Liquidity to remain in the neutral zone

Indranil Pan, Chief Economist

Deepthi Mathew, Economist

Economics Knowledge Banking

YES BANK

FinTech BizNews Service

Mumbai, April 6, 2024: RBI Governor Shaktikanta Das announced the MPC's decisions on Friday.

RBI policy: Waiting...for how long?

As expected, RBI kept the repo rate and the stance unchanged at 6.50% (one member

voted for a 25-bps rate cut) and ‘withdrawal of accommodation’ respectively. Getting

inflation down to 4% on a durable basis remains the focus while risks are seen around

food inflation and uptick in commodity prices. Recurring food inflation risks de-

anchoring inflation expectations and could lead to second-round effects. Given its

assessment of growth-inflation mix, the RBI is likely to stay on an extended pause.

Taking cue from the Fed’s rate cutting cycle and domestic factors, we expect the first rate

cut by the RBI in August 2024. Any delay in Fed’s rate cut / food price shocks could also

delay the rate cutting cycle by the RBI.

Food inflation worries remain: RBI remains optimistic on growth with FY25 GDP

growth rate pegged at 7.0%. Rural demand recovery on anticipation of good rabi

production, buoyant urban consumption, robust government capital expenditure, rising

capacity utilization and healthy balance sheets of banks and corporates are expected to aid

domestic growth. Though the domestic economy is showing resilience, the headwinds from

the external sector through protracted geopolitical tensions and trade disruptions are the

major risks to growth. On the inflation front, Governor highlighted the food price

uncertainties that could influence the inflation trajectory going forward. The rise in crude

oil prices is an added risk even though its direct impact on CPI is limited. The headline CPI

for FY25 is expected at 4.5%. Having said, some of the quarterly estimates have been moved

lower by 10-20 bps over the previous levels. For instance, quarterly inflation forecast for

Q1FY25, Q2FY25 and Q4FY25 has been revised down to 4.9% YoY (5.0% earlier), 3.8% YoY

(4.0% earlier) and 4.5% YoY (4.7% earlier), respectively. Q3FY25 inflation forecast has been

maintained at 4.6% YoY.

Liquidity to remain in the neutral zone: To ensure pass-through of earlier rate hikes

to the lending rates, we expect the RBI to keep liquidity in the neutral zone. The Weighted

Average Lending Rate (WALR) for new rupee loans has moved up by 185 bps compared to

a 250-bps increase in the policy rate (was at 181 bps in February). LAF liquidity is now in

surplus with a pick-up in government spending (April 2024 till date, LAF liquidity averaged

at positive ~ INR 1.3 tn), FX intervention by RBI and maturity of USD 5 bn sell buy swap.

On liquidity, we think that the RBI will gradually move the same into a neutral zone of

around +/- INR 500 bn.

Rate cutting cycle to be shallow in FY25: With growth conditions remaining resilient,

RBI continues to focus on bringing inflation to the 4% target on a durable basis. The inflation

concerns for the RBI remains hinged on the food prices outlook. In this sense, the RBI would

be closely monitoring the rabi harvesting trends (early start in Rajasthan and MP is a

positive), SW monsoon trends (El Nino is reported to be ebbing and give way to La Nina in

June-August) and any vegetable shocks like last year. There are also indications in the

Governor’s statement of an impending worry from the cost push items. Oil and commodity

prices have risen on geopolitical tensions and can also sustain in the medium term. A stable

growth atmosphere will also enable companies to pass on higher input costs. Higher crude

oil prices are also boosting up global edible oil prices as oilseeds are used in the production

of biofuels. The government had earlier reduced the customs duty on edible oil and there

may be limited scope of containing domestic price pressure on edible oil in this round.

Adding to it, the Red Sea crisis has led to higher freight rates and insurance premiums,

resulting in substantial imported inflation. As per RBI’s and our own projections, CPI

inflation be at sub-4% only in Q2FY25, but then is expected to rise again. For FY26, RBI

projects Headline CPI at 4.1%.

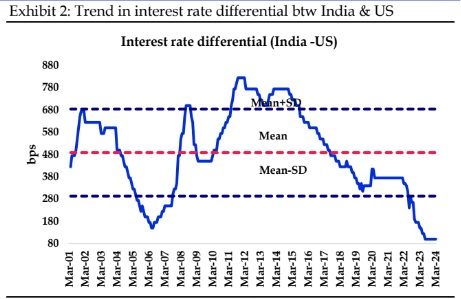

We think that RBI is unlikely to precede Fed in the rate cutting cycle as the interest rate

differential between the two economies is at historic lows (Exhibit 2). The data prints have

indicated a relatively stronger US economy compared to the other major economies. With

the latest dot plots indicating a 75-bps rate cut by the Fed in 2024, the markets are pricing in

a June start date. However, the recent Fed-speak has been pushing out the timing of the rate

cut by the Fed to H2CY24. Though the timing of the first cut from RBI is now difficult to

ascertain, we hazard a guess for August 2024, but the probability of an October cut is also

building. There is a bigger confidence in indicating that the rate cut cycle will be shallow at

~50-75 bps.