA & SA onboarding

• Co-sourcing of demat & trading account with SA

• Co-origination of SA & Merchant Acquiring (POS) with CA

DIY with VKYC

• End to End STP journey for digital account opening

• Key USP: Intuitive UI / UX for consultative onboarding Servicing & Cross Sell 2 Digital Journeys for seamless Customer Acquisition, Servicing & Cross sell

Servicing

• More than 80 straight through digital service journeys available for all banking and loan requirements e.g.. PAN / Email / Address / Nominee Update, Debit Card Reissuance, Re-KYC, Foreclosure statement, Loan repayment schedule, Card transaction control etc.

Cross Sell

• End-to-end digital journeys for Fixed deposit, Credit card, Personal loan, 3-in-1 trading, Mutual fund & Insurance etc. • Journeys available across DIY and Assisted

29 branches converted to Business Correspondent Banking Outlets (BCBO) during the quarter.

On the back of purposeful digital investments:

Expanded Product offerings through launch of Education Loan

• Loan in seconds (LIS) platform and front-end automation initiatives (Yes Robot) have resulted in lower TAT along with higher productivity

• Adopted the account aggregator ecosystem as FIU / FIP to capitalize on consent layer of India stack

• Sales Force implementation helping in process improvement and customer delight

• Pre-qualified Gold Loan OD for existing customers 24x7 digital process

Analytics for expansion towards paperless processing

Digital & Analytics to enhance customer experience / reduce TAT

• Digital on-boarding, dedicated LMS for rule-based sanctions & disbursements and geotagged based monitoring

• Usage of Bureau data up to PIN code level for geographical expansions & periodic portfolio scrub to monitor portfolio health

• Leveraging Fintech/ digitechs for underwriting and risk management

Digital and product innovation at fulcrum of the franchise

CGTMSE: Limit increased from 2 to 5 Crs; Funding to New-to-Credit segment started

• Launched Digi OD: Pre-approved offering of high yielding OD product up to 15 lacs for ETB Customers

• Score based templated lending extended to 7.5 cr for faster TAT and curated offering

• Digital documentation: Automated prefilled FL and digital agreement generation from LOS system • Fee collection digitized with automated real-time reconciliation, GST advice to Customer

Credit Cards: Strong business growth and enhanced customer experience

Steady growth in new card acquisition leading to 28% Y-o-Y growth in customer base to reach 1.65 million base

• Highest ever Spends of INR 5,726 Crs in Q2FY24. 51.5% YOY growth over Q2FY23

• Book size of INR 4,334 Crs at end of Q2FY24. 51% YoY growth over Q2FY23 • Improvement in Revenue per customer through Cross-sell. Highest ever Term book of INR 1,000 Cr+ in Q2FY24

• Highest ever Term booking of INR 250 Cr+ in Sep’23.

Distribution Outreach and Digitization

• Launched a co-branded credit card with Freo Technologies in Sept’23.

• Digital acquisition contribution at 94% at the end of Q2 FY 24

• Went live with biometric verification for digital VKYC drop-offs in Jul’23.

• Launched ‘remote assisted journey’ and ‘pre-filled’ feature on the digital acquisition platform in Jul’23

• Initiated rationalization of credit card application fields in-order to reduce journey drop-offs.

Digital & Transaction Banking

Sustainable & granular revenues through digital payments, trade finance & cash mgt:

95% of our Corporate CASA is embedded with digital & transaction banking product & solutions. 70% of all lending clients have 2+ TBG & DB product embedment.

YBL processes 1 in 3 Digital Payment transaction in India: UPI – 38.1% Rank #1 | NEFT – 7.4% | IMPS - 9.6% | NACH - 12% | AePS - 23.8% Rank#1, 2% growth in UPI, 95% in NACH & 39% growth in BBPS YoY 22%.

150% growth in GST payments; 70% growth in EPFO payments. 12 million queries and 400k service requests managed by Yes Robot and Whatsapp Banking.

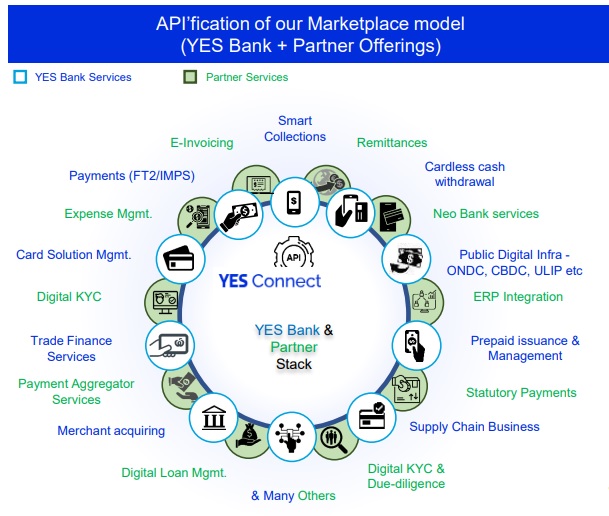

Embedded (Connected) Banking Digitizing client journeys & creating inorganic client acquisition funnel thru Fintech partnerships

YES Connect: Enriched CX, Super App for Businesses

30+ Partners, 450+ APIs, 100+ Solutions, 2x QoQ User growth.

IRIS: Enriched customer experience. Super APP for Retail Customers

? IRIS is a native API-led mobile platform offering banking on fingertips across customer lifecycle (100+ features)

? Leveraging 30% mobile native consumers + Digital India stack to build a highly scalable and low C2I digital business model.

Key Differentiators

? India’s first banking app built on co-creation ? Simple & intuitive design

? Significantly enhanced and superior banking experience with acquisition & onboarding journeys

? Complete customer lifecycle with hyper-personalized financial experiences

6+ lac users within 2 months of launch, Targeting 30% of new digital acquisition of the bank in near-term.

Strategically leverage Public Digital Infrastructure Contributing to building new-age India through collaboration on Key Digital Initiatives.

Financial Markets – Customised solutions for clients

FX Sales: 60+ Member experienced professionals. Active FX trading desk for market making providing best in class pricing for customer transactions and Propriety trading. Available across digital platforms for Rate booking Retail Contributes 50% of overall income.

Debt Capital Markets & PD: Connect with a wide range of Large/Mid-Size Issuers; Comprehensive Product Suite, Numerous maiden issuances & multiple repeat mandates; Diversified Investor. Connect.

Bullion Desk: Consignment import, Outright domestic and Export Sales;

? 3rd Largest Bank for Bullion in India

? Extended specialized desk coverage ?

Pioneered the first INR settlement trade between India and UAE.