Rupee breaches the psychological barrier of 90

FinTech BizNews Service

Mumbai, 4 December 2025: The State Bank of India’s Economic Research Department has cpme out with a the Research Report on the Rupee. The report has been authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

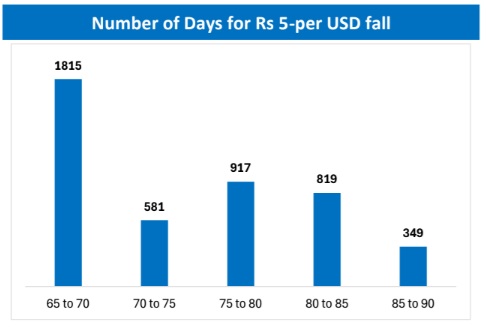

Rupee breached a psychologically important level of 90 on Wednesday, the slide one of the quickest in recent times after the heady days of Taper Tantrum. The decline in the value of the currency is being driven to the edge by trifecta of limbos in US-India trade deal, FPI outflows, chiefly equities (after two years of robust inflows) and RBI’s clear stance of distancing itself from an ’interventionist regime’ while wagering all it takes on excessive volatility by traders, arbitrageurs and jobbers.

Separately, offshore NDF has also gained momentum while signs of resurgence in Dollar index are quite palpable. However, the decline in value of rupee as being ascertained by a section of market to a negative trade data is not factually correct.

The overall goods and services deficit till Apr-Oct was at $78 bn, marginally higher against $70 bn in the like period the previous year. Clearly, the negative data on trade data has been oversold to the market.

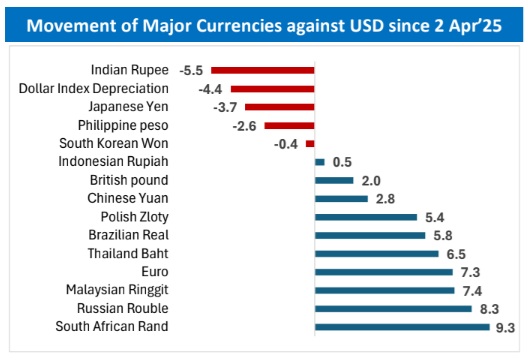

Since 02 Apr’25, when US announced sweeping tariff hikes across economies, Indian rupee (INR) has deprecated by 5.5% against USD (most amongst the major economies), notwithstanding sporadic phases of appreciation owing to optimism over positive, mutually beneficial conclusion. However, while INR is the most depreciated currency amidst select major economies, it is not the most volatile. Analysis of Coefficient of variation indicate that INR is one of the least volatile currencies since 02 Apr’25 (1.7%). This clearly indicates that the high slab of 50% tariff imposed on India, substantially higher than peers like China (30%), Vietnam (20%), Indonesia (19%), and Japan (15%), is one of the major factors behind current phase, notwithstanding evident efforts on Indian exports diversification and FTAs though $45 billion worth of major Indian exports is expected to be impacted by US tariff, mostly in labour intensive areas.

Looking at the REER data of 40-currency basket with base 2015-16, the index was above 100 until May 2025 but the onset of the trade war has pulled it below 100 level, as rupee lost more ground compared with other EM currencies. Since April 2023, INR has declined 10% and the REER reached the lowest level 97.40 in September 2025, which is 7-years low since Nov’2018. Further, the latest RBI REER data as on Oct’2025 indicates INR is undervalued for 3rd straight month, which reflects softer currency and lower inflation. The NEER has also weakened dramatically, to 84.6 in Oct’2025 from 92.1 in June 2024, indicating depreciation in rupee.

Analysing the data across spot and forwards markets, the combined excess demand in merchant market has been $102.5 billion. As per the latest available data, RBI has intervened around $18 billion in the forex market during June-Sept, and we have estimated (by looking at the forward market data) another $10 billion in Oct’25. So, the total amount stands at around $30 billion till Oct25, while forex reserves declined by $15 billion during the same period. The scheduled visit of Russian President to India and the impasse on imports of oil despite slowdown in volumes could keep rupee moving in a tight zone.

Select importers have shown inclination of leaving positions unhedged, seeking to benefit from lower devaluation compared to the interest rate differential. They often pay forward premiums to hedge, but the current environment has encouraged risk-taking, adding pressure on the rupee. FPIs have also kept positions open to capture extra gains.

Historically, the rupee has been one of the most stable currencies, but the one-month NDF (non-deliverable forward) is now trading 7–8 paise above the actual interest rate differential, exerting additional downward pressure as panic in NDF markets as FPIs are hedging their open positions.

At present, the ability of market participants to supply Greenback is quite limited, leaving the Mint Street as the last resort and ultimate supplier of USD to the market but the RBI has likely chosen a restrained approach, avoiding aggressive inter-ventions as part of its policy to not protect any level. Additionally, once the rupee breached the Rs90 level, several exotic option like barriers were triggered, amplifying volatility and accelerating the pace of depreciation.

With MPC scheduled to take a call on policy rate, a cut at this juncture can be construed as a knee jerk reaction to protect the rupee which would be detrimental to an otherwise fairly resilient currency, riding the domestic vigor.