AI’s Promise & Peril: Responsible Intelligence For Inclusive Finance; AI is reshaping how we design, deliver, and experience financial services, opening doors for efficiency, inclusion, and resilience

FinTech BizNews Service

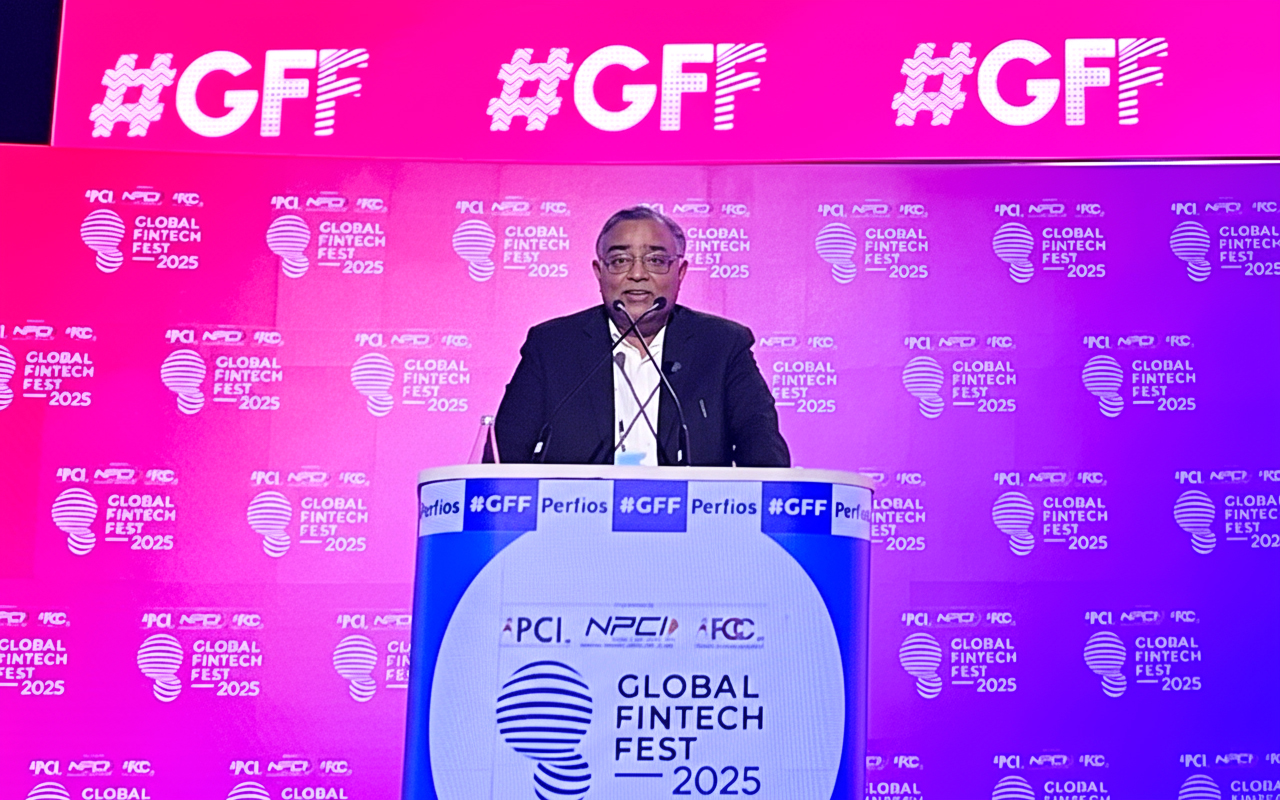

Mumbai, 7 October 2025: “Artificial intelligence has moved from the margins to the mainstream. It is reshaping how we design, deliver, and experience financial services, opening doors for efficiency, inclusion, and resilience,” said Shri Ajay Kumar Choudhary, Non-Executive Chairman and Independent Director, National Payments Corporation of India (NPCI), delivering his special keynote address at the 6th Global FinTech Fest (GFF) 2025 in Mumbai.

Speaking on the theme “AI’s Promise and Peril: Building Responsible Intelligence for Inclusive Finance”, Shri Choudhary emphasised that while AI unlocks unprecedented opportunities, it also introduces complex challenges that demand prudent governance and cross-border collaboration.

He noted that investment in AI across banking, insurance, capital markets and payments is

expected to reach nearly USD 100 billion by 2027, with 78% of financial organisations

already deploying AI in at least one function, a sharp rise from 55% in 2023. “The industry is no

longer debating if AI will matter, it is preparing for how far and how fast it will take us. The real

question is whether we harness this power carefully.” he said.

Highlighting two critical dimensions of the AI revolution, Generative AI, which creates and

analyses at scale, and Agentic AI, which can autonomously pursue complex tasks, Shri

Choudhary underlined their transformative potential for fraud detection, compliance

automation, trading precision and customer engagement. Early studies suggest global banks

could see productivity gains of USD 200–340 billion annually through these technologies.

At the same time, he cautioned against AI-driven vulnerabilities, including model bias,

explainability gaps, concentration risks and systemic dependencies across infrastructure layers

from specialised chips to cloud, data and large foundation models. Global standard-setting

bodies like the Basel Committee, IMF and BIS have warned of potential amplification of financial

cycles and systemic risks if AI adoption remains unchecked.

A key strategic priority flagged by Shri Choudhary was the concentration risk in AI

infrastructure. He explained that the AI ecosystem rests on five inter-dependent layers i.e.

specialised chips, cloud platforms, vast datasets, foundation models and end-user applications.

Today, one company produces about 90% of advanced processors, three firms control most

global cloud capacity, and only a handful of entities dominate foundation models. Such systemic

dependencies, he cautioned, affect not only financial resilience but also economic sovereignty

and national security, and must be addressed proactively through diversification and robust

governance.

“This is why responsible AI is not a slogan. It is the only way forward,” he said, urging domestic

and international collaboration to diversify dependencies, strengthen data governance,

and ensure resilience in an AI-driven era.

Shri Choudhary also spotlighted India’s leadership in inclusive innovation, citing the

transformative scale of the Unified Payments Interface (UPI), now processing over 20

billion transactions a month. He showcased NPCI’s initiatives such as ‘UPI Lite’ for low-

bandwidth regions, ‘UPI for Her’ empowering women entrepreneurs, and ‘UPI 123Pay’ enabling

feature phone users. NPCI’s federated AI models are being piloted to combat fraud without

sharing sensitive data, while real-time mule account detection is strengthening payment

integrity.

He further shared NPCI’s vision to support sovereign, interoperable real-time payment systems

through NPCI International, expand UPI and RuPay acceptance globally, and build affordable,

secure cross-border remittance corridors aligned with G20 objective. He also announced

upcoming digital payment innovations to enhance security, transparency and ease of use,

including the launch of Bharat Connect’s Internet & Mobile Banking Platform (IBMB) to

standardise merchant payments across online channels. He highlighted NPCI Tech Solutions Ltd.

(NTSL) as a new hub for deep-tech experimentation and breakthrough innovation.

Concluding his address, Shri Choudhary called for a human-first approach to AI in finance.

“The true test of AI will be whether it strengthens stability rather than weakens it. It should be

harnessed to make finance more stable, not more fragile. It must become a tool of resilience, not

a trigger of instability. That is the responsibility we share. If we apply it with vision, discipline,

and responsibility, it can widen access, build resilience, and make growth more inclusive. If we

neglect these duties, it may magnify the very vulnerabilities we seek to avoid,” he said.