INR is trading stronger today

Sonal Badhan,

Economist,

Bank of Baroda

Mumbai, March 21, 2024: In line with market expectations, US Fed left its key policy rates unchanged in Mar’24 at 5.25-5.5%. The Central Bank updated its economic projections, and now expects GDP growth at 2.1% in CY24 versus 1.4% projected in Dec’23. Inflation expectation for CY24 remains unchanged at 2.4%. However, core PCE is estimated to witness some upward pressure (2.6% versus 2.4%) due to resilience in domestic demand. FOMC reiterated possibility of 75bps rate cut in CY24, with analysts now predicting 70% chance of rate cut cycle beginning in Jun’24. Separately in UK, ahead of BoE’s rate decision due today, UK CPI slowed to 3.4% in Feb’24 from 4% in Jan’24. The moderation was led by food, restaurant and cafes. In Asia, flash manufacturing PMIs for Australia (46.8 in Mar’24 versus 47.8 in Feb’24) and Japan (46.5 versus 45.3) indicate that sector remains under duress, due to weak demand.

Except FTSE (flat), other global stock indices ended higher after US Fed hinted at 3-possible rate cuts this year while keeping the rate unchanged in line with expectation. US indices advanced and rallied to an all-time high. Sensex rebounded supported by gains in oil & gas and power stocks. It is trading higher today, in line with other Asian stocks. Nikkei surged to a record high in the morning session today.

Global currencies ended mixed. DXY retreated (0.4%) post Fed’s rate decision where it projected three rate cuts are likely this year. The focus will now turn towards BoE rate decision, due later today. INR depreciated further. However it is trading stronger today, while other Asian currencies are trading mixed.

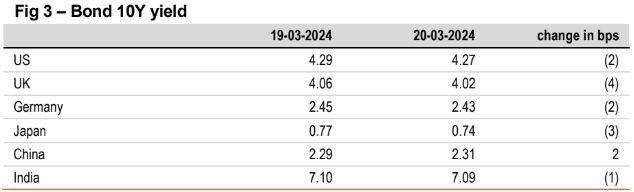

Barring China, other global 10Y yields inched further down. Fed in its policy

statement reiterated that it expects 75bps cut in policy rates this year. Also,

members believe that strength in labour market will not impact inflation, thus

further raising probability of a cut in Jun’24. India’s 10Y yield fell by 1bps, as oil

prices eased. It is trading further lower today, at 7.07%.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)