26.11 lakh folios being added during November 2025

FinTech BizNews Service

Mumbai, 11 December 2025: Association of Mutual Funds in India (AMFI) has on Thursday released Mutual Fund Industry Monthly Data for November 2025.

Highlights AMFI Mutual Fund Industry Monthly Data November 2025:

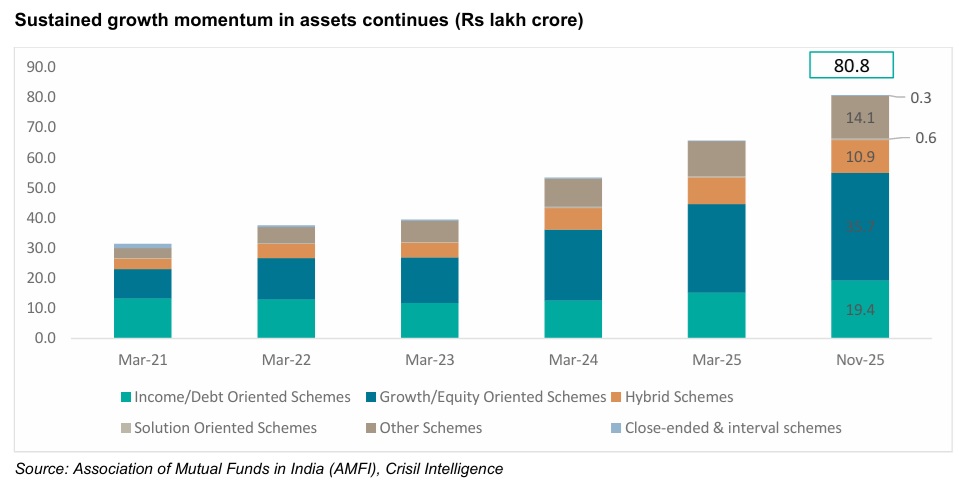

Mutual Fund Industry’s Net AUM stands at Rs 80,80,369.52 crores for the month of November 2025. Net AUM for the month of October 2025 was Rs 79,87,939.94

The AAUM for the month of November 2025 is Rs 81,31,763.67 crores.

Mutual Fund Folios are at 25,86,14,320 as of November 2025 with 26.11 lakh folios being added during the month. Folios as of October 2025 stood at 25,60,03,815.

Retail MF Folios (Equity + Hybrid + Solution Oriented Schemes) are at 20,15,85,661 for the month of November 2025 as against in 19,98,07,323 October 2025

Retail AUM (Equity + Hybrid + Solution Oriented Schemes) stood at Rs 46,48,599 crores for November 2025

57th month of positive equity inflows, starting from March 2021

The SIP AUM is at Rs 16,52,665.35 crores for the month November i.e 20.5% of the total mutual fund industry AUM.

SIP contribution for November 2025 stood at Rs 29,445.28 crores

The number of Contributing SIP accounts stood at 9,42,51,845 crores in November 2025

A total of 24 schemes were launched in the month of November 2025, all open-ended and across categories, raising a total of Rs 3,126 crores

SIF data

Specialized Investment Fund (SIF) assets rose to Rs2,932 crore in November 2025, registering a 45.8% month-on-month increase from Rs2,010 crore. The month also recorded total net flows of Rs902 crore.

Venkat N Chalasani, Chief Executive, AMFI, explians the Nov25 data takeaways: “The mutual fund industry crossed the Rs80 lakh crore mark in November, reflecting steady investor confidence. SIP assets rose to Rs16.53 lakh crore, now contributing over one-fifth of the industry’s total AUM, indicating that investors remain committed to disciplined, long-term investing.

Equity-oriented schemes continued to drive growth, supported by sustained inflows. Hybrid and passive funds also saw healthy traction, with multi-asset and arbitrage funds together accounting for over 70% of hybrid category flows.

SIFs saw a 45% month-on-month increase in assets, suggesting gradually increasing interest in newer investment avenues among mass-affluent investor.

As the industry expands, AMFI remains committed to strengthening investor awareness and ensuring a transparent, diversified, and accessible investment ecosystem.”