Power Of Digital Transactions: Currency In Circulation Falls In Diwali Week

Over the years, the Indian cash lead economy now has changed to smart-phone lead payment economy chart SBI 23 Nov

FinTech BizNews Service

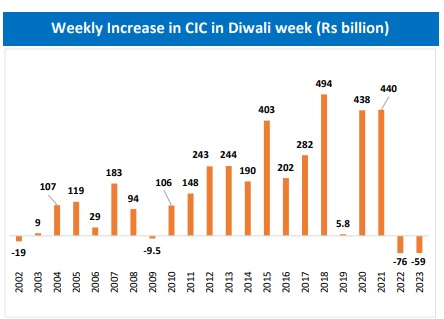

Mumbai, November 23, 2023: In a remarkable development, for the record second consecutive time in 20 years, CIC/currency in circulation declined during the Diwali week. The innovations in technology have now changed the Indian payment system, reveals a report, authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

Over the years, the Indian cash lead economy now has changed to smart-phone lead payment economy. A lower currency in circulation also is akin to a CRR cut for the banking system, as it results in less leakage of deposits and it impacts monetary transmission positively! The success of the digital journey is primarily due to the relentless push by the Government to formalize and digitalize the economy. Further, the interoperable payments systems like UPI, Wallets & PPIs have made it simple and cheaper to transfer money digitally, even for those who don’t have bank accounts. Over the years, the system has expanded rapidly with new innovations like QR code, NFC etc and has also seen the swift entry of big tech firms in this industry. In the festive month of October 2023, UPI has increased (mom) by 853 million transactions of Rs 1366 billion in value terms.

CIC IN DIWALI WEEK

- With the increased acceptance of digital payments in the country, the over reliance on cash is slowly fading away. The India’s digital payment journey is built on the India Stack - a comprehensive digital identity, payment and data management system. This open-access software standards facilitate digital payments between banks, fin-techs and digital wallets.

- If we look the retail digital transactions data, NEFT holds a share of around 51% in value terms and most of the transactions are done through either at branch or through internet banking. However, if we look only at transactions done through smart phones on NPCI platform like UPI, and IMPS , they have share of around 21%, and 8.5% respectively. While, if we look the UPI transactions in (in volume), which holds around 75% of the total transactions in the payment industry.

- In the festive month of Oct’23, UPI has increased (mom) by 853 million transactions of Rs 1366 billion in value terms.

- Interestingly, the impact of the UPI transactions on monetary aggregates is revealing in terms of our structural VAR model. In case of CIC, it results in a decline in CIC for around 3 months than it wanes out after 4 months. In case of M0, it results in a decline in M0 for one month and starts waning out after 4 months. In simple terms, it implies that the RBI has to print less of currency given that UPI transactions impact currency in circulation with a lag. This is a win-win for both RBI and government, as it results in saving of Seignorage costs and also a less cash economy. This will also mean all the analysis of currency leakage impacting bank deposits, liquidity estimation now could see a fundamental reorientation in the future!