While an August rate cut remains possible, we see a larger probability of the first cut in October, given our expectation for the Fed to start moving in September 2024.

Indranil Pan & Deepthi Mathew,

Economics Knowledge Banking.

YES Bank

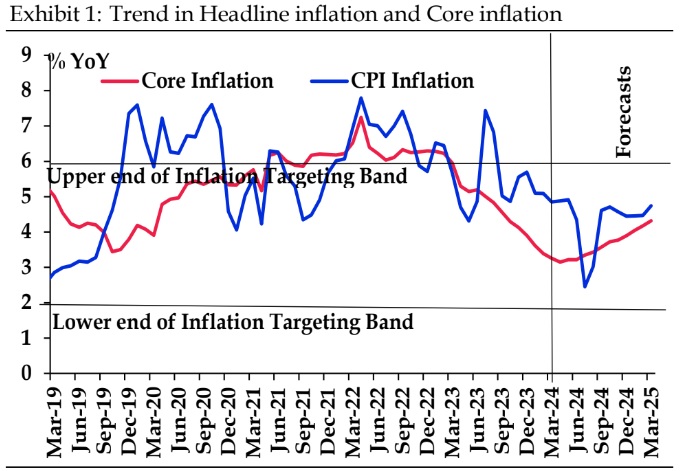

Mumbai, April 14, 2024: CPI moderated to 4.85% in March vs 5.09% in February. On a sequential basis, the CPI index registered flat growth. The moderation in CPI was majorly driven ‘fuel and light’ prices that declined by 2.6% MoM, reflective of the LPG price cut announced in March. Food prices picked up by 0.2% MoM in March. Within the food basket, vegetable prices increased by 0.3% MoM after registering negative growth for three consecutive months. Sequential declines were noted in eggs, pulses, oils & fats, sugar, and spices prices. Core inflation continued to move lower, at 3.3% YoY in March (3.4% YoY in February). For FY25, we expect inflation to average 4.3%. While an August rate cut remains possible, we see a larger probability of the first cut in October, given our expectation for the Fed to start moving in September 2024.

Food prices picked up 0.2% MoM:

In today’s print, after three consecutive months of negative growth, vegetable prices increased by 0.3% MoM. With the vegetable basket, heavy weights like potato and onion prices grew by 15.5% MoM and 1.3% MoM, respectively, whereas tomato prices declined by 2.6% MoM. Fruits also grew by 1.9% MoM after four consecutive months of negative growth. The pace of increase in cereal prices moderated to 0.3% MoM vs 0.5% in February 2024 with wheat and rice prices registering a growth of 0.5% MoM and 0.2% MoM,

respectively. ‘Fish and meat’ prices grew by 1.3% MoM whereas egg prices registered a sharp decline of 4.7% MoM. Spice prices declined for the fourth consecutive month driven by the decline in ’jeera’ prices while ‘turmeric’ prices registered strong momentum. Pulses (-0.6% MoM), oils & fats (-0.1% MoM), and sugar (-0.5% MoM) registered sequential declines. On a YoY basis, food inflation came to 8.5% (Feb: 8.7% YoY).

Consolidated fuel inflation declines:

On a sequential basis, consolidated fuel inflation declined by 2.6% MoM. LPG prices declined by 6.6% MoM reflective of INR 100/- cut on the LPG cylinder announced in March. Electricity prices registered a marginal growth of 0.1% MoM whereas ‘firewood and chips’ grew by 0.2% MoM. Kerosene prices registered a de-growth of 3.7% MoM.

Both diesel prices and petrol prices declined by 0.8% MoM in March. To recollect, government had slashed petrol/diesel prices by INR 2/-, effective from 15th March 2024. On a YoY basis, consolidated fuel inflation declined to 3.2%.

Core inflation moderates to 3.3% YoY:

RBI Core inflation (ex-food, fuel, PTI) grew by 0.1% MoM after registering a rise of 0.3% MoM in February. ‘Housing’ prices saw a sequential decline of 0.1% while ‘clothing and footwear’ prices increased by 0.2% MoM. Miscellaneous components grew by 0.2% MoM. Within miscellaneous, ‘HH good and services’ (+0.2% MoM), ‘health’ (+0.4% MoM), ‘recreation & amusement’ (+0.2% MoM), ‘education’ (+0.1% MoM) and ‘personal care & effects’ (+1.4% MoM) registered sequential increases. Within ‘personal care and effects’, gold and silver prices increased by 3.8% MoM and 1.7% MoM, respectively. ‘Transport & communication’ declined by 0.2% MoM on account of the drop in diesel/petrol prices.

IIP picks up on a YoY basis, declines sequentially:

IIP rose 5.7% in February vs 4.1% (revised higher from the earlier 3.8%) in January. On a sequential basis, IIP declined by 4.1% driven by a broad-based decline across the sectors. Mining, manufacturing, and electricity declined by 3.1% MoM, 4.1% MoM and 5.1% MoM, respectively. On the use-based side, primary goods (-3.9% MoM), intermediate goods (-3.0% MoM), capital goods (-2.1% MoM) and infrastructure goods (-

3.7% MoM) registered sequential declines. Consumer durables declined by 0.1% MoM whereas consumer non-durables registered a sharper decline of 9.2% MoM.

RBI to be on an extended pause:

While the inflation trajectory is softening, uncertainties remain on account of the unforeseen weather events and continuing geopolitical tensions. In the last MPC policy, RBI governor highlighted food price uncertainties that could influence the inflation trajectory going forward. As per RBI’s and our own projections, CPI inflation would be at sub-4% only in Q2FY25 but is expected to rise again. Global commodity price changes will be tracked to ascertain if there are pass throughs from the input side to the output side. Hence, we believe that the RBI is unlikely to pivot soon – both on the rates as also on the stance of monetary policy, before having factored in all the risks from climate, geopolitics, and commodity. Alongside, we think that RBI is unlikely to precede Fed in the rate cutting cycle as the interest rate differentialbbetween the two economies is at historic lows. The data prints have indicated a relatively stronger US economy and stickier inflation. With a stronger than expected inflation print for March, the market has started to price in the first rate cut by the Fed in September (pushed out from the earlier expected June 2024). We now see an increased chance for the RBI to start cutting in October 2024 (earlier call was for an August cut). Further, the rate cut cycle is likely to bebshallow, restricted to 50-75 bps in FY25.