US 10Y inched up considerably

Dipanwita Mazumdar,

Economist,

Bank of Baroda

Mumbai, March 4, 2024:

Bonds Wrap

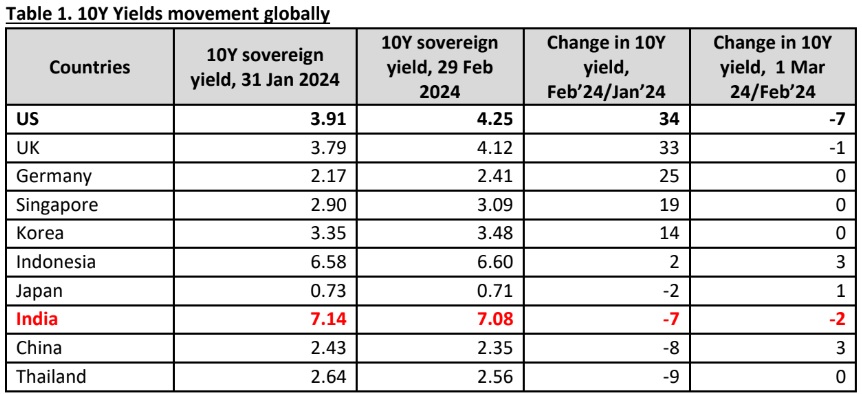

Sell off in global bond market persisted in Feb’24 as well since markets have already priced in a late start to the rate cut cycle of major central banks. For Fed, odds are in favour of a rate cut from Q2 onwards. For other central banks, it may be an even more delayed response based on the evolution of growth-inflation data. For domestic yields, the undertone is different. India’s 10Y yield got support from buoyant demand from FPIs. In Feb’24, there were inflows of US$ 2.7bn in the debt segment. Going forward, resilient domestic macros, fiscal discipline and easing price pressure would put further downward bias on yields. We expect 10Y yield to remain in the range of 7-7.10% in the current month. Liquidity deficit is likely to persist and remain in the range of 1.0-1.2% of NDTL. Durable liquidity would come under further pressure due to expected increase in currency in circulation in the coming months.

US 10Y inched up considerably:

· US 10Y yield continued to inch up. The undertone of major Fed officials (Atlanta Fed President, Chicago Fed President and Fed Governor) was that policy rate has already peaked but easing warrants a correct balance of macroeconomic mix. The core PCE data closely tracked by Fed in policymaking has remained firm. University of Michigan’s inflation expectations have also hinted at stickier inflation both for 1 and 5 year horizon. Other macro data such as ISM manufacturing print, consumer confidence index and new homes data showed some softening. This has pared the increase in yields to some extent. As per CME Fed watch tool the odds of a rate cut is visible only from Q2CY24 onwards. The upcoming Fed Chair’s testimony before the Congress and payroll data holds the cue. · Other central banks such as BoE and ECB closely monitored the growth-inflation dynamics of the region. BoE’s Chief Economist was not convinced of easing price pressures and hinted at ‘guard against a false sense of security’. Markets are not pricing any move by BoE before Aug’24. Elsewhere, Bundesbank President also cautioned against easing policy too soon. In the Eurozone, despite cooling inflation, core has remained sticky. · 10Y yield in China was supported by PBOC’s surprise move of cutting the 5 year loan prime rate by 25bps. In Thailand, worries about state of the economy has led to a fall in yield, due to risk-off sentiment.

Domestic 10Y yield

Domestic 10Y yield fell by 7bps in Feb’24 and by another 2bps in yesterday’s trading session, supported by continued buying support from FPIs on account of fairly resilient macro data and growing confidence about fiscal prudence.

The longer part of the curve shifted downwards completely. Even for the 3 month paper, considerable moderation in yield was noticed. This has increased the gap between 3 Month and 30Y paper to 30bps as on 29 Feb 2024 from 23bps as on 31 Jan 2024.

What auctions in the domestic market reflect?

In Feb’24, cut off yields inched down across the board, with SDL noticing a sharp drop.

Pressure on liquidity still remained:

· Average system liquidity deficit moderated to Rs 1.9lakh crore in Feb’24 from Rs 2.1 lakh crore in Jan’24. RBI’s fine tuning operations with the frequency of VRR being higher than VRRR kept liquidity range bound. The VRRR auction results with offers received being lower than the notified amount, itself enumerated that liquidity conditions are still tight. Call money rate is also above repo, hovering at 6.67%, currently. · System liquidity is likely to be in the range of 1.0-1.2% of NDTL. The current gap between incremental credit and deposit in FYTD24 is at Rs 3.2 lakh crore. Thus, medium term pressure on liquidity cannot be discounted. · Adding to this, durable liquidity also came under pressure moderating to Rs 1.7 lakh crore as on 29 Feb 2024 from Rs 1.8 lakh crore as on 31 Jan 2024. This is attributable to increase in currency in circulation which has picked pace since Jan’24 onwards and likely to go up more in the coming months. · The second leg settlement date of INR swap is due on 11 Mar 2024. This is expected to add around Rs 40,000 crore of liquidity into the system. Impact of which is likely to be closely monitored.

Outlook on 10Y yield for the next 30days:

Disclaimer

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity. Bank of Baroda Group or its officers, employees, personnel, directors may be associated in a commercial or personal capacity or may have a commercial interest including as proprietary traders in or with the securities and/ or companies or issues or matters as contained in this publication and such commercial capacity or interest whether or not differing with or conflicting with this publication, shall not make or render Bank of Baroda Group liable in any manner whatsoever & Bank of Baroda Group or any of its officers, employees, personnel, directors shall not be liable for any loss, damage, liability whatsoever for any direct or indirect loss arising from the use or access of any information that may be displayed in this publication from time to time.)