India has grown at an average of 8.3% post-pandemic

FinTech BizNews Service

Mumbai, June 1, 2024: The State Bank of India’s Economic Research Department has come out with a Research Report titled ‘India has grown at an average of 8.3% post-pandemic, FY25 could see growth topping 7.5% higher for longer growth’. The report has been authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

Highlights from the report:

Surpassing all estimates, India’s economy grew by a whopping 7.8% in Q4 FY24 (SBI estimate: 7.4%, Bloomberg Median estimate: 7.0%), much above 6.2% growth witnessed in the same quarter last fiscal. Riding on Q4 numbers, the annual FY24 growth is estimated to increase by 8.2% as against 7.0% in FY23. The GVA grew by 6.3% in Q4 and 7.2% in FY24 while Core GVA grew by 8.4% in FY24.

Manufacturing sector apparently held the forte, driving the above spectacular growth. During Q4, manufacturing grew by 8.9% while for the whole fiscal it has grown by 9.9% (as against a decline of 2.2% in FY23). While mining segment saw a 7.1% growth, Industry sector grew by 9.5% in FY24. Agriculture sector though is still muted, clocking growth by only 0.6% in Q4 (Q3: 0.4%). For FY23, Agriculture GVA grew by 5.4% as against 9.4% growth in FY23. Among services, ‘Financial, Real Estate & Professional Services’ grew by 7.6% and ‘Trade, Hotels, Transport, Communication & Services related to Broadcasting’ grew by 5.1%.

NSO has revised the Q1 & Q3 GDP numbers by 2 bps and 21 bps respectively. Due to upward revision in FY24 GDP numbers (by 57 bps), the fiscal deficit of FY24 as % of GDP will now be revised downwards to 5.6% from 5.8% of GDP. For FY25 there will be no significant change in fiscal deficit due to revisions.

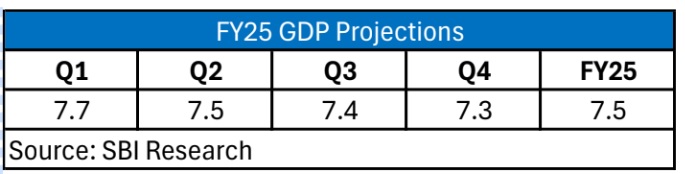

As against the perception from select quarters in market that decline in subsidies largely propelled FY24 growth, the truth aligns with huge increase in net direct taxes. We believe that this trend will remain active in FY25 also and GDP growth may reach the 7.5% mark. Given a historical ICOR of 4.3 and gross investment rate at 33.3% as per professional forecasters, 7.5% growth for FY25 could be a reality!

GDP deflator increased to 2.0% yoy in Q4 FY24 compared to 1.4% yoy in Q3 FY24. Growth in GDP deflator for agriculture has declined to 4.0% yoy in Q4 from 4.7% yoy in the previous quarter. For industry GDP deflator came at -0.2% yoy compared to -0.6% yoy in Q3 FY24, with mining & quarrying and electricity, gas, water supply and other utility services registering higher deflator growth. Meanwhile, growth in services deflator moderated to 2.2% yoy in Q4 from 2.5% yoy in Q3 FY24.

Annually GDP deflator exhibited huge deceleration to 1.3% yoy in FY24 from 6.7% yoy in FY23, with agriculture and services witnessing lower deflator growth and industry de-growth in deflator. Looking ahead with WPI inflation expected to be around 2% yoy in FY25 (compared to -0.8% in FY24), deflator is expected to average around 2.8% yoy in FY25.

The general demand continues to remain robust with real GDP on expenditure side showing strong traction in capital formation. The capital formation in real terms increased by 9% in FY24 showing a strong growth. The consumption expenditure growth however decreased to 3.8% in FY24 from 7.1% in FY23.

Another aspect of the FY24 estimate is that the absolute nominal statistical error (discrepancy) is the highest in FY24 for the entire 2011-12 base series. However, in % real terms it is only 0.7%. We believe however that this discrepancy will be adjusted later. For example, if we estimate average of all such discrepancies on a yearly basis since FY1951, it comes in at a negative 1.1%.

SCBs credit growth continued to remain strong at 19.5% as on May 17, 2024, compared to last year growth of 15.4%. During Apr-May, credit grew by Rs 1.73 lakh crore (1.3% YTD), compared to last year growth of Rs 2.18 lakh crore (1.6% YTD), while deposits grew by Rs 3.38 lakh crore (1.7% YTD), compared to last year growth of Rs 3.32 lakh crore (1.8% YTD). The lower credit growth is seasonal effect, while the growth in deposits could come from select banks raising term deposits rate.

Indian Inc. in Q4 FY24, with around 4000 listed entities, reported top line growth of 9% while EBIDTA grew by around 23%, as compared to almost flat top line in all previous quarters. However, PAT growth declined to around 10% from 42% in the previous two quarters on yoy basis supported by banking sector which reported a PAT growth of 45% during Q4FY24. Corporate results, for Q4FY24, ex BFSI represented by more than 3000 listed entities, shows topline growth of 5% while bottom line managed to grew by 3%.