REs within the co-operative banking sector have been allowed to enter into outsourcing arrangements with lending service providers (LSPs) and digital lending platforms to imbue more flexibility into their business operations

FinTech BizNews Service

Mumbai, December 28, 2023: The Reserve Bank of India released the Report on Trend and Progress of Banking in India 2022-23, a statutory publication in compliance with Section 36 (2) of the Banking Regulation Act, 1949 on Wednesday. This Report presents the performance of the banking sector, including co-operative banks during 2022-23 and 2023-24 so far.

The combined balance sheet of urban co-operative banks (UCBs) expanded by 2.3 per cent in 2022-23, driven by loans and advances. Their capital buffers and profitability improved through 2022-23 and Q1:2023-24. Urban co-operative banks (UCBs) expanded their combined balance sheet in 2022-23, driven by loans and advances, along with a strengthening of asset quality.

For state co-operative banks (StCBs) and district central co-operative banks (DCCBs), growth in loans and advances was accompanied by robust profitability and soundness indicators in 2021-22.

Regulation At Par With Other Regulated Entities

Concerted efforts by the government and the Reserve Bank led to improvements in the regulatory architecture and greater freedom to raise capital even as reforms in deposit insurance facilitated a restoration of depositor confidence in co-operative banks banks. During the year under review, calibrated efforts were made to bring the regulation of the co-operative banking sector at par with other regulated entities (REs), including the prudential framework for stressed assets. REs within the co-operative banking sector were allowed to enter into outsourcing arrangements with lending service providers (LSPs) and digital lending platforms to imbue more flexibility into their business operations.

97% RCCs

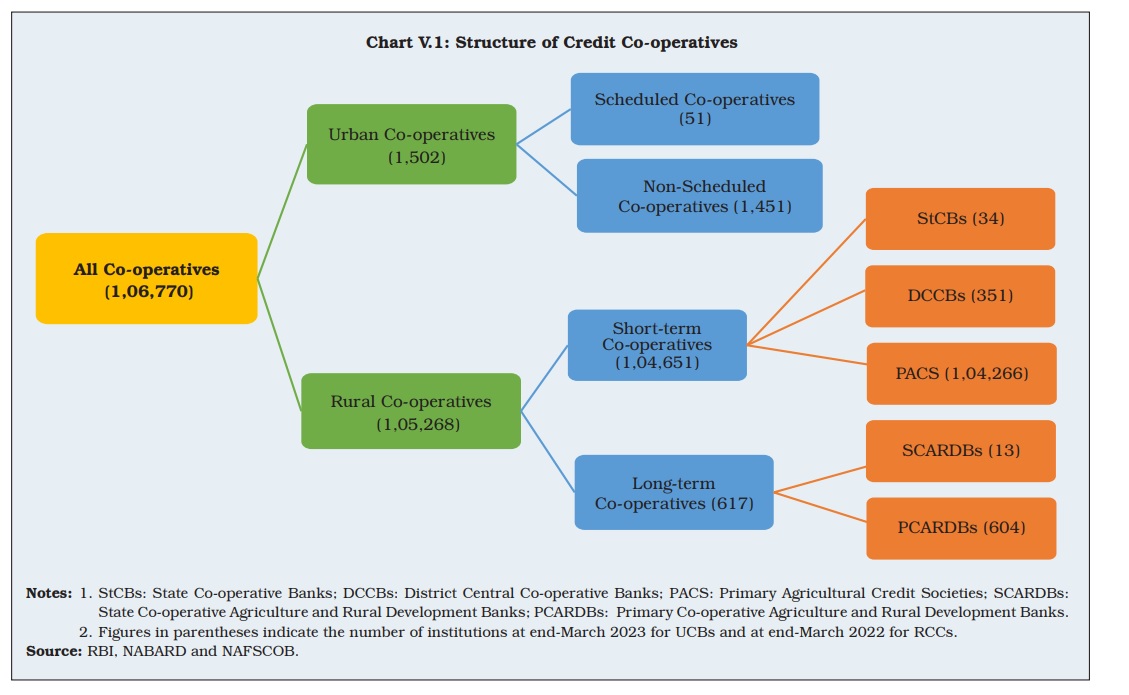

As per latest data available, there were 1,502 UCBs and 1,05,268 RCCs. More than 97 per cent of Rural credit co-operatives (RCCs) are primary agricultural credit societies (PACS). The consolidated assets of the cooperative banking sector at end-March 2022 were Rs21.6 lakh crore, around 10 per cent of that of scheduled commercial banks (SCBs). Rural co-operatives comprise more than two-thirds of the sector.

Declining Share In Direct Agri Credit Flow

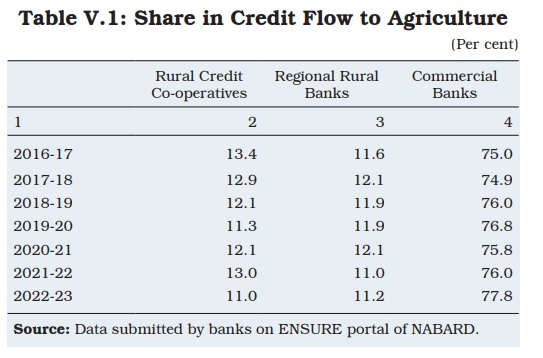

Grassroot lending has been the niche of the co-operative banking sector. Increasingly, however, as other financial institutions, including SCBs and non-banking financial institutions (NBFIs), leverage technology to serve the same clientele, RCCs face formidable competition. Their share in direct credit flow to agriculture has been declining over the years.