Deposit rates moved up more for public sector banks even as RBI holds rates

FinTech BizNews Service

Mumbai, April 15, 2024: Deposit rates moved up more for public sector banks even as RBI holds rates. Deposits of senior citizens has jumped to Rs 34 trillion in GY24 (Rs 14 trillion in FY19) number of accounts at 74 million (41 million in FY19) average deposits at Rs 4.6 Lakh. Superior interest rate offerings & handholding by government & banks ushering in a tectonic change for senior citizens, says a report, authored by Dr. Soumya Kanti Ghosh, Group Chief Economic Adviser, State Bank of India.

Highlights from the report:

Mohun Biswas, the protagonist of V S Naipaul’s magnum opus, lives in a world of contradictions, searching independence.

Indian Banks since FY22, have been remarkably successful in transmitting the calibrated hike in policy rates to both borrowers as also lenders over the time curve ably supported by twin synchronous pillars; unconventional yet strategically woven fiscal and other policy supports, and slew of interwoven elastic measures initiated by the regulator aimed at fortifying the financial fiefdom. Clearly, India Inc. is enjoying the fruits of ’twin balance sheet advantage’ to the core, the calm in domestic markets and the orderly movement of yields, sans panic, demonstrating the power of this tacit approach.

The robustness in banking architecture in India of late is revealed by bank credit growth that stood at 20.2% in 2024 (net Rs 27.6 lakh cr), continuing the momentum of FY23 (15%) and moving sizably up from FY22 (8.6%). In turn, deposit accretion picked up in the later part of the year growing by 13.5% in FY24 i.e. net Rs 24.3 lakh cr (though better than FY23 (9.6%) and FY22 (8.9%). Interestingly, the aggressive pitch by select banks to woo deposits, amidst fluctuating liquidity constraints, saw banking system raising the deposits rate in H2, despite RBI holding the rate since Feb 2023!

ASCBs have increased weighted average domestic term deposit rates (WADTDR) on outstanding deposits by 96 bps and weighted average term deposit rates on fresh deposits by 22 basis points while across banking groups, the pass-through to WADTDRs on fresh and outstanding deposit rates has been higher for Public Sector Banks / PSBs than Private Sector Banks / PVBs. PSBs have imbibed the competitive spirit in true sense, offering optimal rates to discerning depositors as they galvanize to meet the surging credit demands from economy. A palpable shift in depositors’ behaviors has been the inclination to capitalize on interest rate differentials between core and term deposits, with the incremental share of TD increasing to 93% (estimated) and CASA share declining to 7% in FY24.

The increase in deposit rates, the higher interest rate differential for senior citizens and the special deposit schemes for senior citizens (for example WE-CARE by SBI) have all propelled a tectonic shift in deposits accretion for senior citizens ably supported also by Government initiatives on SCSS, Mahila Samman Savings Certificate and so on.

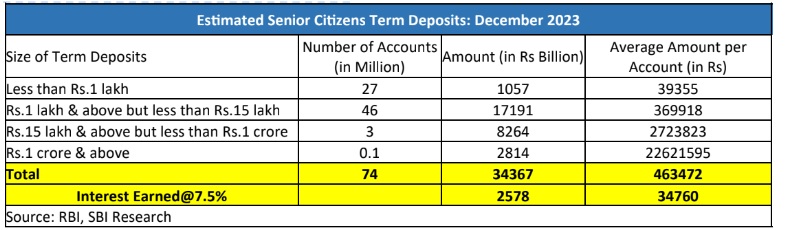

Through our research, we estimate there could be now close to 74 million senior citizens term deposits accounts in the country, with aggregate deposit to the tune of Rs 34 lakh crore. In fact, the share of Sr citizen term deposits (by no. of accounts) increased to ~30% now from ~15% earlier in term deposits kitty! Out of such 74 million odd accounts, almost 73 million accounts should be in the size bracket of up to Rs 15 lakh. By assuming interest on Sr citizen bank deposits being 7.5%, the interest earned would stand at Rs 2.7 lakh crores during the year.

Interestingly, these 74 million accounts is a significant jump from that in FY19, when we had estimated that there were around 41 million senior citizens term deposits accounts in the country with total deposit of Rs 14 lakh crores. So, in a short span of ~5 years, there has been an increase of 81% growth in number of accounts and 143% in amount in this cohort! The average balance in the accounts has grown handsomely by 38.7%, to Rs 4.6 lakh cr from earlier Rs 3.3 lakh cr.

In recognition of challenges faced by the senior citizen in sunset years with medical and other care needs growing exponentially as the nuclearization of families gains velocity, GoI has deftly ensured superior interest offerings through specialized schemes like SCSS (8.2% RoI with 1.62 lakh cr O/S) as also card rates of banks having 50-75 bps markup for this segment.

So, the total interest earned by Sr citizen works out to Rs 2.7 lakh crore; Rs 0.13 lakh crore from SCSS and Rs 2.57 lakh crore from Sr citizen’s bank deposits. By assuming 10% (Average) tax paid by the Sr citizen harmonized across cohorts, the tax mop-up by GoI would come around Rs 27,106 crore. The Government has also raised the threshold of TDS on deposits for senior citizens to Rs 50,000 now, possibly working as an additional fillip for deposit mobilization for senior citizens.

Separately, APY, a path breaking Universal social security scheme initiated by GoI in 2015, along with PMSBY/PMJJBY and targeting the fringe and vulnerable groups mostly, is presently having 5.46 crore subscribers with an AUM of Rs 34781 crore (Feb’24). The subscribers are slated to receive the fixed maximum pension of Rs 5000 per month (ranging from Rs 1000 to Rs 5000), at the age of 60 years, depending on their contributions, which itself would be based on the age of joining the APY. There is scope to increase the maximum pension amount to say Rs 10000 per month from the existing limit of Rs 5000 per month, for the benefit of senior citizen.