Growth In Credit To NBFCs Decelerated In Dec 2023

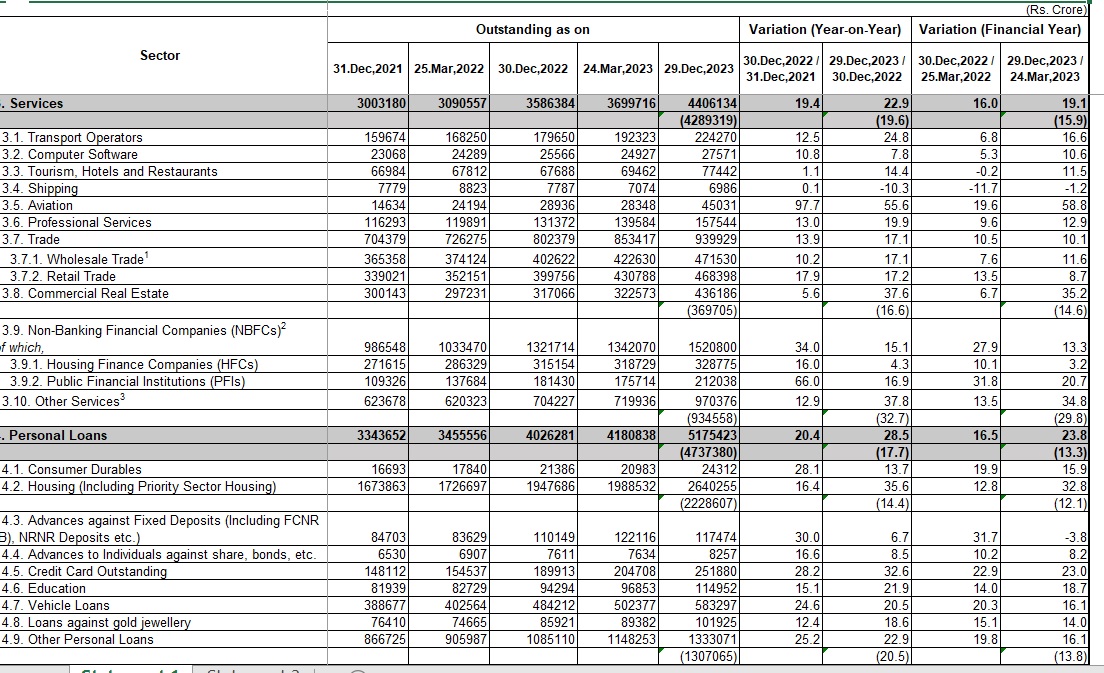

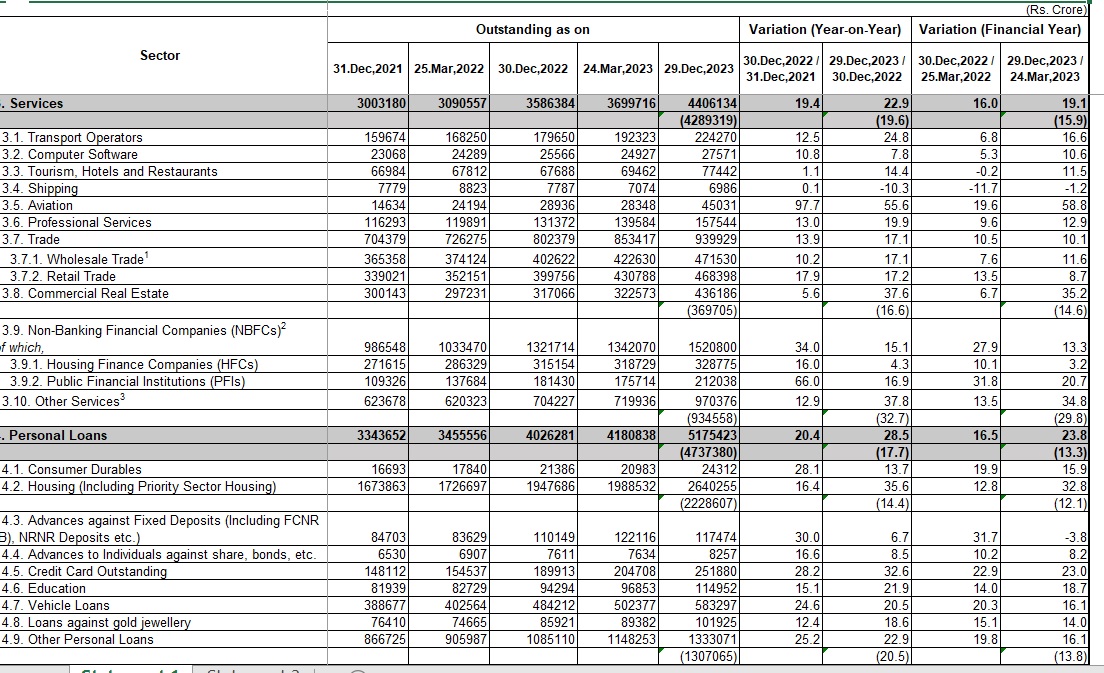

Sectoral Deployment of Bank Credit – December 2023

credit breakup

credit breakup

FinTech BizNews Service

Mumbai, February 1, 2024: Data on sectoral deployment of bank credit for the month of December 2023 collected from 41 select scheduled commercial banks, accounting for about 95 per cent of the total non-food credit deployed by all scheduled commercial banks, are set out in Statements I and II.

On a year-on-year (y-o-y) basis, non-food bank credit registered a growth of 15.8 per cent in December 2023 as compared with 15.3 per cent a year ago.

Highlights of the sectoral deployment of bank credit are given below:

- · Credit to agriculture and allied activities expanded by 19.5 per cent (y-o-y) in December 2023 as compared with 11.6 per cent a year ago.

- · Credit to industry grew at 8.1 per cent (y-o-y) in December 2023 as compared with 8.6 per cent in December 2022. Among major industries, growth in credit (y-o-y) to ‘food processing’ and ‘textiles’ accelerated in December 2023 as compared with the corresponding month of the previous year, while that to ‘basic metal & metal products, ‘chemicals & chemical products’ and ‘infrastructure’ decelerated.

- · Credit to services sector inched up to 19.6 per cent (y-o-y) in December 2023 as compared with 19.4 per cent a year ago. Among major contributors, growth in credit (y-o-y) to ‘trade’ improved while that to ‘non-banking financial companies (NBFCs)’ decelerated in December 2023.

- · Personal loans growth slowed to 17.7 per cent (y-o-y) in December 2023 (20.4 per cent a year ago), due to moderation in credit growth to housing and vehicles.