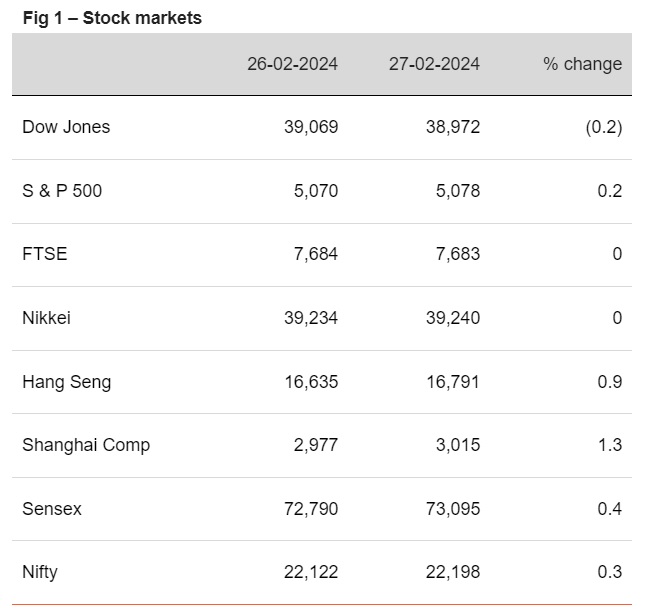

Sensex opened higher today, while other Asian stocks are trading lower.

Sonal Badhan,

Economist,

Bank of Baroda

Mumbai, February 26, 2024: Durable goods orders in the US fell by (-) 6.1% in Jan’24 versus est.: (-) 4.5% decline, and down from (-) 0.3% in Dec’23. This was largely led by (-) 58.9% decline in civilian aircraft orders. However, core capital goods orders (non-defence excl aircrafts) rose by 0.1% in Jan’24, following (-) 0.6% decline in Dec’23, supported by orders for computers, electronic products, appliances, and electrical equipment. US conference board consumer confidence data showed that sentiment fell in Feb’24 to 106.7 from 110.9 in Jan’24. This was driven by dip in both present situation and expectations index. Mixed macro data has further raised uncertainty around the timing and quantum of Fed’s rate cuts. PCE data is awaited for more guidance.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)