Q2 GDP IS EXPECTED TO BE CLOSER TO 7.5%

FinTech BizNews Service

Mumbai, November 18, 2025: The November GST collections could cross Rs 2.0 lakh crore, reveals the State Bank of India’s Economic Research Department’s special Research Report. The report has been authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Advisor, State Bank of India:

Growth is being supported by a pick up in investment activities, recovery in rural consumption, and buoyancy in services and manufacturing, underpinned by structural reforms like GST rationalization that also helped unleash a festive spirit that decisively showcased triumph of hope over hype

❑ In continuum of the good numbers from festive led sales, percentage of leading indicators in consumption and demand across Agri, Industry, service showing acceleration has increased to 83% in Q2 from 70% in Q1. Based on the estimated model, we obtain a nowcast of real GDP growth of ~7.5% in Q2FY26 with possibility of an upside surprise

❑ Our analysis indicates that gross domestic GST collections may come around Rs 1.49 lakh crore for Nov’25 (returns of Oct’25 but filed in Nov’25), a YoY growth of 6.8%... Coupled with Rs 51,000 crore of IGST and cess on Import, the November GST collections thus could cross Rs 2.0 lakh crore, driven by the peak festive season demand led by lower GST rate and increased compliance while most of states experience positive gains

❑ During the last month festive season (Sep-Oct’2025), consumption has got a big boost with GST rationalization, first indication coming from analysis of Credit and Debit card spending patterns across the latitude.... In credit cards, merchant categories like Auto, Grocery stores, Electronics, Furnishing and Travel indicated a huge growth in e-commerce channel where 38% spends were on Utility & Services, followed by 17% on Supermarkets and Grocery and Travel Agents held 9% share... Also, city wise credit card spends reveals that demand has increased across regions but growing in mid-tier cities the most as E-com sales have largely been positive across cities (w.r.t. PoS channel)

With GST rationalization, Debit card spends too shows growth across all major states in Sep/Oct25 over Sep/Oct24...However, for Debit cards, within E- Commerce spending, Metro has shown highest growth (8%) followed by Urban areas (7%) in Sep/Oct’25 compared to Sep/Oct-24.... Top 5 items comprise 70% of the total purchases during Sep/Oct’25, led by Groceries and Supermarkets as also Departmental stores

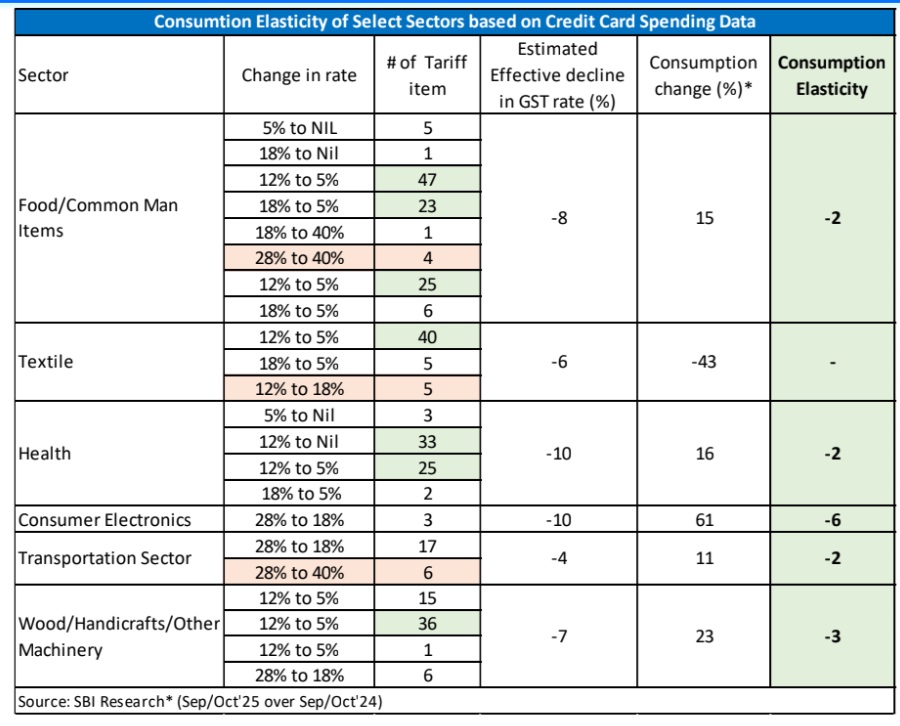

❑ Decoding consumption elasticities for major sectors based on the change in weighted effective GST rate post GST rationalization reveals all sectors except textile are highly elastic (abs value >1) delineating strong response of consumption due to GST rationalization... The reduction of effective GST rate should spurt savings for the consumers. Juxtaposing GST rates with MPCE (HCES: 2023-24) reveals that on an average, a consumer may save 7% per month on their consumptions based on initial estimates and could rise further with availability of more data

❑ A bottom-up growth narrative is evident in our analysis of vehicle sales PAN-India.... While all regions exhibited double-digit growth in car sales volume (~19%), maximum growth came from Rural regions, followed by Urban region with 39% of cars sold in the price range of above Rs 10 lakh .... Urban and Metro centers also exhibited growing premiumization as higher end variants / models / brands (>20 lakh) found accelerated growth across value-volume matrix.

THE GREAT INDIAN BIG BILLION FESTIVAL..... TRIUMPH OF HOPE OVER HYPE

Festive season sales in India on E-com sites have been approximated at around Rs1.24 lakh crore / $14 Bn of Gross Merchandise Value (GMV) of goods sold in 2025 (Datum Intelligence).... The buoyancy of Hyper sales traversing the latitude of colossal nation saw nearly Rs61,000 crore clocked during the first few days coinciding with GST rationalization and onset of festivities (last week of September’25) itself, finding much traction from its 2024 level of Rs94,800 crore / $11 Bn GMV.... Basis Datum, consumer electronics and appliances were most in demand (GMV growth of ~35-43% yoy). Other items, witnessing traction in demand included mobiles (26%), lifestyle products (22%), and beauty and personal care items (21%). Also, demand for premium and high-end categories showed traction...Interestingly, non-metro centers formed the bulk of shoppers across the myriad platforms, fueling the frenzy and spurring a digital First mentality....

In comparison, in 2024, U.S. consumers reportedly spent $10.8 billion online on Black Friday, a 10.2% increase from 2023 (Adobe

analytics/queue-it) while Mastercard data reported the online sales growth at 14.6% over 2023 (while overall retail sales remained somewhat muted at 3.4%). Basis Adobe, Black Friday sales are expected to rise again in 2025, by 8.3% to $11.7 billion but going by the recent University of Michigan report putting US Consumer Sentiment Index at second lowest figure of 50.3 (the lowest was 50.0 in June’2022) and Consumer sentiment fell back about 6% this November, led by a 17% drop in current personal finances, things may not be looking rosy for the harbinger of US Holidays.

The House could remain divided on whether Indian consumer, now less with Band, Baaja and Brouhaha and more of Buying Gunpowder, has entered the ‘Super Age of online gratification’ BUT it would be worthwhile to put in place a tracking / monitoring architecture that looks at holistic purchase patterns with a 360° panorama that also accounts for Stand alone and individual online places......