Going ahead with some correction in US 10Y yield, some reversal in the trend may be expected

Dipanwita Mazumdar

Economist,

Bank of Baroda

Mumbai, November 15, 2023: FPI flows in the past few months have been disappointing. This was in line with muted flows globally. Heightened geopolitical tensions, pressure on currency and volatility in US treasury yields have impacted investor confidence which in turn got reflected in muted flows. Going ahead with some correction in US 10Y yield, some reversal in the trend may be expected.

How month wise flows have moved:

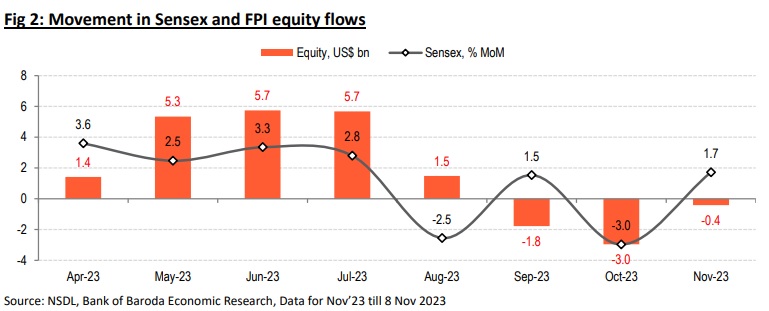

Since Aug’23, FPI flows have moderated considerably. From US$ 6.8bn inflow seen in May’23, it fell to US$ 2.2bn in Aug’23. Both in Sep’23 and Oct’23, outflow amounted to US$ 3.8bn. A multitude of factors came into play which resulted in somber flows. Uncertainty over Fed policy outlook and the puzzling growth inflation dynamics continue to weigh on US treasury yield, which exhibited sharp upturn. Upside risks to inflation have also not receded completely. On top of that, heightened geopolitical tensions have resulted in volatility in crude prices. Growth remained on a mixed footing. While in the US some high frequency indicators pointed towards resilience; in Eurozone and China, it remained uncertain. This impacted direction of flows.

Interestingly, equity flows pattern and Sensex moved in tandem. In 4 out of 6 months, Sensex has moderated on a sequential basis and also witnessed flows getting hampered. Needless to say there is no one to one correspondence as some degree of support is also provided by domestic intuitional investors which have often countered these flows. In FYTD24 (Apr-Sep’23), net inflows under Mutual Fund rose to Rs 2.1bn from Rs 427mn in the same period of previous year. Better quarterly earnings of companies in Q1 especially profit indicators posting buoyant growth have helped in retaining confidence of domestic investors.

In FYTD24, US 10Y yield went up considerably. Expectation of a tighter financial condition on the back of overheated economic conditions have resulted in the same. Despite a falling gap between India and US 10Y yield (in Apr’23, it was at 373bps and in Nov’23 it is at 271bps; historical average spread is at 442bps), debt inflows have maintained some momentum. This is attributable to risk off sentiment in the event when volatility in global markets have resurfaced due to uncertain geopolitical space.

How flows in other economies have moved?

In other EMs as well, there have been pressure with regard to flows. During Oct-Nov’23 period, there have been outflow in the equity segment for almost all EMs. The more pronounced outflow is visible in case of China, Taiwan, South Korea, amongst others. The macro indicators of these region are currently giving very conflicting signals. In China, worries persist as major high frequency indicators such as PMIs, exports have remained benign. In economies such as Indonesia and South Korea inflation is sticky and growth gaining ground. The future direction of flows will also be contingent on Fed’s policy guidance.

How sector wise flows have moved?

As per Assets under Custody as of 31 Oct 2023, sector wise data showed that financial services followed by IT and oil and gas space dominated the flows in the equity segment.

Way forward

(Disclaimer: The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)