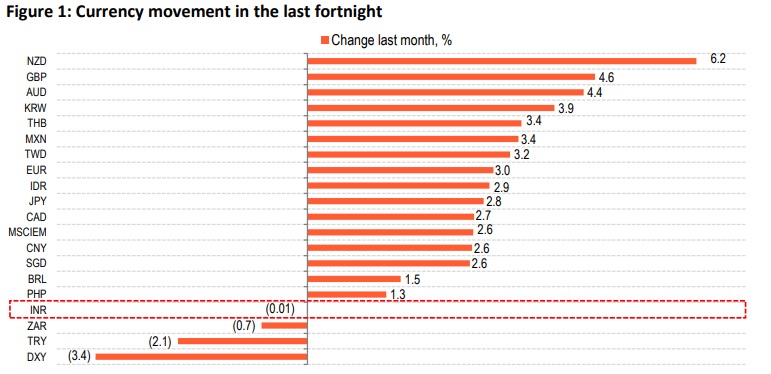

While most global currencies have gained from this, the performance of INR has been underwhelming

Aditi Gupta,

Economist

Bank of Baroda

Mumbai, December 4, 2023: Prospects that the Fed may soon start cutting its policy rates next year, have weighed on the dollar which has been trailing at a 4-month low. Probability of a rate cut by the Fed as early as Mar’24 have increased to 55% as per the CME Fed Watch Tool. US treasury yields, which had traced multi-year highs last week have corrected sharply, putting further downside pressure on DXY. While most global currencies have gained from this, the performance of INR has been underwhelming. The local currency remained under pressure and fell to a record-low several times during the last month alone. Strong dollar demand from importers have been fueling the weakness in INR, even as the macro backdrop has been supportive. RBI has been proactive in managing the level as well as the volatility in INR and the trend is likely to continue. We expect INR to trade in the range of 83-83.5/$ in the next fortnight.

Movement in global currencies

Most currencies appreciated against the dollar as investors do not expect any more rate hikes from the Fed. Expectations have strengthened around possible rate cuts, starting in early 2024, amidst a cooldown in inflation and slowdown in US economy, particularly in the housing and labor market. This has weighed on the dollar, and DXY which measures dollar strength against a basket of currencies, is down by about 3.4% in the month. Against the EUR, dollar is lower by 3%, even as the ECB is also likely to start its rate cut cycle sooner than expected, amidst a sharp decline in inflation.

Performance of INR

INR has been trading in a narrow-range off late. Even as most currencies gained at the expense of dollar, INR is amongst a handful of currencies which were unable to capitalize on the dollar’s decline. INR ended the month flat, with a marginal decline of 1paise. However, it did touch a record-low several times during the month, an unenviable achievement. Another important fact to note is that, volatility in the rupee is also near multi-year lows. The annualized daily volatility in INR has fallen steadily from 5% in Jan’23 to just about 1% in Nov’23.

What are the key drivers?

The relative weak performance of INR seems perplexing given a favorable global as well as domestic backdrop. A softer dollar, lower oil prices, reversal in FPI outflows, easing domestic inflation amidst strong domestic growth momentum, all favor a stronger rupee. While a record trade deficit in Oct’23 can at the margin be detrimental for the rupee, the increase in trade deficit is likely to be a one-off. The rupee’s underperformance can be explained by a strong demand of dollars by importers in the last few weeks. This has put pressure on INR. Timely and efficient intervention by the RBI in the forex market has ensured orderly movement in the exchange rate, preventing it from falling further.

We expect a range of 83-83.5/$ for the next fortnight.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)