Sensex is trading lower today

Sonal Badhan,

Economist,

Bank of Baroda

Mumbai, March 19, 2024:In line with market expectations, BoJ hiked rates for the 1st time in 17 years, as it increased short-term rates (primary policy tool) to 0-0.1% from (-) 0.1%. Negative rates had been in place since 2016 and the latest decision has been taken in view of Central Bank being confident in achieving 2% inflation target on sustainable basis from Jan’24 onwards. BoJ has also abolished YCC policy. Yen is holding ground so far, as the impact of this will be felt over the coming months. Separately, Reserve Bank of Australia also announced its decision to hold rates (cash rate at 4.35%) unchanged, in line with market expectations. The Central Bank acknowledged that while the inflation is coming down, it’s more due to goods inflation, while services inflation remains elevated. Tightness in labour market and wage growth were also cited as cause of concerns. Next, investors await decisions of US Fed and BoE.

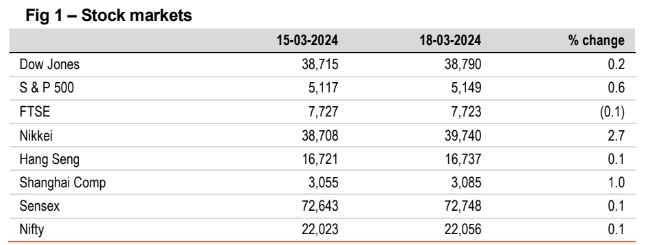

§ Except FTSE (lower), other global stock indices closed higher. US indices ended in green ahead of the Fed meeting. Moreover, gains in technology related stocks supported the market. Nikkei climbed higher, followed by gains in Shanghai Comp. Sensex rebounded led by gains in metal and auto stocks. However, it is trading lower today, while other Asian stocks are trading lower.

§ Except INR and CNY, other global currencies ended weaker against the dollar. DXY rose by 0.1% as investors awaited key Central Bank decisions this week. Gains in 10Y yield added to dollar’s strength. INR ended flat. But it is trading weaker today, while other Asian currencies are trading mixed.

Global 10Y yields closed mixed. Yields in US, Germany and India rose, while they fell elsewhere. Investors await Fed’s policy outcome for further guidance. Yields in Japan awaited BoJ’s decision. BoJ has announced today that it is moving away from its negative rate and YCC regime. India’s 10Y yield rose by 3bps, following rise in oil prices. It is trading flat today at 7.09%.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)