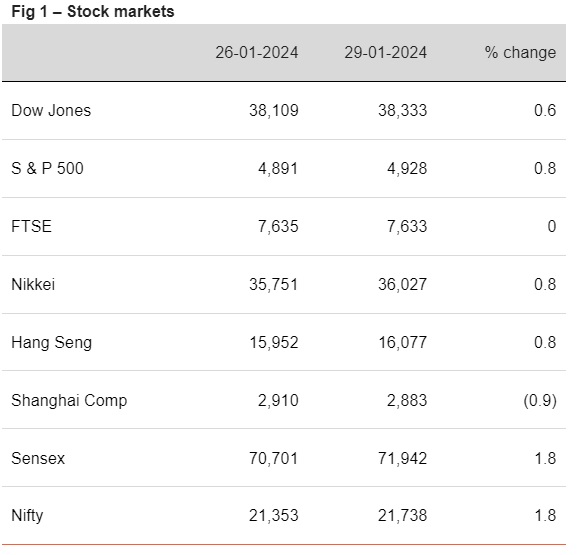

Barring FSTE (flat) and Shanghai Comp (lower), other global indices closed higher

Sonal Badhan,

Economist,

Bank of Baroda

Mumbai, January 29, 2024: As US Fed begins its 2-day meeting today, it is largely expected to keep policy rates on hold. Investors will also look for guidance on timing of future rate cuts, as growth is easing slower than anticipated. Slew of other economic data points pertaining to labour market, manufacturing and services activity index, will also shed light on direction of US rates. Separately, similar economic strength is not currently visible in other major economies. For instance, in China, industrial profits fell by (-) 2.3% in CY23, following (-) 4.4% decline between Jan-Nov’23. In Australia, retail sales in Dec’23 fell by (-) 2.3% (MoM), after posting 1.6% increase in Nov’23. Most significant decline was noted in discretionary spending (mainly household items). Only sales of food recorded an increase in Dec’23.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)