Currency update: A Stronger Dollar Did Weigh On Most EM Currencies

Aditi Gupta

Economist,

Bank of Baroda

Mumbai, April 1, 2024: INR depreciated by 0.6% in Mar’24, reversing the gains it made in the last 3-months. With this, the INR

ended FY24 1.5% lower. This was much better than last year when it had depreciated by 7.8%. A

favorable domestic as well as global landscape along with efficient management by the RBI, ensured

that the depreciation in INR was much more orderly. With Fed rate cuts expected to begin from Jun’24,

dollar strength is likely to wane, which would be a tailwind for INR. This along with robust foreign

inflows and comfortable trade deficits will ensure that INR trades with an appreciating bias in FY25.

We expect INR to trade in a narrow range of 82.50-83.50/$. At a record US$ 642.6bn, RBI’s foreign

exchange reserves are more than enough to cushion the rupee against any volatility.

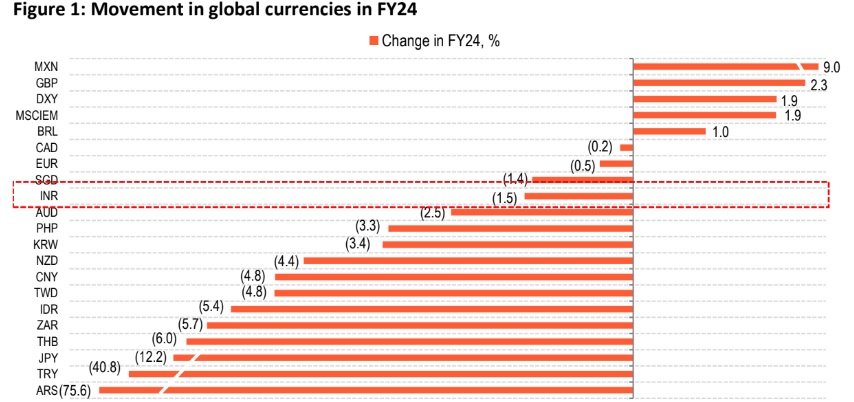

When compared with other major global currencies, INR has performed better. The median

depreciation in the above basket of currencies was 4.6%, which was much higher than the

depreciation seen in INR. On the other hand, currencies such as CNY and JPY have depreciated more

than the median depreciation.

What can explain the rupee’s over performance?

A combination of robust macro fundamentals, along with comfortable external position and

benevolent global backdrop kept INR mostly range bound in FY24. Year-end dollar demand and

weakness in Chinese Yuan lead to heightened volatility in USD/INR pushing it to a record close in the

last few days of FY24. Before Mar’24, INR had appreciated steadily for the last 3 months. Apart from

a lower trade deficit and robust foreign inflows, prospects of a Fed rate cut, and lower oil prices also

supported the INR. Apart from this, RBI’s effective intervention in the foreign exchange market also

ensured that volatility in the exchange rate remained contained.

Going ahead, we expect INR to trade with an appreciating bias. This is because:

- India’s GDP growth is expected to maintain momentum next year as well, which will continue

to draw foreign investors to India.

- In terms of India’s external position, the situation is quite comfortable.

- Robust services inflows and a recovery in demand in key markets will ensure that exports pick

up, keeping the trade deficit in check.

- We expect CAD in the range of 1.2-1.5% of GDP in FY25.

- This is likely to be funded by a robust surplus on account of foreign inflows. FPI inflows are

likely to see a further pickup in coming months as India gets included in global indices. FDI and

ECB too will pick up as the global rate cycle reverses.

- This suggests that the balance of payments is likely to remain in a surplus even in FY25.

Also, the global economic landscape will favor a stronger rupee. Global rates are headed lower, with

the Fed likely to be leading the way. Fed rate cuts are imminent, with the first rate cut being priced-in

in Jun’24. This is likely to be followed by two more rate cuts in 2024. Hence the relative attractiveness

of the dollar is likely to diminish. This will benefit the INR.

We hence expect INR to trade in a range of 82.50-83.50/$ in FY25.

Disclaimer

The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda.

Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation

to do so for any securities of any entity. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy;

completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the

same. Bank of Baroda Group or its officers, employees, personnel, directors may be associated in a commercial or personal capacity or may

have a commercial interest including as proprietary traders in or with the securities and/ or companies or issues or matters as contained in

this publication and such commercial capacity or interest whether or not differing with or conflicting with this publication, shall not make

or render Bank of Baroda Group liable in any manner whatsoever & Bank of Baroda Group or any of its officers, employees, personnel,

directors shall not be liable for any loss, damage, liability whatsoever for any direct or indirect loss arising from the use or access of any

information that may be displayed in this publication from time to time.