On demand front, still the picture is hazy

Dipanwita Mazumdar, Jahnavi Prabhakar

Economist,

Bank of Baroda

Mumbai, June 12, 2024: CPI print came in slightly lower than our estimate at 4.75% (BoB estimate: 4.9%). Food inflation continued to remain sticky. Sequential food items with 32% weight in overall CPI basket are witnessing considerable momentum. However, a lot of it is attributable to seasonal phenomenon. Added to this, another tomato and onion price shock may be imminent. Already in Jun’24, prices of these items of vegetables are on the rise, attributable to adverse weather conditions and demand supply mismatches. We do not foresee food inflation dipping below 7.5-8% in the near term. Thus, headline CPI may overshoot RBI’s inflation projections in Q1. The only comfort kicks in with a favorable base in Q2. Core continues to provide the desired comfort. However, some upward correction might be witnessed from rural demand if Southwest monsoon pans out well. Thus, RBI’s approach would be nimble balancing and counterbalancing the risks. A lot of events would be closely watchable from a monetary policy standpoint, ranging from the impact of final Budget, its impact on growth and inflation and evolution of global policy rate.

Food inflation continued to remain sticky

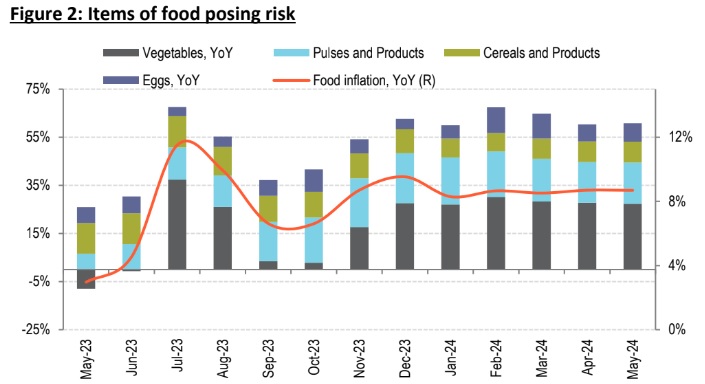

CPI inflation came in slightly lower than our estimate: CPI inflation came in at 4.75% in May’24, on YoY basis, marginally lower than our estimate of 4.9%. Food inflation remained sticky at 8.7% in May’24. Within food, 6 out of 12 broad categories have remained above 6%, with inflation remaining elevated for vegetables (27.3%, YoY), pulses (17.1%), cereals (8.7%) and eggs (7.6%). Considerable upside pressure was also visible in the case of oils and fats and fruits. The sequential picture gives a better picture of the evolution of food inflation. Food inflation has risen by 0.7% in May’24 (MoM). On a seasonally adjusted basis, however, food inflation fell by 0.3%, so some of the upside rise was attributable to seasonal phenomenon. Pressure points were far board ranging from cereals, eggs, vegetables, pulses, sugar and spices. Going forward, there is considerable upside risk to overall food inflation. It is unlikely to go beyond 7.5-8% in the near term. Again, a tomato and onion induced price shock might lead to overshooting of headline CPI numbers compared to RBI’s trajectory.

Core CPI (excl. food and fuel) softened to 3.1%, on YoY basis. Apart from personal care and effects, sub-categories of core showed moderation across the board. The sharpest pace of moderation was visible for household goods and services. Sequentially, the fall in core was led by housing (seasonal phenomenon), personal care and effects (due to moderation in gold prices), household goods and services and clothing and footwear. Demand conditions are still patchy, so core is likely to be range bound between 3.5-4% in the near term. Fuel and Light inflation inched up to -3.8% in May’24 from-4% in Apr, on YoY basis and by 0.8%, on a sequential basis, as Kerosene prices rose.

Way forward:

Food inflation continues to pose considerable upside risk in Jun’24, as well. Our in-house BoB ECI is tracking at 6.8% YoY. The monthly increase of prices of vegetables such as Tomato and Onion have been significant. For tomatoes, the Dec-Jun harvesting crop is impacted, attributable to heatwave in Apr and May and early rain in some States. For Onion as well, demand-supply mismatches have impacted prices. Other than vegetables, even pulses such as Gram and Tur are witnessing price rise. As per reports, there may be some strain in the existing buffer stock of pulses, as well. Thus, Q1FY25 inflation print might offshoot RBI’s projection of 4.9%, if the food price shock continues to prevail. Reservoir levels are also lower compared to last year (22% compared to 28% of same period of previous year, till 6th Jun). Global food prices are stickier. Thus, the trajectory of headline CPI now hinges on the spatial distribution of South-West monsoon. On demand front, still the picture is hazy. FMCG companies in their recent financial performance has highlighted towards resorting to a volume-led approach by undertaking price cuts. Thus, upside risk to core remains capped albeit some correction with expected pick up in rural demand