Markets In Japan, UK And Hong Kong Ended Higher And Others Ended In Red

Barring JPY (higher) and INR (flat), other global currencies ended lower against the dollar

Sonal Badhan,

Economist,

Bank of Baroda

Mumbai, December 21, 2023: Ahead of the release of key US GDP print and PCE report, economic data continued to show resilience with consumer confidence jumping to a 5-month high of 110.7 in Dec’23 driven by optimism of current and future business conditions. On the domestic front, RBI in its monthly bulletin highlighted global growth remains fragile and is expected to slowdown in FY24. The disinflation across geographies will also lead the way for interest rate reduction. India is expected to grow at 7% for FY24 while inflation is projected at 5.4% with risks evenly balanced. It was also noted that the risk of stagflation in the country is as low as 1%.

- Global indices closed mixed, with markets in Japan, UK and Hong Kong ending higher and others ending in red. Investors in the US rebalanced portfolios, awaiting US PCE data, due tomorrow. FTSE rose to 3-month high as UK’s inflation report pushed chance of rate cut by BoE in Mar’24 to 50%. Sensex fell from its record high, dragged by power, metal and capital good stocks. It is trading further lower today, in line with other Asian markets.

- Barring JPY (higher) and INR (flat), other global currencies ended lower against the dollar. DXY rose by 0.2%. GBP fell the most as lower than expected UK CPI (lowest in 2 years) has added fuel to speculations of rate cut by BoE in Mar’24. INR ended flat, despite rise in oil prices. However, it is trading lower today, while other Asian currencies are trading mixed.

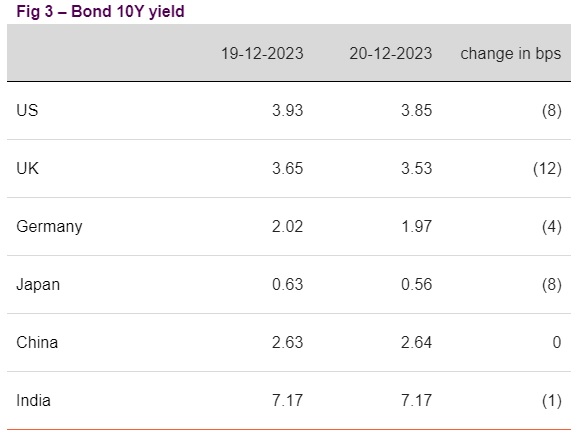

- Except China (flat), other global yields closed lower, with significant decline noted in UK, US (lowest since Jul’23) and Japan’s 10Y yields. Despite better than expected macro data from the US investors are still pricing in a rate cut by Fed in Mar’24. Dip in UK’s CPI has also steered hopes of an early rate cut by BoE. India’s 10Y yield fell by 1bps, and is trading further lower today.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)