RBI to remain static

Jahnavi Prabhakar,

Economist,

Bank of Baroda

Mumbai, April 3, 2024: Monetary Policy committee in the upcoming policy meet is likely to retain the repo rate and continue

with the ‘withdrawal of accommodation’ stance. US Fed has hinted at 3-rate cuts in CY24 with the first

one expected in Jun’24. Bank of England and ECB too is expected to follow suit with rate cuts this year.

On the other hand, BoJ made a historic shift and had hiked rates (0.1% from 0%) for the first time in

over 17-years. RBI is unlikely to pivot at the current juncture, given the resilience in domestic economy.

The likelihood of any rate cuts has been pushed forward to H2FY25. We expect 2-rate cuts this year of

25-50bps with the first one likely in Aug’24 which however is contingent on evolving inflation scenario.

RBI is expected to announce the first monetary policy for FY25 and the rates are likely to remain

unchanged with possibility of no change in the stance too. The repo rate was last revised in Feb’23

when it was hiked by 25bps, bringing the repo rate to 6.5% mark. In the last policy (Feb’24), 5 out of

6 members voted to keep the policy rates unchanged even as 1-member voted to reduce repo rate by

25bps.

What has been the story so far?

On the growth front, MOSPI recently released the Q3 GDP print, which noted the economy has

accelerated by 8.4% from 8.1% in Q2FY24, signaling the economy has been on the strong footing. The

resilience in domestic economy has been supported by robust manufacturing sector which continues

to grow in double digits. Furthermore, investment continues to grow at a steady pace and bodes well

for the economy. Additionally, other high frequency indicators have also been reflecting growing

strength in the economy with the strong GST collections (Second highest at Rs 1.8 lakh crore) and

manufacturing PMI climbing to a 16-year high in Mar’24 (59.1 from 56.9 in Feb’24). Given the above

backdrop, we expect both investment and consumption to contribute significantly to India’s growth

story in FY25 and based on this we expect India’s economy to clock a 7.8% growth in FY25.

Price picture

CPI inflation for the last 3-month has been on the downwards trajectory, down from 5.7% in Dec’23

to 5.1% in Jan’24 and similar levels in Feb’24. Core inflation also has been easing on a durable basis

down from 3.9% in Dec’23 to 3.6% in Jan’24 and followed by further dip of 3.3% in Feb’24. RBI in its

last policy while retaining its projection at 5.4% for FY24 had revised its projection downward for

Q4FY24 to 5% and lower for Q1 and Q3FY25 to 5% and 4.6% respectively. In Q2 it is expected to be

4%. The outlook on inflation will witness further moderation on the back of favorable base and gradual

easing of commodity prices. We expect inflation at 4.5-5% in FY25. There remain some upside risks

given the adverse weather conditions or how pronounced the impact of El Nino (83% chance of

occurrence in Apr-Jun’24) will be in the coming months and if this will lead to below normal rainfall.

However, agencies such as NOAA (National Oceanic and Atmospheric Administration), has pointed the

La Nina will play a prominent role, Jun’24 onwards which is the beginning of South-West monsoon in

the country.

Bank Credit and Deposit Growth

Credit growth in Feb’24 inched up to 16.5% (excl merger) from 16.2% in Jan’24. As on 8 Mar 2024,

credit growth was 16.5%. Deposit growth remained steady and inched up marginally in Feb’24 at

13.1% (13.2% in Jan’24). As on 8 Mar 2024, deposit growth was at by 13.7%. Even as deposit growth

remain in double digit, credit growth has outpaced the deposit growth.

10Y Bond Yield

Since the last policy in Feb’24, the 10Y bond yield has remained broadly stable in the range of 7.02-

7.06%. Going ahead, we expect factors such as lower borrowing in H1FY25 and stronger FII inflows

with the inclusion of JP Morgan and Bloomberg index to support 10Y yield.

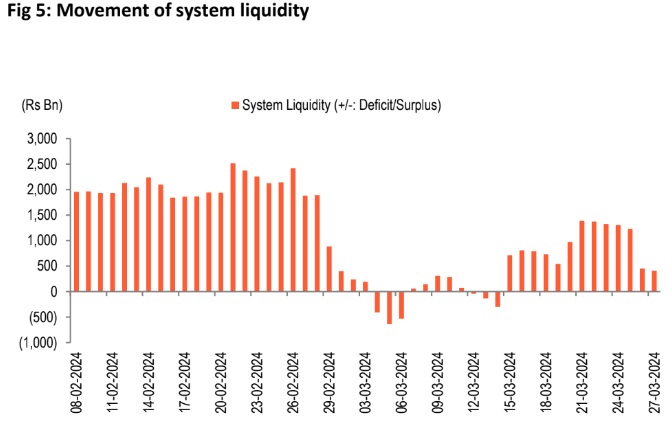

Liquidity

Average system liquidity since the last policy stood at a deficit of Rs 11,125 crore. Liquidity conditions

have slightly improved in the recent months due to increased government spending. As the new

financial year commences it may be expected that government spending would be on track.

Currency

Since the last policy, INR has depreciated by 0.5% in Mar’24. India’s forex reserves has reached at an

all-time high of US$ 642.6 bn as on 22 Mar 2024 and will support the currency. The country’s external

position remain comfortable with exports expected to gradually pick up in FY25.

Disclaimer

The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda.

Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation

to do so for any securities of any entity. Bank of Baroda Group or its officers, employees, personnel, directors may be associated in a commercial or personal capacity or may have a commercial interest including as proprietary traders in or with the securities and/ or companies or issues or matters as contained in this publication and such commercial capacity or interest whether or not differing with or conflicting with this publication, shall not make or render Bank of Baroda Group liable in any manner whatsoever & Bank of Baroda Group or any of its officers, employees, personnel,

directors shall not be liable for any loss, damage, liability whatsoever for any direct or indirect loss arising from the use or access of any

information that may be displayed in this publication from time to time.