US elections are due in November 2024 and thus the Democrats may not be comfortable with a slowing economy before elections and hence a frontloaded slowdown looks more imminent

FinTech BizNews Service

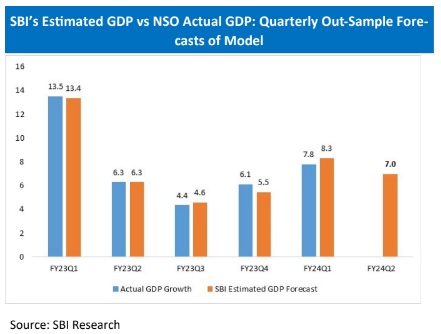

Mumbai, November 22, 2023: SBI’s in-house developed ANN model with 30 high frequency indicators has been trained for the quarterly GDP data from 2011 to 2020. The forecast performance of the model in the previous periods has been mostly precise. On the basis of the deep learning ANN model, we forecast that the quarterly GDP growth for the Q2FY24 should be at 6.9%-7.1%, though there could be still a forecasting bias. The mean growth rate thus comes at around 7% for Q2FY24. This will firmly push up the FY24 growth rate over RBI projections at 6.5%, says a report, authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

Domestic economic activity in Q2 has been supported by robust agricultural performance, sustained buoyancy in services, strong capital expenditure by centre (49% of budgeted) and states (32% of budgeted) and a robust pick up in consumption expenditure.

However, concerns on global growth remain. US labour markets are now beginning to wilt a bit with a consistent theme emerging in the Non Farm Payroll releases this year – the headline figures have been revised lower for 8 of the 9 months. Says the report, “We believe that once US consumers wind up excess savings, that are still estimated around $1 trillion, US economy could be headed for a slowdown that now looks more frontloaded beyond 2024. It may be noted that US elections are due in November 2024 and thus the Democrats may not be comfortable with a slowing economy before elections and hence a frontloaded slowdown looks more imminent.”

With a palpable slowdown of major economies globally, export competitiveness seems to have a hit a temporary roadblock. However, the growing commitment of global behemoths to incrementally source components and parts, apart from local manufacturing commitments aimed at exports, augurs well for the sector in times ahead. Against this backdrop, deficit of net exports of goods and services increased to $21 billion in Q1 FY24 owing to higher goods trade deficit and lower net surplus in services. However, in nominal terms the weighted contribution of net exports in nominal GDP was positive at 1.3% in Q1 FY24. In Q2 FY24, goods trade deficit increased to $60 billion, while services trade surplus improved to $40 billion, leading to net exports deficit of goods and services at $20 billion. In yoy terms this is 55% higher than net exports in Q2 FY23 (deficit of $44 billion). Accordingly, the net exports contribution to nominal GDP is likely to come positive and increase in Q2 FY24 compared to Q1 FY24, possibly around 2%.

Additionally, there seems momentum continuing at Indian Inc. in Q2FY24 after a 30% growth in PAT in the Q1FY24. In Q2FY24 also, Indian Inc., though reported a top line growth of 4%, it reported EBIDTA and PAT growth of 66% and 31% respectively as compared to Q2FY23 chiefly contributed by sectors such as Banks, Auto, Capital Goods, Cement, Electronics, Power Generation, Realty, FMCG, etc. Thus it seems that corporate results have been strong across the universe and are largely broad-based.

Corporates, ex BFSI, represented by more than 3000 listed entities reported almost flat topline in Q2FY24. However, EBIDTA and PAT grew by more than 40% as compared to Q2FY23. Further, it is pertinent to mention that corporate margin, which was under pressure in last year has shown sign of distinct improvement since Q4FY23. EBIDTA margin, on aggregate basis of more than 3000 companies, improved by 444 bps to 15.19% in Q2FY24 as compared to 10.75% in Q2FY23 contributed by low input prices.