Global Market Snapshot Report Oct 2023 by Motilal Oswal AMC

FinTech BizNews Service

Mumbai, November 10, 2023: Indian stock markets exhibited a negative trend in in October 2023, reports MOAMC Global Market Snapshot Report.

Nifty Midcap 150 declined by 3.80% in October 2023, most among all Indices. While Nifty 50 declined by 2.84%. Nifty Midcap 150 and Nifty Smallcap 250 declined by 3.80% and 1.69%, respectively. Nifty Next 50 declined by 2.26% and Nifty 500 declined by 2.84%. Momentum Factor declined by 3.66%

According to Motilal Oswal Asset Management Company’s (MOAMC) Global Market Snapshot Report in October 2023, Indian stock markets exhibited a negative trend, highlighted by a 2.84% fall in the Nifty 50 index, with the Midcap 150 index leading the decline at 3.80%. However, the report by MOAMC notes that in commodities Gold has seen a positive change/has given positive returns of 21.84% in the past one year, while change/ returns on Silver is 21.05%. As of October 31, 2023, Gold is priced at 1,996.9 $/ounce while Silver is 23.2 $/ounce.

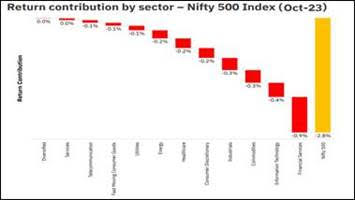

With the exception of Realty, all sectors reported negative performance. The Metals sector saw the steepest decline, dropping by 6%. Factor-based investment strategies, including Momentum, Low Volatility, Quality, and Value, all delivered negative returns for October. Momentum experienced the most significant decline at 4%. On the return contribution side, The Financial Services sector remained a key driver of returns for the Nifty 500 index, contributing 0.88% to the overall 2.84% decline in the index during October 2023.

In the US, S&P 500 and NASDAQ 100 both experienced a 2% decline in October 2023, with the Healthcare & Consumer Discretionary sector being the largest contributor to the S&P 500's fall. Globally, both emerging and developed markets saw negative performance, with declines of 4% and 3%, respectively. South Korea witnessed the most significant drop at 7%, while Switzerland led the decline in developed markets with a 5% fall.

Crude oil prices nosedived by 11% during October, due to rising geo-political risks, low demand from the US and mixed Chinese data. On the commodities front, precious metals were in the green with gold and silver prices rising by 7% and 1% respectively, amid rising tensions in the middle east. Cryptocurrencies like Bitcoin and Ethereum went soaring at 29% and 9%, respectively.

(Disclaimer: The information contained herein is for general purposes only and not a complete disclosure of every material fact. The information/data/charts herein alone is not sufficient and should not be used for development or implementation of any investment strategy. All opinions, figures, estimates and data are as on date. The content does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Readers shall be fully responsible/liable for any decision taken on the basis of this article.)