Reports of an escalation in tensions between Israel and Iran have roiled global markets

Aditi Gupta

Economist,

Bank of Baroda

Mumbai, April 19, 2024: Reports of an escalation in tensions between Israel and Iran have roiled global markets. Asian markets and currencies are trading in red, and oil prices have inched up. Demand for safe haven has pushed gold, dollar and yen higher. A wider conflict in the Middle East is likely to lead to increased volatility in the global markets while also pushing global commodity prices higher. This can jeopardize the fight against inflation. Possibility of Fed rate cuts has been pushed back further with New York Fed President also endorsing the narrative of higher for longer rates. Labour market conditions in the US remained tight with jobless claims unchanged at 212,000 (est. 215,000). However, existing housing sales declined by 4.3%. Separately, BoJ Governor hinted at the possibility of more rate hikes to mitigate the inflationary impact of a rapidly depreciating JPY. Incidentally, core CPI in Japan eased to 2.6% in Mar’24 from 2.8% in Feb’24.

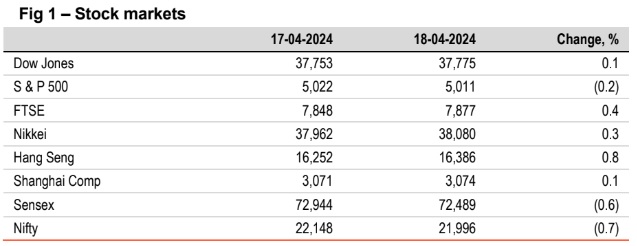

§ Global stocks closed broadly higher. Investors eyed major developments such as geopolitical tensions in the Middle East, hawkish comments from Fed officials and US jobless claims which hinted at a tight labour market. Hang Seng rose the most followed by FTSE. Sensex fell by 0.6%, led by consumer durables and banking stocks. It is trading further lower today, in line with other Asian stocks.

Global currencies depreciated. DXY was up by 0.2% after hawkish comments by Fed officials. EUR depreciated the most by 0.3% as the ECB is likely to cut rates before the Fed. INR hovered near a record low amidst a global risk-off sentiment. It is trading further weaker today, in line with other Asian currencies.

Except Japan and China (lower), global yields closed higher. US 10Y yield rose the most by 5bps as Fed officials advocated a no rush approach towards rate cuts. Germany’s 10Y yield also rose by 3bps despite ECB policymaker hinting at rate cut in Jun’24. India’s 10Y yield closed flat and is trading higher at 7.21% today amidst news of increased tensions in Middle East.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)