US GDP in Q4CY23 expanded by 3.3%, beating expectation of 2% growth, but slowing from 4.9% in Q3

Sonal Badhan,

Economist,

Bank of Baroda

Mumbai, January 29, 2024: US GDP in Q4CY23 expanded by 3.3%, beating expectation of 2% growth, but slowing from 4.9% in Q3. The sharper than estimated jump was driven by consumption (PCE was up by 2.8%, broadly stable compared to previous quarter). Other components such as increase in state and federal spending and gross private investment also helped beat expectations. Thus, CY23 growth clocked in at 2.5% versus 1.9% in CY22. However, inflationary pressures remain under control, with core PCE deflator rising by 2.9% in Dec’23 versus est. 3% and slowing from 3.2% in Nov’23. Investors are now expecting 47% probability of rate cut in Mar’24. In Europe, as ECB maintains that rate cut talks are “premature”, pessimistic business outlook in Germany is back. The Ifo index fell to 85.2 in Jan’24 from 86.3 in Dec’23 as participants brace for stagnation to shallow recession in the economy.

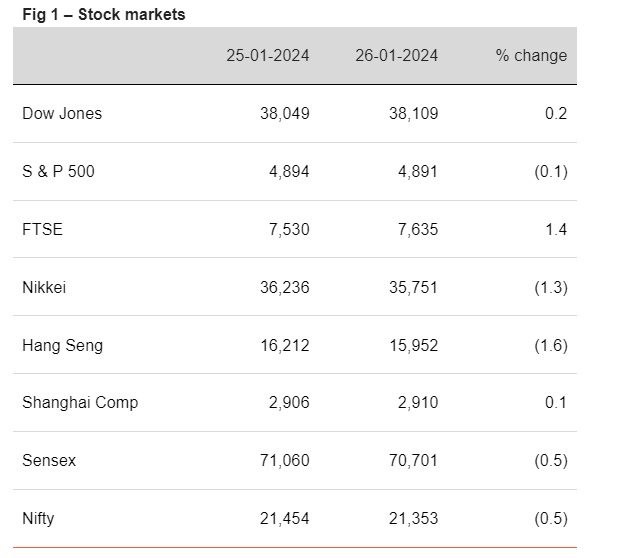

Global indices closed mixed. Moderation in consumer inflation in US raised hopes of possible rate cuts by Fed. Dow Jones ended in green. FTSE too climbed higher (1.4%) led by strong gains in household goods stocks and ahead of the rate decision. Sensex is trading higher ahead of the announcements from the Economic Survey and Interim budget. Asian indices are also trading higher with gains in Hong Kong market after news of liquidation order of a firm.

(The views expressed in this research note are personal views of the author(s) and do not necessarily reflect the views of Bank of Baroda. Nothing contained in this publication shall constitute or be deemed to constitute an offer to sell/ purchase or as an invitation or solicitation to do so for any securities of any entity.)