There has been disproportionate shock of COVID-19 on smaller HFCs

(The Reserve Bank released the October 2023 issue of its monthly Bulletin on 19 October 2023. The Bulletin includes two speeches, six articles and current statistics. One of the articles is titled Housing Finance Companies and the COVID-19 Pandemic: Does Size Matter?) Edited excerpts:

By Nandini Jayakumar, Rajnish Kumar Chandra, Brijesh P., and Prayag Singh Rawat

Housing Finance Companies (HFCs) play an important role as the second largest lender in the housing finance space and one of the largest borrowers of the financial system. The HFC sector weathered multiple challenges in the last few years, with the COVID-19 pandemic striking the most recent blow. We empirically examine the heterogeneous impact of the pandemic by studying the relationship between credit growth of HFCs and their size and find that vis-á-vis big HFCs, credit disbursements by smaller HFCs declined in the post COVID period.

In terms of employment, housing and real estate is the second largest employment provider, next to agriculture, and as per estimates, was slated to have employed over 67 million by 2022 (GoI, 2018). Housing also accounts for a preponderant share in total institutional indebtedness of households, ranging from 61 per cent in urban areas to around 22 per cent in rural areas (NSO, 2021).

The HFC sector in India is highly concentrated, as evidenced by the Herfindahl–Hirschman Index (HHI). In terms of asset size, the largest HFC holds around 52 per cent and the five largest HFCs account for around 85 per cent of market share at end of September 2022. This is largely attributable to the strong market position and extensive geographical presence of HDFC. Going forward, consequent to HDFC twins’ merger, the concentration in the sector is expected to decrease.

Balance Sheet Analysis

The HFC sector weathered multiple challenges in the last few years, with the COVID-19 pandemic striking the most recent blow. However, with gradual resumption of economic activities, the sector demonstrated its resilience by growing in double digits at end-March 2022. The demand for credit extended by HFCs also gained traction, mainly on account of low interest environment, higher savings rate and increased preference for home ownership in the post-COVID period. The consistent thrust from the government through affordable housing schemes, refinance and regulatory support also aided the revival of the sector (NHB, 2022).

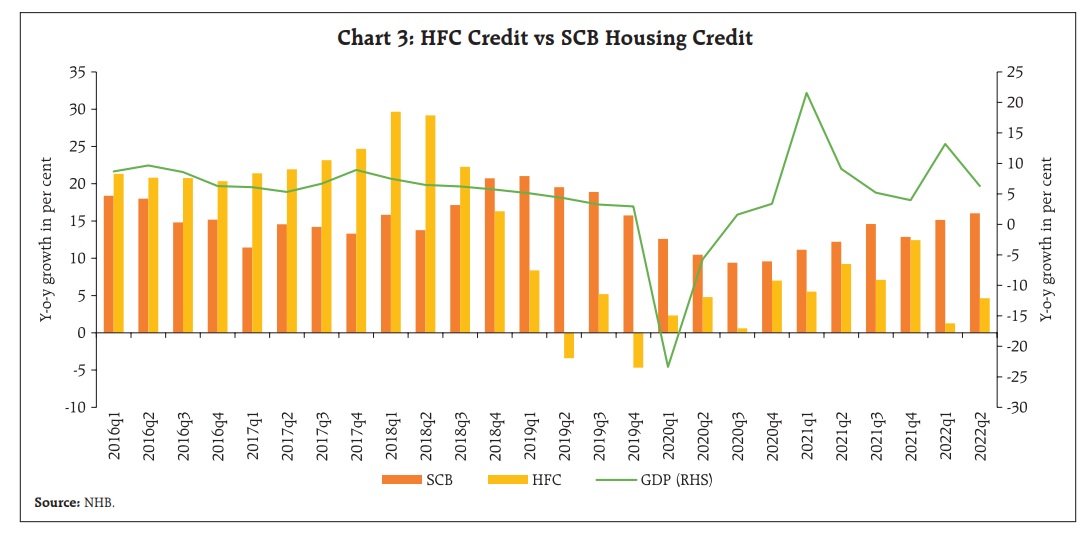

Credit extended by HFCs was growing at a robust rate before the liquidity shock due to the IL&FS crisis spilled over to the HFC sector in September 2018. With a few major HFCs defaulting on their debt obligations in 2019, the liquidity stress exacerbated. On the other hand, SCBs stepped up their housing credit during this period, filling the credit gap created by a slowdown in HFC credit. The COVID-19 pandemic and subsequent nationwide lockdown in 2020 aggravated the already delicate business environment. In the post-pandemic period, with government policies and support from regulators, HFCs’ credit growth witnessed revival (Chart 3). On the liabilities side, HFCs predominantly rely on markets and banks for their funding requirements. At end-September 2022, borrowings from these two sources constituted around 68 per cent of the total resources mobilized. Post IL&FS episode, there has been a gradual decline in the share of market borrowings, reflecting waning market confidence. In the aftermath of the COVID-19 outbreak, low interest rate environment resulted in an increase in borrowing from banks and a further moderation in share of market borrowings. Other borrowings, which included, borrowings from the government and refinance support from NHB also grew during this period

Soundness Indicators

Overall asset quality of the sector witnessed an improvement at end-September 2022, over the previous year. Gross non-performing assets (GNPA) ratio declined mainly on the back of better recovery by HFCs, improvement in collections under the SARFAESI Act and economic revival (ICRA, 2022). Profitability indicators, return on assets (RoA) and return on equity (RoE) saw a marginal dip in Q2:2022- 23 vis-à-vis Q1 of the same year.

To sum up, the HFC sector continues to grow in the aftermath of the COVID-19 shock, exhibiting double digit credit growth and low GNPA ratio, aided by policy and regulatory support.

Data and Summary statistics

The data spans from June 2016 to September 2022 and covers 58 HFCs. The panel is not balanced due to data availability and/or quality issues. Further, information is not available for all variables for all HFCs. However, the dataset covers around 98 per cent of the HFC universe in terms of asset size (at end-March 2022) and therefore, is representative of the sector.

We find that as expected, credit growth decelerated and GNPA ratio has increased for both categories in the post-COVID period (quarter-ending June 2020 to September 2022) as compared to the pre-COVID period (quarter-ending June 2016 to March 2020). We further note that the big HFCs maintain a higher liquidity ratio in the post COVID period, in a bid to shore up liquidity buffers. While the capital position of smaller HFCs did not change materially, big HFCs buttressed their financial position by raising additional capital and strengthened their balance sheets.

Empirical Strategy and Results

We are particularly interested to know if there was a differential impact of COVID-19 pandemic on HFCs based on their size. We find significant statistical evidence that in the post-COVID period, credit growth by small HFCs is lower than the big ones. This shows the disproportionate shock of the COVID-19 pandemic on the smaller HFCs. We also find that among the HFC specific variables, high GNPA ratio and funding cost dampen credit growth and high capital ratio stimulates it. Among macroeconomic controls, we find that SCB housing credit, GDP growth rate and HPI have expected signs and are significant.

A major change experienced by the HFC sector in recent times, apart from liquidity shocks and the COVID-19 pandemic, is the merger of HDFC, the largest mortgage financier, with HDFC Bank. HDFC accounted for over half the size of the sector at end- September 2022. In this regard, one can question if HDFC, by virtue of its size and dominance, is driving our results by its inclusion in the sample. To address this question, we employ the same framework excluding HDFC for robustness. Upon exclusion of this major HFC, we do not find any change in our results, particularly the interaction coefficient, which is our variable of interest.

Conclusion

In India, HFCs are an important financing channel to the housing and real estate sector and are instrumental in providing affordable finance to marginalized and new-to-credit borrowers. The sector exhibits oligopolistic characteristics, with the largest five HFCs accounting for around 85 per cent of the total assets at end-September 2022. In this regard, recent scale-based regulation introduced by the Reserve Bank seeks to regulate these bigger entities more stringently. The COVID-19 pandemic struck a blow to the HFC sector, which was already reeling under difficulties. Nevertheless, as the economy began inching toward normalcy on the back of liquidity support from the government and regulatory forbearance, the sector also showed signs of revival. Balance sheet of HFC sector recovered and continues to remain sound in terms of asset quality and profitability. The impact of the pandemic, however, differed for bigger and smaller HFCs. We establish this heterogeneity by using quarterly data and find that vis-á-vis big HFCs, credit disbursements by smaller HFCs declined in the post-COVID period. Our results remain robust to various controls and validity checks. In the wake of existing demand-supply gap in the housing sector, HFCs, as the second largest player in the housing finance space, are instrumental in providing accessible and affordable finance options to desiring borrowers. Apart from larger HFCs that dominate the sector, many small players also operate in this space and have developed geographical expertise and knowledge of local markets. They play an important role in promoting last-mile financial inclusion by providing access to housing finance to customers in tier-II and tier-III geographies and their strengthening will reinforce the ‘Housing for all’ agenda.