RBI is expected to maintain a hawk eye on inflation dynamics

Indranil Pan, Chief Economist

Deepthi Mathew, Economist

Economics Knowledge Banking

YES BANK

Mumbai, February 7, 2024: The RBI is expected to keep rates and stance unchanged at the February policy. Even as the worst of inflation is behind us and core retail prices are on a downward journey, the RBI is expected to maintain a hawk eye on inflation dynamics, given that food side inflation has been of a recurrent nature in the near past due to uncertainties in climatic conditions and rising geopolitical tensions. As long as growth holds up, monetary policy focus will remain on keeping inflation pressures contained. The guidance of the RBI towards achieving the stated target of 4% would continue, and we expect the first rate cut to be in August 2024. On the liquidity side, we think that the RBI is currently guiding for the operative rate to be close to the signaling rate.

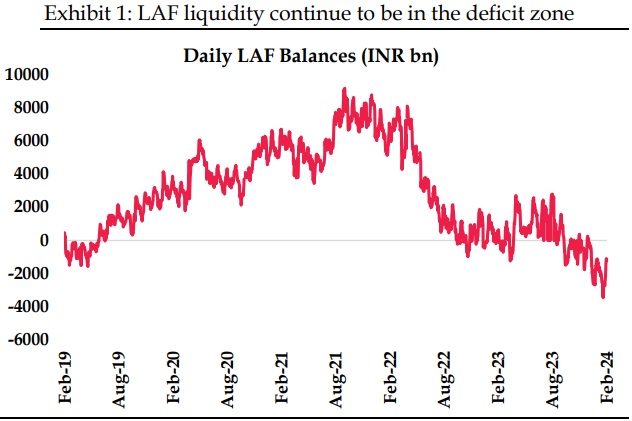

Veggies have cooled but 4% inflation target still to elude: Food prices (specifically vegetables) had been a major risk to India’s inflation trajectory. The arrival of winter crops has eased the pressure on vegetable prices. After peaking at 38% MoM in July, vegetable prices moderated in the subsequent months and comfort is expected to continue in the rest of FY24. As per the NHB data, vegetable prices have picked up only 0.4% in February 2024 MTD with sequential declines in heavy weights like onion and potato. However, tomato prices have increased by 15.3% MoM compared to seasonal average of (-) 9% MoM in February. Alongside, the uncertainty over food prices is likely persist on account of the negative impact from El Nino. As per the latest data, rabi sowing is up by 0.2% compared to last year but with pulses sowing lagging by 6.1% as of 2nd February 2024. As per reports, summer this year in India is likely be strong on the back of El Nino effect. For FY24, we expect Headline CPI to average at 5.4%, with the support mainly coming from core inflation. Our model projections point towards an average Headline CPI of 4.7% for FY25 with Q1FY25 averaging at 5.1% and Q2FY25 at 3.8%. Liquidity conditions to remain tight till March: LAF liquidity deficit stood at an average of INR 2.1 tn in January 2024, mostly due to lower spending by the government and a pickup in CiC. In January 2024, central government’s cash balance with RBI stood at an average INR 3.9 tn with the peak estimated at INR 5.2 tn. As per the latest data, the government’s cash balance with the RBI has moderated to INR 3.3 tn. Though improved government spending could bring some relief, we expect the tightness in liquidity to persist till March 2024. As per FY24RE, government is planning to carry forward cash balance to the tune of INR 267 bn to the next fiscal year (highest in the last 11 years). Similarly, as we are approaching the general elections, higher currency in circulation could put further pressure on the system liquidity.

On the other hand, liquidity can improve if the RBI absorbs the higher FPI inflows (preemptive flows before the JP Morgan bond inclusion date starting June 2024) to prevent any sharp appreciation of the INR. RBI had been conducting VRR to ease the liquidity strain experienced by the system. A check on the data indicates that these have been timed to situations where the overnight money market rates had been closer to the MSF. On the other hand, the RBI has also conducted VRRR to suck out additional liquidity if the overnight rate is below the repo rate. Our sense is that the RBI is trying to fine tune the liquidity position in such a way that the operative rate and the signaling rate are close to each other. February policy unlikely to change anything: Policy rates have peaked elsewhere in the world while some central banks have also started easing monetary policy. While the markets had been expecting a March rate cut in the US, the latest FOMC meeting as also the relatively strong data (especially the unemployment data) has ruled out any early rate cuts in the US. Given our current assessment, we think that the US Fed might pivot to a rate cut in June 2024 while the cycle will be shallow at 75 bps. Real rates in the US have recently turned positive, and we expect Fed to support a positive real rates scenario for a longer period, till there is a confirmation of a 2% inflation target being achieved. Consequently, we expect the RBI to follow the Fed and not precede it in the rate cutting cycle and start easing policy rates starting August 2024. There are talks in the market that the RBI will change its stance to ‘neutral’ in the February meeting given the non-inflationary nature of the FY25 interim budget. However, we expect RBI to maintain the stance at ‘withdrawal of accommodation’, as we do not think there has been any major change in the inflation trajectory between the previous policy and now.

(Disclaimer: Information gathered and material used in this document is believed to have been obtained from reliable sources. However, YES Bank makes no warranty, representation or undertaking whether expressed or implied, with respect that such information is being accurate, complete or up to date, nor does it assume any legal liability, whether direct or indirect or responsibility for the accuracy, completeness or usefulness of any information in this document. YES Bank takes no responsibility for the contents of those external data sources or such third party references. No third party will assume and direct or indirect liability, whose references have been provided in this document. It is the responsibility of the user of this document to make its/his/her own decisions or discretion about the accuracy, currency, reliability and correctness of information found in this document.)