KMB’s Standalone PAT Up 26% To Rs138 Bn; As at March 31, 2024, GNPA was 1.39% & NNPA was 0.34% (GNPA was 1.78% & NNPA was 0.37% at March 31, 2023)

FinTech BizNews Service

Mumbai, 4 May, 2024: The Board of Directors of Kotak Mahindra Bank (“the Bank”) approved the audited standalone and consolidated results for the quarter and financial year ended March 31, 2024, at the Board meeting held in Mumbai, today.

Kotak Mahindra Bank standalone results

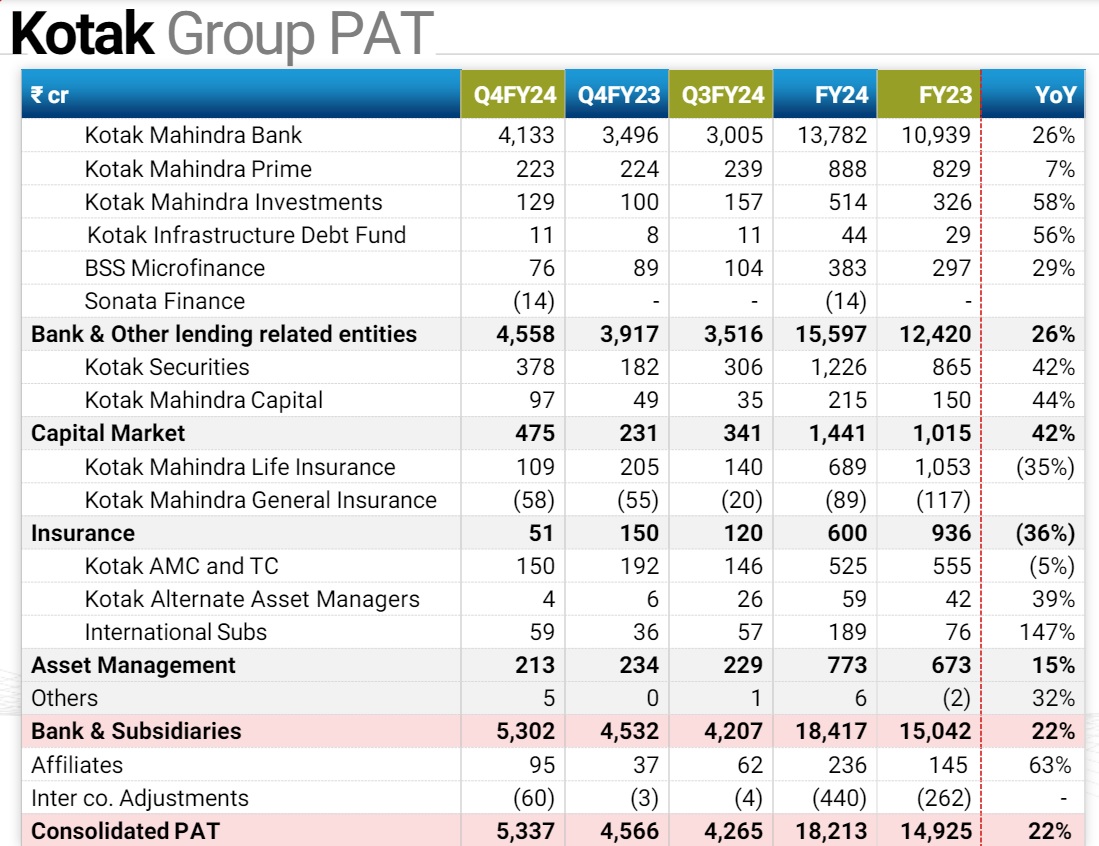

The Bank’s PAT for FY24 increased to Rs 13,782 crore from Rs 10,939 crore in FY23, up 26% YoY. PAT for Q4FY24 stood at Rs 4,133 crore, up 18% YoY from Rs 3,496 crore in Q4FY23 (up 38% QoQ from Rs 3,005 crore in Q3FY24). Net Interest Income (NII) for FY24 increased to Rs 25,993 crore, from Rs 21,552 crore in FY23, up 21% YoY and for Q4FY24 increased to Rs 6,909 crore, from Rs 6,103 crore in Q4FY23, up 13% YoY (up 5% QoQ from Rs 6,554 crore in Q3FY24). Net Interest Margin (NIM) was 5.28% for Q4FY24. Fees and services for FY24 increased to Rs 8,464 crore from Rs 6,790 crore in FY23, up 25% YoY and for Q4FY24 increased to Rs 2,467 crore from Rs 1,928 crore in Q4FY23, up 28% YoY (up 15% QoQ from Rs 2,144 crore in Q3FY24). Operating costs increased to Rs 16,679 crore in FY24 (Rs13,787 crore in FY23).

Technology expenses were 10% of total operating cost in FY24. Operating profit for FY24 increased to Rs 19,587 crore from Rs 14,848 crore, up 32% YoY and for Q4FY24 increased to Rs 5,462 crore from Rs 4,647 crore in Q4FY23, up 18% YoY (up 20% QoQ from Rs 4,566 crore in Q3FY24).

Customers as at March 31, 2024 were 5.0 cr (4.1 cr as at March 31, 2023). Advances (incl. IBPC & BRDS) increased 20% YoY to Rs 391,729 crore as at March 31, 2024 from Rs 325,543 crore as at March 31, 2023. Customer Assets, which comprises Advances (incl. IBPC & BRDS) and Credit Substitutes, increased by 20% YoY to Rs 423,324 crore as at March 31, 2024 from Rs 352,652 crore as at March 31, 2023. Unsecured retail advances (incl. Retail Micro Finance) as a % of net advances stood at 11.8% as at March 31, 2024 (10.0% as at March 31, 2023). Bank completed acquisition of Sonata Microfinance, an entity based out of North of India in FY24. CASA ratio as at March 31, 2024 stood at 45.5%. Average Current deposits grew to Rs 60,160 crore for Q4FY24 compared to Rs 58,415 crore for Q4FY23 up 3% YoY. Average Savings deposits grew to Rs 123,457 crore for Q4FY24 compared to Rs 117,824 crore for Q4FY23

Update on RBI Supervisory Action

Order and Impact assessment

• Reserve Bank of India (“RBI”) order of 24th April 2024, directs the Bank to cease and desist (i) onboarding new customers through the Bank’s online and mobile banking channels and (ii) issuing fresh credit cards.

• As per the bank's presentation on financial results, the order does not impact

• servicing and cross-sell of products (excl. new credit cards) to the existing customer base through all channels

• on-boarding of new customers through other than online / mobile banking channels Way forward and action plan

• We are totally committed to working with all our regulators to achieve the required technology standards

• Bank will step-up investments to fortify its IT systems. The focus is on: • Accelerate execution of the comprehensive plan for core banking resilience • Demonstrate sustainable compliance to Baseline Cyber Security Framework for Banks • Continue to strengthen digital payment security controls

Business impact analysis

• The Bank has assessed impact of above restrictions on: • Franchise and customers • Directly impacted businesses • Primarily new credit cards and customer acquisition through 811 • Potential financial impact • Bank is looking to redeploy resources to minimize the business impact • The Bank believes that these directions will not materially impact its overall business.