In UK, house price index firmed up in Feb'24, while PMI reading still trailed below the 50 mark. On domestic front, PMI data rose to its 5 month high supported by both domestic and external demand

Dipanwita Mazumdar,

Economist,

Bank of Baroda

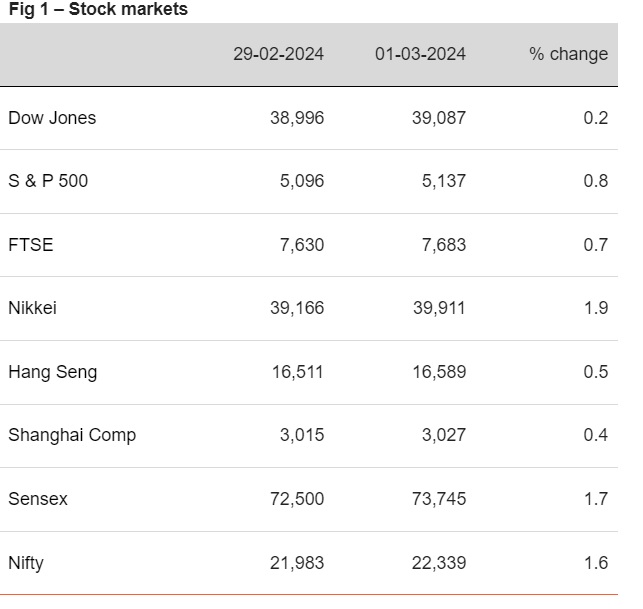

Mumbai, March 4, 2024: Delayed start to the rate cut cycle by major central banks led to rally in global stocks buoyed by risk on sentiments. Yields continued to paint a volatile picture. In the US, a weaker ISM manufacturing print has led to fall in 10Y yield. Even for other economies, yields traded in a narrow range monitoring comments of major central bank officials. Amongst other major macro releases were University of Michigan’s inflation expectations index, which still showed some stickiness in inflation. In the Euro area, inflation print especially the core inflation data provided some discomfort. In UK, house price index firmed up in Feb’24, while PMI reading still trailed below the 50 mark. On domestic front, PMI data rose to its 5 month high supported by both domestic and external demand. Even inflationary pressures moderated.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)