US jobless claims rose to a 3month high for the week ending 11 Nov

Dipanwita Mazumdar

Economist,

Bank of Baroda

Mumbai, November 17, 2023: A slew of economic data in the US pointed towards the fact that US Fed fund rate has already peaked. US jobless claims rose to a 3month high for the week ending 11 Nov. Even industrial production data of the region remained downbeat due to labour disputes in the auto sector. CME Fed watch tool is pricing in a 99.8% probability of status quo in rate compared with 85.4% probability attached a week earlier. Fed officials such as Lisa Cook and Loretta J. Mester have also warned of risks to an unnecessarily sharp slump in activity due to excessive tightening. In another news, US President Joe Biden has said that talks with China have been constructive. On domestic front, RBI came in with a directive to increase risk weightage for certain categories of personal loans and also for consumer credit exposure of NBFCs.

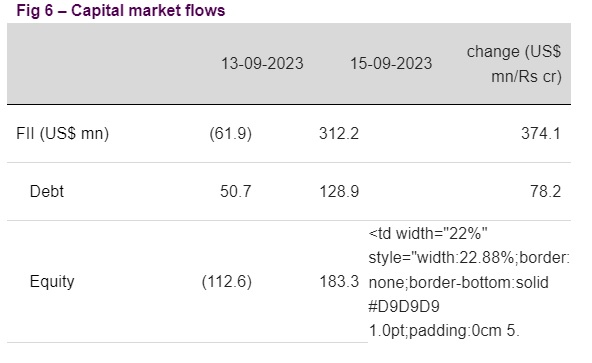

Global stocks ended mixed. Investors monitored soft macro data in the US (jobless claims and industrial production) as well as US-China talks. Equity markets in China and Hang Seng fell, led by a rout in tech stocks. In India, Sensex rose by 0.5%, led by gains in technology and consumer durable stocks. However, it is trading lower today, in line with other Asian stocks.

Except JPY which was higher by 0.4%, other global currencies traded in narrow ranges. DXY was marginally lower as weak macro data has strengthened the case for rate cuts. INR depreciated by 0.1% as India’s trade deficit touched a record high in Oct’23. It is trading further lower today, while other Asian currencies are trading mostly stronger.

Except India, global yields closed lower. A host of factors such as weaker economic data in US, Eurozone and China hinted at slowdown in global growth and this has increased appetite for sovereign securities. Fed officials and ECB President all are hinting at risks of overtightening. India’s 10Y yield rose by 2bps, ahead of the weekly auction. It is trading at 7.23% today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)