INR to continue to trade in a tight range

FinTech BizNews Service

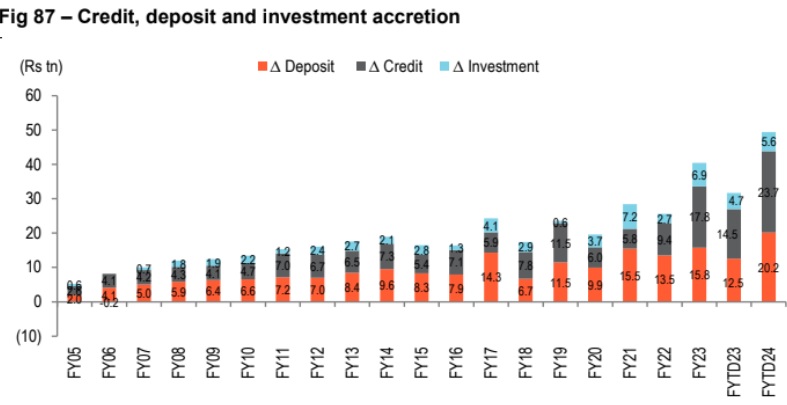

Mumbai, February 10, 2024: India’s growth resilience continued with high frequency macro indicators such as non-oil-non-gold and electronic imports, power demand, GST collections and credit demand, holding up well, according to India Economics Monthly Chartbook, February 2024, brought out by Economic Research Department of the Bank of Baroda.

Rabi sowing has also been higher than estimates which faded some bit of inflationary concerns. Fiscal prudence shown in the Union Budget by progressively bringing down fiscal deficit ratio, finely tuned revenue spending and quality capex, have been major positives. As a response, domestic yields inched down despite global yields showing fluctuations from an expectation of delayed start to the global rate cut cycle.

On monetary front, RBI’s policy remained on expected lines. Inflation projections indicate that some breathing space would be available for policy easing in Q2. On external front, India’s growth picture remained favourable for INR.

Strengthening of domestic demand:

Early signs of recovery in consumption demand has been visible as reflected by high frequency indicators including pick up in non-oil-non-gold and electronic imports and power demand.

Additionally pickup in GST collections and steady growth in E-way bills augers well for the economy. On rural front, demand for MGNREGA work has been increasing slowly. The acreage levels for Rabi crops have been higher this year than last year indicating support to the agriculture sector. As per the Advance Estimates, production of horticulture crops (2.3% in 2022-23) led by fruits and vegetables is higher than the estimate for 2021-22.

Health of centre’s finances:

Centre’s fiscal deficit ratio (% of GDP, 12MMA) settled at 5.9% as of Dec’23 compared with 5.8% as of Nov’23. As per revised estimates announced in the Union Budget for 2024-25, fiscal deficit ratio will be brought down to 5.8% by the end of FY24 and further to 5.1% in FY25. In FYTD24 (Apr-Dec’23), centre’s overall spending momentum was maintained with growth at 8.4% versus 8.6% as of Nov’23. Marginal softening was due to easing seen in revenue spending (2.3% versus 3.6%). Capex growth on the other hand accelerated (37.5% versus 31%). On the income side, centre’s net revenue receipt growth eased to 15.4%, compared with 20.9% growth seen as of Nov’23. This was due to slowdown in both direct (23.2% versus 24.8%) and indirect tax collections (4.6% versus 5.1%). Within direct taxes, both income and corporate tax collections moderated.

India’s 10Y yield likely to remain rangebound: In Jan’24, India’s 10Y yield fell by 3bps, whereas in Feb’24 (till 8th Feb), it has fallen by 7bps. Much of the fall in yields was post the Budget announcement. Fiscal prudence, less reliance on market borrowings, attested to government’s credibility, which was positive for yields. RBI’s recent policy though maintained status quo on policy rate and stance. Inflation forecasts for FY25 suggest there is some space for easing of policy rate in Q2. Thus, downward bias to domestic yields persist. On liquidity front, we expect deficit to continue as accretion of currency in circulation has started gaining pace.

INR to continue to trade in a tight range:

INR was the best performing major currency against the dollar in Jan’24. Strong macrofundamentals along with a comfortable external position have contributed to INR’s strength, even as other major currencies came under pressure due to a resurgence in dollar strength.

We believe INR to appreciate gradually in the near term. Trajectory of Fed rates and jump in oil prices due to ongoing tensions in Middle-East remain a key risk. We anticipate a range of 82.5-83/$ in the next fortnight.