Provisions (excluding provision for tax) were Rs891 crore (US$ 104 million) in Q4-2025

FinTech BizNews Service

Mumbai, April 19, 2025: The Board of Directors of ICICI Bank Limited (NSE: ICICIBANK, BSE: 532174, NYSE: IBN) at its meeting held at Mumbai today, approved the standalone and consolidated accounts of the Bank for the quarter ended March 31, 2025 (Q4-2025) and the year ended March 31, 2025 (FY2025). The statutory auditors have audited the standalone and consolidated financial statements and have issued an unmodified report on the standalone and consolidated financial statements for FY2025.

Performance Review: Quarter ended March 31, 2025

• Profit before tax excluding treasury grew by 13.2% year-on-year to Rs 16,534 crore (US$ 1.9 billion) in the quarter ended March 31, 2025 (Q4-2025) • Core operating profit grew by 13.7% year-on-year to Rs 17,425 crore (US$ 2.0 billion) in Q4-2025

• Profit after tax grew by 18.0% year-on-year to Rs 12,630 crore (US$ 1.5 billion) in Q4-2025

• Profit before tax excluding treasury grew by 11.4% year-on-year to Rs 60,713 crore (US$ 7.1 billion) in the year ended March 31, 2025 (FY2025)

• Core operating profit grew by 12.5% year-on-year to Rs 65,396 crore (US$ 7.6 billion) in FY2025 • Profit after tax grew by 15.5% year-on-year to Rs 47,227 crore (US$ 5.5 billion) in FY2025

• Consolidated profit after tax increased by 15.7% year-on-year to Rs 13,502 crore (US$ 1.6 billion) in Q4-2025 and by 15.3% year-on-year to Rs 51,029 crore (US$ 6.0 billion) in FY2025

• Total period-end deposits grew by 14.0% year-on-year to Rs 16,10,348 crore (US $ 188.4 billion) at March 31, 2025

• Average deposits grew by 11.4% year-on-year to Rs 14,86,635 crore (US$ 173.9 billion) in Q4-2025

• Average current account and savings account (CASA) ratio was 38.4% in Q4 2025

• Domestic loan portfolio grew by 13.9% year-on-year to Rs 13,10,981 crore (US$ 153.4 billion) at March 31, 2025

• Net NPA ratio declined to 0.39% at March 31, 2025 from 0.42% at December 31, 2024

• Provisioning coverage ratio on non-performing loans was 76.2% at March 31, 2025

• Total capital adequacy ratio was 16.55% and CET-1 ratio was 15.94%, on a standalone basis, at March 31, 2025 after reckoning the impact of proposed dividend

• The Board has recommended a dividend of Rs 11 per share for FY2025. The declaration and payment of dividend is subject to requisite approvals

Profit & loss account • Profit before tax excluding treasury grew by 13.2% year-on-year to Rs 16,534 crore (US$ 1.9 billion) in Q4-2025 from Rs 14,602 crore (US$ 1.7 billion) in the quarter ended March 31, 2024 (Q4-2024) • Core operating profit grew by 13.7% year-on-year to Rs 17,425 crore (US$ 2.0 billion) in Q4-2025 from Rs 15,320 crore (US$ 1.8 billion) in Q4-2024

• Net interest income (NII) increased by 11.0% year-on-year to Rs 21,193 crore (US$ 2.5 billion) in Q4-2025 from Rs 19,093 crore (US$ 2.2 billion) in Q4-2024

• Net interest margin was 4.41% in Q4-2025 compared to 4.25% in Q3-2025 and 4.40% in Q4-2024. The net interest margin was 4.32% in FY2025

• Non-interest income, excluding treasury, increased by 18.4% year-on-year to Rs 7,021 crore (US$ 821 million) in Q4-2025 from Rs 5,930 crore (US$ 694 million) in Q4-2024

• Fee income grew by 16.0% year-on-year to Rs 6,306 crore (US$ 738 million) in Q4 2025 from Rs 5,436 crore (US$ 636 million) in Q4-2024. Fees from retail, rural and business banking customers constituted about 80% of total fees in Q4-2025

• Treasury gains were Rs 239 crore (US$ 28 million) in Q4-2025 as compared to a treasury loss of Rs 281 crore (US$ 33 million) in Q4-2024. The treasury loss in Q4-2024 was due to transfer of negative balance of Rs 340 crore (US$ 40 million) in Foreign Currency Translation Reserve related to Bank’s Offshore Unit in Mumbai to profit and loss account in view of the proposed closure of the Unit

• Provisions (excluding provision for tax) were Rs 891 crore (US$ 104 million) in Q4-2025 compared to Rs 718 crore (US$ 84 million) in Q4-2024 and Rs 1,227 crore (US$ 144 million) in Q3-2025

• Profit before tax grew by 17.1% year-on-year to Rs 16,773 crore (US$ 2.0 billion) in Q4-2025 from Rs 14,321 crore (US$ 1.7 billion) in Q4-2024

• Profit after tax grew by 18.0% year-on-year to Rs 12,630 crore (US$ 1.5 billion) in Q4 2025 from Rs 10,708 crore (US$ 1.3 billion) in Q4-2024

• Profit after tax grew by 15.5% year-on-year to Rs 47,227 crore (US$ 5.5 billion) in FY2025 from Rs 40,888 crore (US$ 4.8 billion) in the year ended March 31, 2024 (FY2024) Credit growth

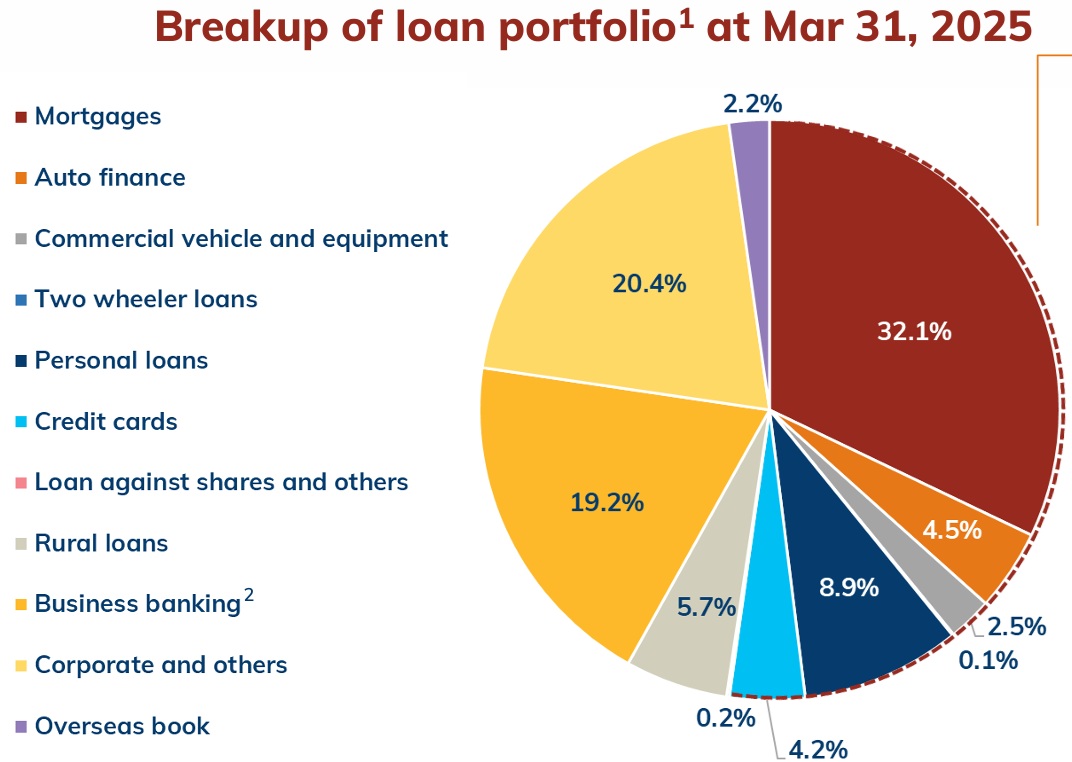

The net domestic advances grew by 13.9% year-on-year and 2.2% sequentially at March 31, 2025. The retail loan portfolio grew by 8.9% year-on-year and 2.0% sequentially, and comprised 52.4% of the total loan portfolio at March 31, 2025. Including non-fund outstanding, the retail portfolio was 43.8% of the total portfolio at March 31, 2025.

The business banking portfolio grew by 33.7% year-on-year and 6.2% sequentially at March 31, 2025. The rural portfolio grew by 5.1% year-on-year and declined by 1.5% sequentially at March 31, 2025. The domestic corporate portfolio grew by 11.9% year on-year and declined by 0.4% sequentially at March 31, 2025. Total advances increased by 13.3% year-on-year and 2.1% sequentially to Rs 13,41,766 crore (US$ 157 billion) at March 31, 2025.

The Bank continues to enhance the use of technology in its operations to provide simplified solutions to customers and making investments in its digital channels. The Bank expects to further strengthen system resilience and simplify processes.

Deposit growth

Total period-end deposits increased by 14.0% year-on-year and 5.9% sequentially to Rs 16,10,348 crore (US$ 188.4 billion) at March 31, 2025. Average deposits increased by 11.4% year-on-year and 1.9% sequentially to Rs 14,86,635 crore (US$ 173.9 billion) in Q4 2025. Average current account deposits increased by 9.6% year-on-year and 1.4% sequentially in Q4-2025. Average savings account deposits increased by 10.1% year-on year and 0.2% sequentially in Q4-2025.

With the addition of 241 branches during Q4-2025, the Bank had a network of 6,983 branches and 16,285 ATMs & cash recycling machines at March 31, 2025.

Asset quality

The gross NPA ratio was 1.67% at March 31, 2025 compared to 1.96% at December 31, 2024. The net NPA ratio was 0.39% at March 31, 2025 compared to 0.42% at December 31, 2024. The gross NPA additions were Rs 5,142 crore (US$ 602 million) in Q4-2025 compared to Rs 6,085 crore (US$ 712 million) in Q3-2025. Recoveries and upgrades of NPAs, excluding write-offs and sale, were Rs 3,817 crore (US$ 447 million) in Q4-2025 compared to Rs 3,392 crore (US$ 397 million) in Q3-2025. The net additions to gross NPAs, excluding write-offs and sale, were Rs 1,325 crore (US$ 155 million) in Q4-2025 compared to Rs 2,693 crore (US$ 315 million) in Q3-2025. The Bank has written-off gross NPAs amounting to Rs 2,118 crore (US$ 248 million) in Q4-2025. There was sale of NPAs of Rs2,786 crore (US$ 326 million) in Q4-2025 which consists of Rs 1,605 crore (US$ 188 million) of security receipts and Rs 314 crore (US$ 37 million) in cash.

The Bank continues to hold 100% provisions against these security receipts. The provisioning coverage ratio on non-performing loans was 76.2% at March 31, 2025. Excluding NPAs, the total fund based outstanding to all borrowers under resolution as per the various extant regulations/guidelines declined to Rs 1,956 crore (US$ 229 million) or about 0.1% of total advances at March 31, 2025 from Rs 2,107 crore (US$ 247 million) at December 31, 2024. The Bank holds provisions amounting to Rs 643 crore (US$ 75 million) against these borrowers under resolution, as of March 31, 2025. In addition, the Bank continues to hold contingency provisions of Rs 13,100 crore (US$ 1.5 billion) at March 31, 2025. The loan and non-fund based outstanding to performing corporate borrowers rated BB and below was Rs 2,854 crore (US$ 334 million) at March 31, 2025 compared to Rs 2,193 crore (US$ 257 million) at December 31, 2024.

Capital adequacy

The Bank’s total capital adequacy ratio at March 31, 2025 was 16.55% and CET-1 ratio was 15.94% after reckoning the impact of proposed dividend compared to the minimum regulatory requirements of 11.70% and 8.20% respectively.

Dividend on equity shares

The Board has recommended a dividend of Rs 11 per share (equivalent to dividend of US$ 0.26 per ADS) in line with applicable guidelines. The declaration of dividend is subject to requisite approvals. The record/book closure dates will be announced in due course.

Consolidated results

The consolidated profit after tax increased by 15.7% year-on-year to Rs 13,502 crore (US$ 1.6 billion) in Q4-2025 from Rs 11,672 crore (US$ 1.4 billion) in Q4-2024. Consolidated assets grew by 11.8% year-on-year to Rs 26,42,241 crore (US$ 309.1 billion) at March 31, 2025 from Rs 23,64,063 crore (US$ 276.6 billion) at December 31, 2024.

Key subsidiaries

The annualised premium equivalent of ICICI Prudential Life Insurance (ICICI Life) was Rs 10,407 crore (US$ 1.2 billion) in FY2025 compared to Rs 9,046 crore (US$ 1.1 billion) in FY2024. Value of New Business (VNB) of ICICI Life was Rs 2,370 crore (US$ 277 million) in FY2025 compared to Rs 2,227 crore (US$ 261 million) in FY2024. The VNB margin was 22.8% in FY2025 compared to 24.6% in FY2024.

The profit after tax was Rs 1,189 crore (US$ 139 million) in FY2025 compared to Rs 852 crore (US$ 100 million) in FY2024 and was Rs 386 crore (US$ 45 million) in Q4-2025 compared to Rs 174 crore (US$ 20 million) in Q4-2024.

The Gross Direct Premium Income (GDPI) of ICICI Lombard General Insurance Company (ICICI General) was Rs 24,776 crore (US$ 2.9 billion) in FY2024 compared to Rs 26,833 crore (US$ 3.1 billion) in FY2025. The combined ratio stood at 102.8% in FY2025 compared to 103.3% in FY2024. Excluding the impact of CAT losses of Rs 94 crore (US$ 11 million) in FY2025 and Rs 137 crore (US$ 16 million) in FY2024, the combined ratio was 102.4% and 102.5% respectively.

The profit after tax of ICICI General grew by 30.7% to Rs 2,508 crore (US$ 293 million) in FY2025 compared to Rs 1,919 crore (US$ 225 million) in FY2024. The profit after tax of ICICI General was Rs 510 crore (US$ 60 million) in Q4-2025 compared to Rs 519 crore (US$ 61 million) in Q4-2024.

The profit after tax of ICICI Prudential Asset Management Company, as per Ind AS, increased to Rs 692 crore (US$ 81 million) in Q4-2025 from Rs 529 crore (US$ 62 million) in Q4-2024. The profit after tax grew by 29.3% year-on-year to Rs 2,651 crore (US$ 310 million) in FY2025 from Rs 2,050 crore (US$ 240 million) in FY2024.

The profit after tax of ICICI Securities, on a consolidated basis, as per Ind AS, was Rs 381 crore (US$ 45 million) in Q4-2025 compared to Rs 537 crore (US$ 63 million) in Q4-2024. The profit after tax grew by 14.4% year-on-year to Rs 1,942 crore (US$ 227 million) in FY2025 from Rs 1,697 crore (US$ 199 million) in FY2024.